Standing Committee on Finance and Economic Affairs

Second Interim Report: Economic Impact of COVID-19 on Tourism

1st Session, 42nd Parliament

69 Elizabeth II

ISBN 978-1-4868-4640-5 (Print)

ISBN 978-1-4868-4643-6 [English] (PDF)

ISBN 978-1-4868-4644-3 [French] (PDF)

ISBN 978-1-4868-4641-2 [English] (HTML)

ISBN 978-1-4868-4642-9 [French] (HTML)

The Honourable Ted Arnott, MPP

Speaker of the Legislative Assembly

Sir,

Your Standing Committee on Finance and Economic Affairs has the honour to present its Report and commends it to the House.

Amarjot Sandhu, MPP

Chair of the Committee

Queen's Park

August 2020

Standing Committee on Finance and Economic Affairs

Membership list

1st Session, 42nd Parliament

Amarjot Sandhu

Chair

Jeremy Roberts

Vice-Chair

IAN ARTHUR DAVID PICCINI

Stan Cho Mike Schreiner

Willowdale

Stephen Crawford Sandy Shaw

Mitzie Hunter Donna Skelly

Sol Mamakwa Dave Smith

Peterborough—Kawartha

Non-voting members

Stephen Blais Laura Mae Lindo

Catherine Fife Kaleed Rasheed

Randy Hillier John Vanthof

Andrea Khanjin

Norman Miller (Parry Sound—Muskoka) regularly served as a substitute member of the Committee.

Julia Douglas

Clerk of the Committee

Andrew McNaught and Dmitry Granovsky

Research Officers

Contents

Repayable versus Non-Repayable 12

The Importance of Testing and Contact Tracing 16

Worker Protection and Training 16

Broadband and Cell Phone Access 17

Indigenous Tourism and Sport 18

Grape Growers, Wine Producers, and Craft Brewers 19

Appendix A: Terms of Reference*

Appendix B: Dissenting Opinion of the Liberal Party Members of the Committee

Appendix C: Dissenting Opinion of the Green Party Member of the Committee

Introduction

The Standing Committee on Finance and Economic Affairs is pleased to present its Second Interim Report on the Economic and Fiscal Update Act, 2020 and the impact of the COVID-19 crisis on the Ontario economy.

The report presents the Committee’s findings and recommendations following its review of the impact of COVID-19 on Ontario’s tourism sector. It reflects testimony received during public hearings held on June 4, 5, 11, 18, 19, and 22, as well as written submissions delivered to the Committee Clerk as of 5:00 p.m. on June 22, 2020.

At the Committee’s request, the Minister of Heritage, Sport, Tourism and Culture Industries appeared as the first witness on June 4. Following the Minister’s update, the Committee received submissions from dozens of organizations, businesses, and individuals from across the province, representing the broad range of activities that constitute Ontario’s tourism sector.

Although at times troubling, their testimony revealed resiliency in the face of considerable adversity, and a determination to ensure that Ontario’s tourism sector not only survives the current pandemic, but is restored to its place as a key driver of jobs and economic activity. The Committee is grateful to those who took the time to share their views and personal stories.

This report is an overview of the main issues raised during the Committee’s public hearings. For details of witness submissions, and their responses to questions from Committee Members, readers are referred to the official record of proceedings, as reported in Hansard, and to the written submissions themselves.

Committee recommendations and a list of witnesses appear at the end of the report.

Committee Mandate

Motions adopted unanimously in the House on March 25 and May 12, 2020, established a two-part mandate for the Committee.

On March 25, 2020, when the House passed Bill 188, the Economic and Fiscal Update Act, 2020, it also adopted a motion providing that party leaders and independent Members may file letters with the Speaker, setting out their recommendations for economic and fiscal measures that should be included in the Bill. The motion further provided that when committees of the Legislature resume, the Standing Committee on Finance and Economic Affairs would be authorized to consider the Act, together with any letters filed by leaders and independent Members, and that the Minister of Finance would be the Committee’s first witness when it commenced its review.

The motion passed on May 12, 2020, authorized the Committee to begin consideration of the matters that had been referred to it on March 25. In addition, it empowered the Committee to study the impact of the COVID-19 crisis on specific sectors of the provincial economy, including “measures which will contribute to their recovery.” The sectors identified in the motion are:

· tourism;

· culture and heritage;

· municipalities, construction and building;

· infrastructure;

· small and medium enterprises; and

· other economic sectors selected by the Committee.

The Committee is specifically authorized to release interim reports, as it sees fit. Interim reports are to be presented to the House, and a copy of each report is to be provided to the Chair of Cabinet’s Ontario Jobs and Economic Recovery Committee. Interim reports will not be placed on the Orders and Notices paper for further consideration by the House, and the Government will not be required to table a comprehensive response to them.

A final report will be tabled in the House, and a copy delivered to the Chair of the above-noted Cabinet committee, by October 8, 2020.

The Committee’s mandate is reproduced in full in Appendix A to this report.

Ministry Update

Ontario’s Minister of Heritage, Sport, Tourism and Culture Industries, the Honourable Lisa MacLeod, presented to the Committee on June 4, 2020.

The Minister prefaced her remarks with the following:

Because these are not normal times, I will not be sugar-coating what we’re dealing with. While COVID-19 has hit everybody hard, my ministry oversees sectors that have been shattered.

As outlined by the Minister, immediately prior to the onset of the COVID-19 pandemic, the tourism sector had registered a “spectacular” economic and social bottom line. In addition to $75 billion in direct and indirect economic activity—including the employment of hundreds of thousands of people across the province—Ontario’s pre-pandemic tourism sector featured thriving sports, arts, and entertainment industries.

Today, “these people are hurting.” Ministry figures indicate sector losses of at least $20 billion; and according to a report from the C.D. Howe Institute, four of the hardest hit industries fall within the Ministry’s purview: transportation and sightseeing tours; air transportation; accommodations and food services; and arts, recreation and entertainment. The Minister cited several examples of how the pandemic has affected these industries:

· Hotel occupancy in April 2020 stood at 13.8%, down from 62.5% a year earlier.

· Restaurants Canada estimates that the industry has lost 300,000 jobs in Ontario alone.

· The Conference Board of Canada reports that airlines have lost 13 million seats, including 11 million in April and May.

· Indigenous Tourism Ontario projects $330 million in losses.

· Tourism Toronto estimates a $5.6 billion loss; Ottawa projects at least $1 billion in economic loss.

· The Tourism Industry Association of Ontario estimates that more than 65% of tourism industry operators are currently closed.

In the Minister’s assessment, COVID-19 represents a “triple threat”—a public health crisis, an economic crisis, and a social crisis. The latter, which is distinguished by social distancing requirements, bans against mass gatherings, and the fear and stigma associated with a return to dining in restaurants or attending festivals and sporting events, may necessitate fundamental changes to the tourism sector. According to the Minister:

None of us should be naive to the fact that there will be lasting damage, that many customers are rethinking their old habits, that restaurant and music venues will not be filled any time soon, and that with international travel restricted, we cannot expect a return to previous levels of foreign or domestic tourism any time soon.

The Minister outlined several steps her Ministry has taken to address the effects of COVID-19, beginning with the first signs of trouble in the early New Year:

· reviewing the SARS recovery model in January, including consultation with former tourism and culture ministers from the SARS crisis;

· assembling in February informal tables with stakeholders to assess data coming in from international partners;

· initiating telephone town halls with over 1,000 stakeholders; ministerial advisory committees with industries ranging from airlines and hotels to tourism leaders; and virtual town halls with Regional Tourism Organizations;

· appointing MPP Norm Miller to undertake a consultation throughout the province;

· tripling the Tourism Development and Recovery Fund, from $500,000 to $1.5 million;

· working with Destination Ontario, the Tourism Industry Association of Ontario, and 13 Regional Tourism Organizations to develop a marketing plan;

· allowing licensed restaurants to sell and deliver unopened alcohol;

· earmarking $341 million to support hotels that are taking in the overflow from hospitals; and

· continuing to flow funds through agencies such as Destination Ontario.

In the medium-term, the Ministry will continue to support local recovery campaigns and promote digital tourism. To support a longer-term recovery, the Ministry is developing a five-year plan to “help us recover, rebuild and then re-emerge as a premier visitor destination in the world.”

Impact of COVID-19

Ontario’s tourism sector encompasses a variety of activities across the province. The sector includes the hospitality industry (hotels and restaurants), tour operators, events and attractions (museums, festivals, theatres, and amusement parks), lodges, outfitters, campgrounds, and transportation services. Tourism businesses vary in size and breadth of operation and may be for-profit or not-for-profit.

Stakeholder testimony was clear: COVID-19 has had a devastating impact on all aspects of the province’s tourism sector.

Over 300,000 hospitality employees are laid off or not working any hours. Some 50% of Ontario’s hotels have been closed, and those staying open operate with skeleton staff largely accommodating essential service needs. We are seeing 94% year-on-year revenue declines. Nearly half of all single-unit restaurants are temporarily closed. Ontario’s foodservice industry is on track to lose around $7 billion in sales just this second quarter.

Ontario Restaurant Hotel and Motel Association

In 2019, the [Shaw Centre] hosted 455 events, generated 1,795 jobs, generated taxes in the amount of $60 million . . . and injected $150 million in total spending into the community. As a convention centre, we employ more than 300 employees, of which 95% have now received temporary lay-off notices. As of March 24, all events have been cancelled through to October, and we’re now fielding cancellations for the end of the calendar year. Our building has been mothballed. . . . It is anticipated that the meetings and convention business will take three to four years to fully rebound. 2020 has devastated us as an industry, and waiting it out just to get to better times is financially challenging.

The Shaw Centre (Ottawa)

The TIFF September festival—the largest revenue driver for our organization—is now precariously positioned in a difficult economic environment. We are facing a COVID-19-induced revenue shortfall of $25 million for this year alone . . . more than 50% of our operating budget. . . . TIFF’s future is at risk . . . [a]nd it’s not just TIFF. There are real impacts for our festival suppliers as well, which has a ripple effect across the economy. Suppliers will be renting less AV equipment, fewer tents for the street events, fewer bookings in restaurants and hotels, and so on.

Toronto International Film Festival

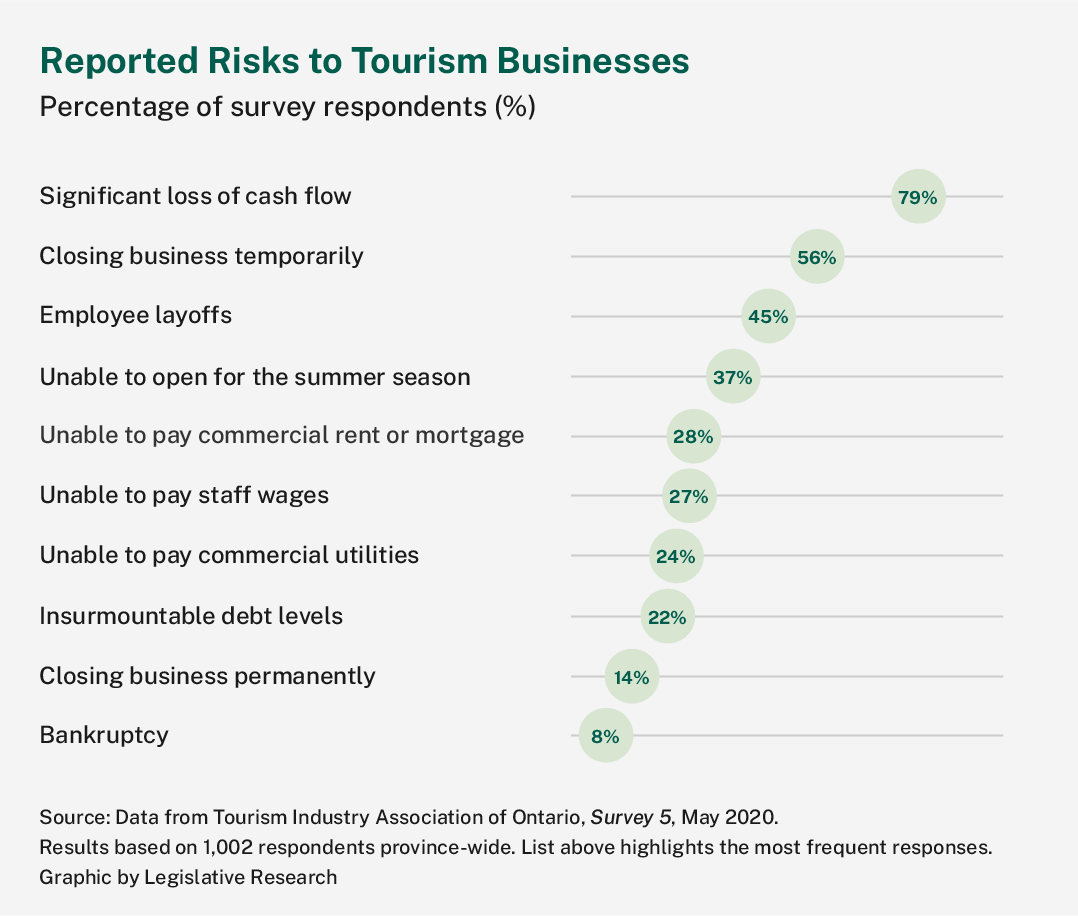

According to a May 2020 survey conducted by the Tourism Industry Association of Ontario (TIAO), more than 65% of tourism businesses are temporarily closed and 37% of seasonal businesses will be unable to open for the 2020 summer season. More than half (54%) of businesses surveyed said that current forms of government financial assistance are insufficient to ensure the survival of their operations.[1]

TIAO’s survey found that the greatest risks facing tourism businesses are as follows:

· uncertainty around when and how they will be able to re-open;

· lack of information and clarity around the re-opening of borders;

· ineligibility for Canada Emergency Commercial Rent Assistance;

· ineligibility for other government aid programs;

· temporary closures becoming permanent;

· insurmountable debt levels and severe disruptions to cash flow;

· risk of bankruptcy; and

· insufficient government aid to ensure business viability.[2]

As outlined below, travel restrictions—and in particular, restrictions on non-essential travel between Canada and the United States—have had serious consequences for tourism in Ontario’s border communities, and pose a continuing threat to recovery.

Travel Restrictions

One of the first responses to the COVID-19 crisis in Canada was the imposition of travel restrictions. On March 20, the federal government announced that the Canada-US border would close to non-essential travel and that this closure would continue until at least July 21, 2020. The resulting loss of American visitors to Canada has decimated tourism businesses in the border communities of Niagara Falls and Northern Ontario.

In Niagara, home to some of the busiest land border crossings in North America, travel restrictions have crippled the region’s tourism sector. With over 14 million visitors annually, it is often said that Niagara has one industry—tourism. Several witnesses described how the economic shutdown not only puts Niagara-area businesses at risk, but threatens “the very communities in which these people and businesses reside.” Close to 40,000 tourism-related jobs have been lost in the region, with many businesses struggling with property tax payments and no other options for generating revenue. According to the Niagara Falls Canada Hotel Association:

With the borders closed and international long-haul leisure tourism at a standstill, we have one market left to sustain us, and it’s Ontarians. In short, we are on life support and you, the Ontario government, are holding the antidote.

In the north, resource-based tourism—lodges, resorts, campgrounds, cottage rentals, and outpost camps—has been hit particularly hard. These businesses cater to anglers, hunters, outdoor enthusiasts, and vacationers. As described by the Executive Director of Nature and Outdoor Tourism Ontario (NOTO), “as you move from northeast to northwest in Ontario, the percentage of US guests grows from 50% to 100%.” As well, “fishing accounts for 80% of all tourism revenues in this region . . . with ninety-nine out of every 100 guests at a fishing lodge in northwestern Ontario originating in the United States.”

Ordinarily, late spring and early summer are the most profitable times of the year for resort operators, as many US tourists come for the spring black bear hunt and the start of the fishing season. This year, businesses report a raft of cancellations from American guests, and do not expect to recoup these losses.

Another factor revealed to the Committee is that 15% to 20% of resource-based tourism businesses in Northern Ontario are American-owned and operated. These owners are not allowed into the country, and cannot prepare for re-opening. According to NOTO, American business owners “are being put at a significant disadvantage and are feeling as though they are being discriminated against.”

Operators located in the northwest also noted that marketing efforts this year focused mainly on US tourists who, as it turned out, could not travel to Canada. Although some businesses have been able to adapt by targeting potential customers within driving distance, the majority do not have the funds for robust marketing campaigns aimed at the local population.

Two presentations in particular resonated with Committee Members and illustrated the immense difficulties Ontario’s tourism sector faces. Michel LeFeuvre-Watson and her husband are the owner-operators of a resource-based, fly-in resort in Algoma District. As a seasonal business, revenues generated during the 20 weeks the lodge is open represent the family’s annual income; 90% of the lodge’s client base is American. This year, with no prospect of income from the spring black bear hunt, and the border closed to US visitors as the fishing season began, the business has already lost over $500,000 in revenues. Michel estimates that it will take several years for the business to recover, and is worried about its ability to repay a $40,000 Canada Emergency Business Account (CEBA) loan within two years:

Our family has been in the resource-based tourism field since 1946. We’re very proud to be able to continue the tradition passed on to us by my husband’s family. That being said, we are currently watching our business fail with the uncertainty of not knowing if and when we will be allowed to open for regular business. We worry that everything that we have built as small business owners over the years will be for naught if things do not change to allow us to operate.

Betty McGie is the owner-operator of a fly-in hunting and fishing resort near Wawa. Her father, Richard Arthur Wilson, started the business in 1946. Born to English immigrants in the railroad town of Oba, Richard served as a fighter pilot for the Royal Canadian Air Force during World War II. He was shot down three times but lived to return home and start the business with a single cabin at the age of 23. Today, Betty’s resort operates for 110-120 days of the year. The vast majority of guests are repeat customers from the United States. According to Betty, “the current situation in the US and the closure of the borders has basically caused 100% loss of income to our businesses [and] Ontario residents are not going to fill this gap.”

Re-Opening the Economy

A consistent refrain from witnesses was the need for clarity around the re-opening process, and in particular, clarity with respect to re-opening dates and the criteria and standards that must be met in order to be able to re-open.

The [Oh Canada, Eh? dinner show] applied for various government loans, but it was not enough to keep the production company from financial distress. With no certainty of a re-opening timeline or if the formerly successful dinner show business model would be feasible under new public health requirements, the owners made this heart-breaking and difficult decision [to close production].

Attractions Ontario

Under these current restrictions, and without a clear timeline for these facilities to reopen, we have no clarity on when we may be able to become viable once again. Without swift action to provide customer insight and [a] path to financial viability, our pipeline of future business is eroding well into 2021 and beyond.

Fairmont Royal York Hotel

One aspect of this issue is the apparent confusion over re-opening rules. Resorts of Ontario, for example, said that while the industry welcomed the lifting of restrictions on short-term rentals announced in early June, resorts subsequently reported that OPP, municipal officials, and local public health units could not agree on whether short-term rentals were, in fact, permitted to open.

Similarly, Central Counties Tourism described how member businesses had submitted re-opening plans to the province for approval, only to be told that permission to re-open is at the discretion of local public health officials. Central Counties’ Executive Director described the industry’s concerns: “No one is saying no, but no one wants to say yes. . . . The clarity has to be there—someone to say, ‘I’m the person. I’m the one who’s saying yes or no.’”

Other witnesses described what they called a “patchwork” approach to re-opening across the province. For example, whereas the Toronto Zoo was allowed to re-open as a drive-through operation, African Lion Safari, located 100 kilometres to the west, was not allowed to do so, even though it pioneered this experience. In Northern Ontario, private operators watched as camping on Crown land resumed before private campgrounds, lodges, and trailer parks were permitted to open.

According to many within the tourism sector, re-opening by government decree is perceived as arbitrary. They say tourism businesses should be given more responsibility in the re-opening process, because these businesses know better than anyone what it will take to restore public confidence. The Royal York Hotel in Toronto, for example, pointed out that hotels were designated as an essential service at the start of the pandemic and have had more than enough time to adjust to the new circumstances:

Hotels have embraced all protocols and guidelines issued by the province and have further complemented these measures by preparing enhanced safety protocols. These additional protocols are in place today and demonstrate the readiness of hotels to accommodate guests, host events, welcome travellers and support businesses that rely on hotels each day.

Ottawa Tourism reported that its members are re-opening “safely” because it is “obviously in their best interests, and they’ll take every possible step they can to ensure that nothing is going to happen because they can’t afford to go back into a lockdown position . . . most of them are going to exceed whatever guidelines are put in place, just for their own business continuity purposes.”

These stakeholders maintain that the government’s role should be limited to establishing clear, sector-based standards for re-opening, based on public health guidelines. For their part, businesses should be allowed to decide how they are going to meet those standards. Any business that can demonstrate it has met these requirements should be permitted to re-open.

Financial Relief

The Committee received considerable testimony about the range of government financial relief programs potentially available to pandemic-affected businesses.

At the federal level, financial relief is available in the form of interest-free loans, loan guarantees, corporate income tax and sales tax payment deferrals, commercial rent assistance, and wage subsidies. In Ontario, businesses are currently receiving five months’ interest and penalty relief with respect to most provincially-administered taxes. Employers may also defer Workplace Safety and Insurance Board (WSIB) payments for up to six months, and the Employer Health Tax exemption has been doubled for 2020. Many municipalities are deferring property tax payments and/or waiving penalties and interest on unpaid property taxes.

The many submissions that addressed this subject were clear: Ontario’s tourism sector greatly appreciates the financial assistance that has been provided to date; indeed, for many businesses it has been a lifeline.

Nonetheless, witnesses pointed out that these programs are not tailored to the seasonality or other unique aspects of the tourism sector, with the result that many businesses are not eligible for assistance. Another commonly expressed concern is that much of the aid on offer is repayable. As such, it may only add to the financial burden businesses have accumulated since the beginning of the economic shutdown.

Eligibility

As initially implemented, eligibility for some financial assistance programs hinged, in part, on whether a business could show that it had a prescribed level of payroll and had experienced a prescribed decline in revenues.

For example, before the Canada Emergency Business Account (CEBA) was revamped in late June, a small business could access the program’s interest-free loans only if it had a payroll of at least $20,000. Under the Canada Emergency Wage Subsidy (CEWS), an employer was eligible for a subsidy equal to 75% of employee wages only if it could demonstrate a loss of revenue of at least 15% in March 2020 and a loss of revenue of 30% in each of April and May.

As described to the Committee, the majority of Ontario’s tourism sector consists of owner-operated small businesses that do not have a payroll, sole proprietors who receive business income directly, or family-owned companies that remunerate in a form other than payroll. As a result, a large swath of the sector was not eligible for CEBA assistance because businesses did not meet the program’s payroll requirement.[3]

Similarly, due to the sector’s seasonal nature, many operators are not up and running in the winter or early spring months, with the result that these businesses did not meet the loss of revenue criteria required under such programs as CEWS.

Even employers who have been able to access CEWS point out that they cannot top up the subsidy while operating with zero revenue. At the Deerhurst Resort, this meant front-line employees had to choose between “staying at home or returning to work with less money in the bank.” In the resort’s view, “this system, although helpful, is not suited for the majority of employers and employees in our industry.”

Other large-scale enterprises, such as Arlington Estate, which specializes in high-end luxury events, described how they have been shut out of government financial aid because they exceed program revenue, payroll, and rent thresholds. Moreover, despite their size, they have difficulty obtaining loans from lenders such as the Business Development Bank of Canada and the Export Development Corporation because they have been “lumped in” with the restaurant industry as “high risk.”

Not-for-profit organizations are also finding it difficult to access financial relief programs. Witnesses reported that in order to access some of the larger business loans, an organization must demonstrate a debt-servicing capability and historical profits. Many not-for-profit organizations, however, are registered charities. As such, they are bound by Canada Revenue Agency rules that limit profit generation. This requirement presents a significant barrier to accessing government support.

Music Africa of Canada described how difficult it is for independent artists to access financial support. Music Africa of Canada is a not-for-profit organization that promotes African music in the Toronto area. The organization’s main event is Afrofest, an annual two-day African cultural festival held each summer in the east end of the city. Afrofest attracts about 120,000 people—locally, nationally and internationally. Due to COVID-19, Afrofest and other events will not be held this year.

Most of the artists who participate in Music Africa’s events are self-employed and depend on events like Afrofest for opportunities to perform. As noted by Music Africa’s executive director, “if we do not present events, then artists don’t get paid.” Moreover, “I can say this personally and out of my own personal experience—most of the African artists that I know have a hard time getting grants from the government.” One of the reasons for this is that grant-giving organizations such as the Toronto Arts Council and the Canada Council for the Arts appear to favour artists who have a track record of receiving grants from the government, rather than new and emerging artists.

Music Africa Canada was joined by the Shaw Festival in recommending financial support programs aimed specifically at independent artists.

Finally, Multicultural Theatre Space (MT Space), a theatre company based in the Waterloo region, informed the Committee that digital arts activities are currently not eligible for grants from provincial funding programs such as the Ontario Cultural Attractions Fund and Celebrate Ontario. As the employer of hundreds of artists and technicians who are currently “faced with an existential crisis,” MT Space urged the Ministry to reconsider the funding criteria these agencies apply. Support for digital arts, it was noted, would not only support local artists and small businesses, it would be consistent with provincial accessibility policies.

Repayable versus Non-Repayable

According to business owners, the other main deficiency in current financial relief programs is the emphasis placed on repayable forms of aid.

Fully-repayable loans and deferrals in particular are viewed as future burdens for small businesses that have been earning reduced or zero revenue for months. Many believe this type of assistance will do little to ensure the survival of individual businesses, let alone re-establish sector-wide stability.

The Ontario Restaurant Hotel and Motel Association described the situation facing hotels and restaurants:

As hotels and restaurants reopen, there will be start-up costs in payroll, in food, in supplies, in addition to paying off government deferral and loan payments. New expenses will be added to deal with sanitization and distancing practices. The issue becomes more dramatic as most businesses will be emerging out of a period without revenues and entering a painfully slow recovery road. Where is the cash coming from?

In Northern Ontario, as noted earlier, the absence of American visitors this year is depleting the resources of outfitters and lodges. These operators view loan programs such as CEBA as inappropriate for small businesses experiencing 100% revenue losses. As stated by the Executive Director of Ontario’s Sunset Country Travel Association, “potentially incurring an additional $40,000 in debt is not necessarily a good business decision. If we have no ability to have some type of aid program that is non-repayable, we will see insolvency in this region.”

For one Toronto restaurateur, financial support is a matter of fairness. In his view, the shutdown process, and the financial aid that has accompanied it, is inherently unfair because it effectively places the entire cost of the crisis on one side:

We’ve been legislated shut, and every month we’re getting this great deferral from our city on the property taxes that we owe . . . ; [however] there’s absolutely no way $1 of those property taxes can ever be paid if people expect these small businesses and entrepreneurs to survive . . . . What’s really dawned on me . . . is somehow we’re being asked to bear 100% of the burden, in terms of shutting our business down, in terms of doing the right thing—and I’m fine with that. But you know what? Our country needs to share this problem, and we simply cannot bear 100% of the cost.

Witness Recommendations

The Committee received many proposals relating to financial assistance. Some call for an extension or enhancement of existing programs while others suggest new programs that offer forgivable/non-repayable aid, as summarized below.

· Government-Backed Loans —provide 100% government-backed loans at zero or low interest rates, with no personal guarantees and a long amortization period.

· Local Lending Institutions —exercise the authority granted under Bill 188 (the Economic and Fiscal Update Act, 2020) and borrow up to $32.1 billion from the Consolidated Revenue Fund. These funds should be distributed to local financial institutions, such as credit unions, which could in turn lend to local businesses at low interest rates.

· Federal Assistance Programs —work with the federal government to convert the $40,000 interest-free loan under the Canada Emergency Business Account (CEBA) into a partially forgivable grant; the province should also contribute to the Canada Emergency Wage Subsidy (CEWS) so that the program can be continued into the recovery period.

· Direct Aid —provide direct financial aid to the tourism sector in the form of non-repayable grants, tax credits, subsidies, and rebates for the purpose of covering the cost of infrastructure upgrades and personal protective equipment necessary to comply with new health and safety protocols; upgrading the skills of returning employees; and re-training tourism employees who have lost their jobs due to the pandemic.

· Tax Credits — provide tax credits to consumers for travel, tourist attractions, and accommodation, to encourage Ontarians to travel locally; increase the charitable donation tax credit from 11% to 20% to encourage private donations.

· Property Taxes —allow municipalities to run operating deficits so that property tax liability can be waived or payment deferrals extended; the province should also direct the Municipal Property Assessment Corporation (MPAC) to amend its property assessment model to take into account depressed business revenues during the recovery period.

· Provincial Fees —waive travel industry regulator fees, as well as fees for land use permits, fishing licences, and other Crown resource-related fees payable by seasonal operators.

· Marketing —provide emergency funds to Destination Ontario, which can be invested in local Destination Marketing Organizations.

· Insurance — investigate whether insurers are honouring claims for “business interruption” coverage; require insurers to provide rebates on auto insurance and business insurance policies.

Commercial Rent Assistance

In April 2020, the federal government, in partnership with the provinces, announced the Canada Emergency Commercial Rent Assistance (CECRA) program.[4]

Administered by the Canadian Mortgage and Housing Corporation, CECRA offers landlords unsecured, forgivable loans to help meet operating expenses on commercial properties during the months of April, May, and June 2020. The loans cover 50% of an eligible commercial tenant’s rent, with the tenant covering another 25%, for combined assistance equal to 75% of total rent owed. In return, landlords agree to forego 25% in rent, and to adhere to a moratorium on eviction during the period of the loan. Loans will be forgiven on December 31, 2020, conditional on compliance with the terms of the loan contract.

A property owner is eligible for a CECRA loan if the commercial tenant is paying no more than $50,000 in monthly rent, generates less than $20 million in gross annual revenues, and experiences at least a 70% decline in revenues compared to pre-COVID-19 levels.

Although landlords are strongly encouraged to apply, participation in the program is voluntary.

Data presented to the Committee indicates that 80% to 90% of small tourism businesses across Canada do not own their business premises. As tenants, these businesses “are currently at the mercy of the landlords and the policy as it stands.”

Multiple businesses reported that CECRA is not working for them, mainly because landlords are reluctant to participate:

· Bingemans, a Waterloo-based hospitality company, which leases properties from two landlords, said that while one of the landlords has been supportive and willing to work with the company, the other landlord simply does not communicate. This has only added to the uncertainty around business operations and re-opening.

· Attractions Ontario, a not-for-profit organization representing over 550 tourism businesses, reported that many of its members have had bad experiences with CECRA. For example, Haunted Walks, a successful attraction that had been operating for 25 years in good financial standing, was forced to close three of its five locations, “due to landlords being unwilling to participate” in CECRA. For the same reason, Canadiana Productions Inc.’s Oh Canada Eh? Dinner Show had to permanently close.

· The Chair of the Church-Wellesley Village BIA in Toronto, who is also the owner-operator of the landmark Pegasus bar on Church Street, said that he feels fortunate that his landlord agreed to participate in CECRA. Anecdotally, however, he believes many landlords in this area of the city “just don’t want to give up the 25%.” The lack of landlord support, he says, will compound the losses Village-area businesses sustain due to the cancellation of this year’s Pride Festival.

CECRA’s eligibility criteria was also questioned. In particular, the program’s 70% decline in revenue requirement is viewed as too restrictive. Many tourism businesses, it was pointed out, become unprofitable when revenues decline by only 20%. Put another way, some businesses only start making money when they reach “85% or 90% of [their] revenue target.”

The Committee received several recommendations for improving support to commercial tenants. Among them:

· Impose a moratorium on commercial evictions. One option is to adopt the approach taken in British Columbia, which prohibits commercial evictions if an eligible landlord does not apply for CECRA. Another is to make the program mandatory for landlords.

· Change the structure of the commercial rent support program so that (1) tenants can apply for rental assistance, and (2) money flows directly to affected businesses, rather than to the landlords.

· Lower the “decline in revenue” threshold for CECRA eligibility.

· Simplify CECRA’s cumbersome and confusing application process.

The Importance of Testing and Contact Tracing

Central to any economic recovery in the tourism sector is the restoration of confidence—confidence on the part of the public and on the part of employees that they can participate safely in the tourism economy.

In the context of a pandemic, stakeholders stressed that one of the keys to restoring confidence is the presence of an advanced testing and contact tracing program. Andreas Antoniou, a Toronto restaurateur, articulated the issue this way:

This is a confidence game. If I know that [someone] inside of a restaurant probably [is not infected], because my government’s on top of testing, tracing and isolating, then I’ve got the confidence to go to that restaurant. I’ve got the confidence to go to the movie theatre. I’ve got the confidence to go to a stadium. And you know what? If it turns out there’s a flare-up of 100 people, they’re going to know quickly, they’re going to put out that flare and then everyone’s got confidence again.

Financial assistance is necessary, he concluded; but at the end of the day, “all roads lead back” to adequate testing, contact tracing, and isolating—and this is where the government should be concentrating its efforts.

Worker Protection and Training

Unions representing thousands of workers in restaurant and food services, as well as the airport, hotel, and car rental industries, described the difficult circumstances facing the many unionized workers who have been laid off or had their hours of work reduced as a result of the pandemic.

Industry layoff figures presented to the Committee included:

· 65% of restaurant workers;

· 80-90% of hotel workers; and

· 90% of food service workers at Pearson Airport.

Workers employed with car rental agencies report an 80-90% decline in business.

According to union representatives, workers are no longer talking about when they will be going back to work; rather, they are questioning whether they will have a job to return to when the economy re-opens. Moreover, some who have been working in hospitality and restaurant services for decades are worried that they may not be able to find other sources of employment, since “they don’t know how to do anything else.”

Organized labour is urging the government to “support and protect” tourism workers in the following ways:

· ensure worker health and safety by providing easy access to publicly delivered COVID-19 testing;

· establish safety protocols for workers, including mandatory personal protective equipment for workers in restaurants, hotels, and airports;

· establish presumptive eligibility for WSIB benefits for workers who contract COVID-19;

· legislate 10 paid sick days; and

· provide training for those who need to upgrade their skills to meet the post-pandemic requirements of their jobs, and retraining for workers who are looking to move into new types of employment emerging from the current crisis.

Broadband and Cell Phone Access

Access to reliable and affordable broadband Internet and cell phone service in rural, northern, and Indigenous communities is considered key to the survival and growth of the tourism sector outside of urban Ontario, now more than ever given the immense challenges posed by COVID-19.

Speaking to the Committee from a remote fishing lodge, the Executive Director of Destination Northern Ontario outlined the importance of technology infrastructure to the future of tourism in these parts of the province:

We know along our highways, there are vast stretches where there’s no connectivity at all. For example, I’m at a fly-in fishing lodge today, so I’m connected to you by Xplornet. If a big cloud comes over (the last time it was a float plane that flew over and disrupted the signal) we [lose] our connection. Today is a presentation, but just imagine a business that’s trying to submit an order for groceries or process credit card payments with a plane at the dock waiting to take a couple out. It’s huge, especially as businesses move to do more and more online, to be able to have that connectivity across the north. It’s really holding us back.

Several presenters echoed these comments, including the Tourism Industry Association of Ontario, the Timmins Chamber of Commerce, Regional Tourism Organization 11 (Haliburton Highlands-Ottawa Valley), and the Anishnawbe Business Professional Association.

These and other stakeholders urged the province to work with the federal government to develop the technology infrastructure necessary to ensure province-wide connectivity for Ontario’s tourism sector.

Specific Industry Issues

Witnesses also commented on issues affecting specific industries: Indigenous tourism; grape growers and wine producers; and aviation.

Indigenous Tourism and Sport

Ontario’s designated provincial Indigenous sport body, Indigenous Sport and Wellness Ontario (ISWO), shared its recent experience with the Committee.

Ordinarily, ISWO provides programs in sport, leadership, and wellness for Indigenous people of all ages. Currently, they are struggling to cope with the effects of COVID-19: the 2020 North American Indigenous Games have been postponed, programs and events have been cancelled, and the organization has recorded a $500,000 loss. ISWO is currently providing online learning and leadership opportunities to keep youth engaged, but hopes to safely resume regular sporting events and programs as soon as possible. ISWO noted that, “for many youth, sport is the only outlet keeping them safe and on the right path.”

Indigenous Tourism Ontario (ITO), Ontario’s main Indigenous tourism organization, spoke to how the pandemic has affected this branch of the tourism sector.

ITO noted that Indigenous tourism has experienced “unprecedented” growth in recent years, thanks in part to the support of the Ontario and federal governments. Like other branches of the tourism sector, however, the COVID-19 crisis poses a serious threat to this success. Projections for Ontario include $330 million in lost revenue, the loss of 4,000 jobs, and the closure of up to 140 businesses.

ITO reported that it has developed a three-phase recovery framework that focuses on (1) maintaining the organization’s relationship with traditional provincial and federal partners, such as Tourism Canada and Ontario Regional Tourism Organizations; (2) establishing a virtual tour model; and (3) developing a more “sustainable and financially viable” Indigenous tourism sector.

To implement this initiative, Indigenous businesses will require resources above and beyond those that have been made available to non-Indigenous activities. Specifically, ITO anticipates that Indigenous tourism will need a combined federal/provincial commitment of at least $2.5 million over the next two years.

Grape Growers, Wine Producers, and Craft Brewers

Ontario’s grape growers and wine producers say that they, as much as any other sector of the economy, have been hit hard by COVID-19. Growers have seen their contracts with processors reduced or terminated. Wineries have sustained major losses due to the closure of retail wine stores and the near total elimination of sales to bars, restaurants, and special events such as weddings. Small and mid-sized wineries lost an important source of revenue when they discontinued tours of their grounds for public health reasons.

Organizations representing hundreds of family-owned farms and wineries say “now is the time, more than ever,” for the Ontario government to support domestic growers and wine producers. Among other measures, they are asking the government to

· eliminate the 6.1% basic tax on Ontario wine;

· remove the $7.5 million cap on the VQA Wine Support Program; and

· direct the LCBO to provide more shelf space for Ontario’s VQA wines.

Ontario’s burgeoning craft brew industry was among the first to experience the effects of the COVID-19 pandemic. According to submissions from the Ontario Craft Brewers Association and the Lake of Bays Brewing Company, based in Muskoka, craft brewers have sustained a decline in sales of more than 50% due to the closure of restaurants, bars, and tap rooms, as well as the cancellation of festivals and community events. These businesses are “sitting on millions of dollars of perishable beer inventory that cannot be sold because of the mandated closures,” and have had to lay off more than 60% of their staff.

The brewers association submitted three recommendations for supporting the industry, during the pandemic and in the long-term:

· temporarily change the LCBO’s shelving policy to better promote Ontario craft beer;

· provide grants to offset the loss of sales due to the cancellation of beer festivals and other events; and

· reduce the red tape that limits access to craft beer—for example, allow the sale of craft beer at farmers’ markets; amend liquor licences to allow the sale of craft beer at community events and pop-up locations; and allow beer manufacturers to have more than one or two retail locations.

Lake of Bays Brewing Company recommended regulatory and policy changes to promote the industry, as opposed to more financial support. First, it would like to see “clear and consistent messaging on travel within Ontario,” to address the fact that some communities are welcoming visitors while others are not. Second, instead of government-imposed 50% capacity limits, establishments should be allowed to “work out their own safety capacity,” while maintaining physical distancing requirements. As a third measure, the brewery recommended that the temporary emergency order allowing restaurants and bars to sell alcohol for take-home consumption should be adopted as permanent policy.

Aviation

Almost half of Canada’s aviation industry is based in Ontario. Twenty-two commercial airlines, including regional carriers, cargo operators, and float plane operators, service all parts of the province. Toronto Pearson International Airport alone generates 6% of Ontario GDP.

The Greater Toronto Airports Authority emphasized the importance of aviation to Ontario’s tourism sector:

Aviation is and will continue to be the critical link to travel and tourism and trade, the conduit to Ontario’s rural and northern communities, and the first and last impression that visitors often have of our amazing province. We truly are the link that connects the world to Ontario.

According to industry representatives, “COVID-19 has been nothing short of devastating to the aviation sector.” Currently, the largest carriers—Air Canada and WestJet—are flying at less than 10% of previous levels. The next tier—Sunwing, Porter, and Air Transat—have suspended all flights. In April 2020, passenger traffic at Toronto Pearson was down year-over-year by 98%. Airports such as Billy Bishop are closed to commercial traffic. Thousands have been laid off, and according to the International Air Transport Association, it may be two to four years before there is a return to previous levels of passenger and flight traffic.

Members of an aviation industry panel that has been reporting to Ontario’s Minister of Heritage, Sport, Tourism and Culture Industries during the crisis stressed that although aviation in Canada is a federally regulated matter, the province nonetheless has jurisdiction to support the industry. In particular, the province could

· encourage the federal government to adopt unified national health standards and protocols;

· work with the other provinces to eliminate provincial quarantine requirements for residents who return after visiting other provinces;

· eliminate Ontario’s portion of the HST from travel and tourism;

· eliminate the provincial tax on airport consumer goods; and

· eliminate the aviation fuel tax.

Children’s Camps

The Committee received a submission from Scott Creed, the founder and CEO of Camp Muskoka in Bracebridge. According to Mr. Creed, “Ontario’s century-long history of providing a rewarding summer camp experience to over 400,000 Ontario children each year is now in peril.”

Speaking as a member of the Ontario Camps Association, Mr. Creed said that the association’s members understand and accept the provincial government’s decision that overnight camps will not be permitted to open this summer, and that day camps may operate only under strict conditions. “What concerns us today,” he said, “is whether Ontario children and youth will have the opportunity to experience summer camp in the years to come.”

Mr. Creed explained that camps differ in a number of ways: some operate all year-round, others operate only in the summer; some are private, others are not-for-profit; and some are specialty camps aimed at vulnerable kids or kids with special needs. What they have in common, however, are ongoing expenses, including mortgage, insurance, and maintenance costs. According to Mr. Creed, if the experts are right—that a return to normal is as far away as 2024—many camps will not survive. Moreover, he said, they may never be replaced: “I could count on one hand how many people have founded camps in the last 30 years.”

Camp Muskoka’s main recommendation is that the province work with the federal government to establish a federal/provincial fund to support overnight camps. Under this program, eligible camps would have access to funds equal to 25% of their annual gross revenue to help cover the cost of ongoing expenses.

Committee Recommendations

The Standing Committee on Finance and Economic Affairs recommends that:

1. The Province should call on the federal government to reduce the “decline in revenue” criterion under the Canada Emergency Commercial Rent Assistance (CECRA) program from 70% to 20%.

2. The Province should call on the federal government to change the CECRA program to have tenants apply for commercial rent assistance.

3. The Province should increase funding for the Tourism Development Fund from $1.5 million to $3 million.

4. The Province should (i) establish Special Tourism Zones to promote tourism; (ii) adopt as permanent measures the temporary regulatory changes implemented to support restaurants and bars during the COVID-19 pandemic, including allowing the sale of alcohol for take-home consumption and reduced red tape for outdoor patios; and (iii) remove the restrictions on where craft breweries may sell their products.

5. The Province should provide government-backed, low-interest or zero-interest loans to tourism businesses, repayable within five years.

6. The Province should consider temporarily eliminating the provincial portion of the aviation fuel tax.

7. The Province should work with the federal government to make province-wide Internet and cell phone connectivity a priority.

8. The Province should use the Northern Ontario Heritage Fund to support northern Ontario tourism businesses during the COVID-19 pandemic.

9. The Province should waive travel industry regulatory fees, and fees for land use permits, fishing licences, and other Crown resource-related fees payable by seasonal operators.

10. The Province should double funding for the Experience and Explore program so that the age cap on children who can enter for free can be raised.

11. The Province should introduce a one-year travel and accommodation tax credit, modelled on programs such as the home renovation tax credit.

12. The Province should increase funding for Tourism Information Centres.

13. The Province should double funding for Ontario festivals in 2021 from $20 million to $40 million.

14. The Province should allow Tourism Information Centres and local airports to set up “buy local” boutiques and facilities.

15. The Province should increase funding for the Ontario Arts Council to fund new and emerging artists, including Black and Indigenous artists.

16. The Ministry of Heritage, Sport, Tourism and Culture Industries should take a collaborative role in attracting catalytic events.

Witness List

|

Organization/Individual |

Date of Appearance |

|

Airport Taxicab Association |

June 19, 2020 |

|

Algoma Kinniwabi Travel Association |

June 5, 2020 |

|

Anderson’s Lodge |

Written Submission |

|

Andreas Antoniou |

June 11, 2020 |

|

Anishnawbe Business Professional Association |

June 18, 2020 |

|

Architectural Conservancy of Ontario |

June 4, 2020 |

|

Arlington Estate |

June 22, 2020 |

|

Art Gallery of Hamilton |

June 19, 2020 |

|

Association of Canadian Travel Agencies |

June 19, 2020 |

|

Attractions Ontario |

June 4, 2020 |

|

Bayview Wildwood Resort |

June 18, 2020 |

|

Bay Wolf Camp |

Written Submission |

|

Bear Claw Tours |

June 5, 2020 |

|

Betty McGie |

June 5, 2020 |

|

Big Hook Wilderness Camps |

Written Submission |

|

Bingemans |

June 4, 2020 |

|

Black Feather The Wilderness Adventure Company |

June 18, 2020 |

|

Boating Ontario Association |

June 4, 2020 |

|

Brenda Livingston |

Written Submission |

|

Bruce Power |

Written Submission |

|

Brunswick Lake Lodge |

Written Submission |

|

Burford Homes/Gravenhurst Muskoka KOA Campground |

Written Submission |

|

Cambridge Butterfly Conservatory |

June 11, 2020 |

|

Camp Kodiak |

Written Submission |

|

Camp Muskoka |

June 5, 2020 |

|

Camping in Ontario |

Written Submission |

|

Canada’s Accredited Zoos and Aquariums |

June 5, 2020 |

|

Canadian Association of Tour Operators |

June 18, 2020 |

|

Canadian Elite Basketball League |

June 18, 2020 |

|

Canadian Football League |

June 18, 2020 |

|

Canadian Gaming Association |

June 19, 2020 |

|

Canadian Mental Health Association |

June 18, 2020 |

|

Canadian Niagara Hotels and Niagara Falls Hotel Association |

June 19, 2020 |

|

Canadian Polar Bear Habitat |

June 19, 2020 |

|

Carmen’s Group |

June 19, 2020 |

|

Central Counties Tourism |

June 4, 2020 |

|

Charitable Gaming Federation of Ontario/Bingo Innovation Association |

Written Submission |

|

Chelsea Hotel |

June 18, 2020 |

|

Cheminis Lodge |

Written Submission |

|

Chemistry Industry Association of Canada |

Written Submission |

|

Church-Wellesley Village BIA |

June 4, 2020 |

|

City of St. Catharines |

June 19, 2020 |

|

City of Stratford |

June 19, 2020 |

|

Computer Animation Studios Ontario |

Written Submission |

|

Corktown Residents and Business Association |

June 4, 2020 |

|

Corporation of Massey Hall and Roy Thomson Hall |

June 19, 2020 |

|

Dan Butkovich |

June 5, 2020 |

|

Daniel Lemieux |

Written Submission |

|

Deerhurst Resort |

June 5, 2020 |

|

Destination Northern Ontario |

June 4, 2020 |

|

Doug Pincoe |

Written Submission |

|

Drayton Entertainment |

Written Submission |

|

Equal Parts Hospitality |

June 22, 2020 |

|

Explore Waterloo Region |

June 4, 2020 |

|

Fairmont Royal York |

June 4, 2020 |

|

Falls Manor Resort and Restaurant |

June 18, 2020 |

|

Fallsview BIA |

June 11, 2020 |

|

Fallsview Boulevard |

Written Submission |

|

Fallsview Group |

June 5, 2020 |

|

Festival of the Sound |

June 18, 2020 |

|

Festivals and Events Ontario |

June 4, 2020 |

|

FirstClass Group Tickets |

June 4, 2020 |

|

Ganesh Hospitality |

June 19, 2020 |

|

Golf Canada |

June 18, 2020 |

|

Gordon Bowen |

Written Submission |

|

Grape Growers of Ontario |

June 4, 2020 |

|

Greater Kitchener Waterloo Chamber of Commerce |

June 4, 2020 |

|

Greater Niagara Chamber of Commerce |

June 4, 2020 |

|

Greater Toronto Airports Authority |

June 18, 2020 |

|

Greater Toronto Hotel Association |

June 4, 2020 |

|

Hamilton Halton Brant Regional Tourism Association |

June 18, 2020 |

|

Hammond Transportation |

June 11, 2020 |

|

Hazelton Hotel |

June 19, 2020 |

|

Hilton Hotels (Niagara Falls) |

June 18, 2020 |

|

Hot Docs |

June 18, 2020 |

|

Indigenous Sport and Wellness Ontario |

June 5, 2020 |

|

Indigenous Tourism Ontario |

June 19, 2020 |

|

International Alliance of Theatrical Stage Employees |

June 19, 2020 |

|

JW Marriot the Rosseau Muskoka Resort and Spa |

June 18, 2020 |

|

Lake of Bays Brewing Company |

June 19, 2020 |

|

Langdon Hall Hotel |

June 11, 2020 |

|

Linda Rider |

Written Submission |

|

Lindsay Agricultural Society |

June 5, 2020 |

|

Live Nation Canada |

June 22, 2020 |

|

Lundy’s Lane BIA |

June 11, 2020 |

|

Manitoulin Radio, Manitoulin Country Fest, Rockin’ the Rock |

June 22, 2020 |

|

MapleBrae Lakeside Cottages |

Written Submission |

|

Mary-Jo Lentz |

Written Submission |

|

Maurice Patry |

Written Submission |

|

McMichael Canadian Art Collection |

June 19, 2020 |

|

Metro Toronto Convention Centre |

June 19, 2020 |

|

Michel Watson |

June 5, 2020 |

|

Mindie Ferkul |

Written Submission |

|

Ministry of Heritage, Sport, Tourism and Culture Industries |

June 4, 2020 |

|

Mrs. McGarrigle’s Fine Food |

June 5, 2020 |

|

Multicultural Theatre Space |

June 18, 2020 |

|

Music Africa of Canada |

June 5, 2020 |

|

Muskoka Woods |

Written Submission |

|

Nature and Outdoor Tourism Ontario |

June 5, 2020 |

|

Niagara Falls Tourism |

June 5, 2020 |

|

Niagara Parks Commission |

June 4, 2020 |

|

Niagara Tourism Partnership |

June 4, 2020 |

|

Niagara West Tourism Association |

June 19, 2020 |

|

Ontario Chamber of Commerce |

Written Submission |

|

Ontario Craft Brewers Association |

June 11, 2020 |

|

Ontario Craft Wineries |

June 4, 2020 |

|

Ontario Federation of Labour |

June 5, 2020 |

|

Ontario Federation of Snowmobile Clubs |

June 11, 2020 |

|

Ontario Harness Horse Association |

June 18, 2020 |

|

Ontario Highlands Tourism Organization |

June 19, 2020 |

|

Ontario Motor Coach Association |

June 5, 2020 |

|

Ontario Museum Association |

June 18, 2020 |

|

Ontario Restaurant Hotel and Motel Association |

June 4, 2020 |

|

Ontario Snow Resorts Association |

Written Submission |

|

Ontario’s Sunset Country Travel Association |

June 5, 2020 |

|

Ottawa Embassy Hotel and Suites and Ottawa Gatineau Hotel Association |

June 22, 2020 |

|

Ottawa Festival Network |

June 22, 2020 |

|

Ottawa Tourism |

June 5, 2020 |

|

Patterson Kaye Resort |

June 19, 2020 |

|

Pride Toronto |

June 11, 2020 |

|

RBC Place London |

Written Submission |

|

Recreational Trails Coalition Ontario |

Written Submission |

|

Regional Tourism Organization 4 |

June 4, 2020 |

|

Regional Tourism Organization 7 |

June 4, 2020 |

|

Regional Tourism Organization 9 |

Written Submission |

|

Resorts of Ontario |

June 4, 2020 |

|

Riverside BIA |

June 11, 2020 |

|

Samantha Gorman |

Written Submission |

|

Sault Ste. Marie Chamber of Commerce |

June 11, 2020 |

|

Shaw Centre |

June 11, 2020 |

|

Shaw Festival |

June 5, 2020 |

|

Sheraton Centre Toronto |

June 22, 2020 |

|

Southwest Ontario Tourism Corporation |

June 4, 2020 |

|

Special Olympics Ontario |

June 4, 2020 |

|

St. Anne’s Spa |

June 22, 2020 |

|

St. Lawrence Parks Commission |

June 11, 2020 |

|

Stratford Festival |

June 19, 2020 |

|

SUNFEST—London Committee for Cross Cultural Arts |

June 18, 2020 |

|

Sunwing Airlines |

June 4, 2020 |

|

Tamara Matthews |

Written Submission |

|

Texas and Sons Guides and Outfitters |

Written Submission |

|

THEMUSEUM |

June 5, 2020 |

|

Timmins Chamber of Commerce |

June 11, 2020 |

|

Tom Steadman |

Written Submission |

|

Toronto International Film Festival |

June 11, 2020 |

|

Toronto Outdoor Picture Show |

June 19, 2020 |

|

Tourism Industry Association of Ontario |

June 4, 2020 |

|

Tourism Toronto |

June 4, 2020 |

|

Town of Niagara-on-the-Lake |

June 18, 2020 |

|

Unifor |

June 18, 2020 |

|

Unite Here |

Written Submission |

|

United Food and Commercial Workers Canada (Local 102 and 333) |

June 4, 2020 |

|

United Food and Commercial Workers Canada (Provincial Council) |

June 5, 2020 |

|

Tony Visca |

June 18, 2020 |

|

Water’s Edge Festivals and Events |

June 5, 2020 |

|

Winery and Grower Alliance of Ontario |

June 18, 2020 |

|

YES Theatre |

Written Submission |

Appendix A:

Terms of Reference*

That the Leaders of the parties represented in the Legislative Assembly as well as Independent Members may file copies of letters with the Speaker, who shall cause them to be laid upon the Table, containing their recommendations to the Minister of Finance with respect to the economic and fiscal measures they proposed to be included in the provisions of Bill 188, and such letters shall be deemed to be referred to the Standing Committee on Finance and Economic Affairs; and

That when the committees of the Legislature resume meeting, the Standing Committee on Finance and Economic Affairs shall be authorized to consider the Party Leader and Independent Member letters, together with An Act to enact and amend various statutes as passed by the Legislature today, with the first witness during such consideration to be the Minister of Finance;

*Votes and Proceedings, March 25, 2020, 42nd Parliament, 1st Session

That, notwithstanding any Standing Order or Special Order of the House, the Standing Committee on Finance and Economic Affairs, and all other committees when they are authorized to resume meeting pursuant to the Order of the House dated March 19, 2020, are authorized to use electronic means of communication when meeting, and committee members, witnesses, and/or staff are not required to be in one physical place, in accordance with the following guidelines:

a) The electronic means of communication is approved by the Speaker;

b) The meeting is held in a room in the Legislative Building, and at least the Chair/Acting Chair, and the Clerk of the Committee are physically present;

c) Other Members of the committee participating by electronic means of communication, whose identity and location within the Province of Ontario have been verified by the Chair, are deemed to be present and included in quorum;

d) The Chair shall ensure that the Standing Orders and regular committee practices are observed to the greatest extent possible, making adjustments to committee procedures only where necessary to facilitate the physical distancing and electronic participation of Members, witnesses, and staff; and

That, notwithstanding the Order of the House dated March 19, 2020, the Standing Committee on Finance and Economic Affairs is authorized to meet at the call of the Chair to consider its Order of Reference dated March 25, 2020, respecting the Economic and Fiscal Update Act, 2020 (Bill 188); and

To study the impacts of the COVID-19 crisis on the following sectors of the economy and measures which will contribute to their recovery:

a) Tourism

b) Culture and Heritage

c) Municipalities, Construction, and Building

d) Infrastructure

e) Small and Medium Enterprises

f) Other economic sectors selected by the Committee

• The committee shall study Bill 188 and each specified economic sector for up to 3 weeks with one additional week allotted for report-writing for each.

• The Sub-committee on Committee Business shall determine the method of proceeding on the study, and at its discretion, may extend each sectoral study by one week where a public holiday may fall during the scheduled time for the sectoral study.

• The Legislative Research Service shall make itself available to the Committee collectively, and to members of the Committee individually, on a priority basis.

• That in accordance with s. 11 (1) of the Financial Accountability Officer Act the Financial Accountability Officer shall make the resources of his office available to the Committee collectively, and to members of the Committee individually, on a priority basis.

• The time for questioning witnesses shall be apportioned in equal blocks to each of the recognized parties and to the Independent Members as a group.

• The Committee may present or, if the House is not sitting, may release by depositing with the Clerk of the House, interim reports, and a copy of each interim report shall be provided by the Committee to the Chair of the Ontario Jobs and Economic Recovery Cabinet Committee; and

• The Committee shall present or, if the House is not sitting, shall release by depositing with the Clerk of the House, its final report to the Assembly by October 8, 2020 and a copy of the final report shall be provided by the Committee to the Chair of the Ontario Jobs and Economic Recovery Cabinet Committee; and

That notwithstanding Standing Orders 38 (b), (c), and (d) the interim reports presented under this Order of Reference shall not be placed on the Orders and Notices Paper for further consideration by the House nor shall the government be required to table a comprehensive response; and

That notwithstanding Standing Orders 116 (a), (b) and (c), the membership of the Standing Committee on Finance and Economic Affairs for the duration of its consideration of the Order of Reference provided for in this motion shall be:

Mr. Sandhu, Chair [Sub-committee Chair]

Mr. Roberts, Vice-Chair

Mr. Arthur

Mr. Cho (Willowdale) [Sub-committee Member]

Mr. Crawford

Ms. Hunter [Sub-committee Member]

Mr. Mamakwa

Mr. Piccini

Mr. Schreiner

Ms. Shaw [Sub-committee Member]

Ms. Skelly [Sub-committee Member]

Mr. Smith (Peterborough—Kawartha)

Ms. Andrew (non-voting member)

Mr. Blais (non-voting member)

Ms. Fife (non-voting member)

Mr. Hillier (non-voting member)

Ms. Khanjin (non-voting member)

Mr. Rasheed (non-voting member)

Mr. Vanthof (non-voting member); and

That, should the electronic participation of any voting Member of the Committee be temporarily interrupted as a result of technical issues, a non-voting Member of the same party shall be permitted to cast a vote in their absence.

*Votes and Proceedings, May 12, 2020, 42nd Parliament, 1st Session

Appendix B: Dissenting Opinion of the Liberal Party Members of the Committee

Recommendations

· Small and medium businesses operating in the tourism and hospitality sector, among other sectors, should qualify for payroll tax relief rather than the deferrals previously announced by the provincial government

· Canada Emergency Commercial Rent Assistance needs to be enhanced and expanded into the new year.

· Develop an Explore Ontario marketing plan with incentives and discounts for snowbirds, younger Ontarians, and families including free or discounted licensing, subsidies, and discounts to Ontario resorts and attractions.

· Expand the LCBO product call for bag-in-box wine for wineries who currently do not have access to that market, and expand the VQA Wine Support Program by 50% to assist these wineries.

· To support Ontario restaurants, the Province should make beer and wine permanently available for takeout and delivery. The Province should also issue an emergency order restricting third-party delivery service commission fees to 15%, like New York and Los Angeles have done.

· The Province must increase funding to LGBTQ+ community centres, like the 519 in Toronto.

· The Province should increase investments into festivals across Ontario and restore the $150,000 cut to the Pride Toronto’s Celebrate Ontario Grant.

· The Government must put forward legislation that protects volunteer and sports organizations from issues related to insurability, and litigation due to following COVID-19 related public health guidelines.

· The Province should provide direct, non-repayable government funding to agricultural societies and rural communities who have had to cancel their agricultural exhibitions and fairs.

· The Province should create a program that incentivizes Ontarians for staying in hotels by providing vouchers and to order at restaurants with a program similar to the U.K.’s model for discounting restaurant bills.

· Create a Visit Ontario grant to support tourism, hospitality and retail sectors. To provide funding to communities to meet pandemic guidelines, and to bridge the revenue gap caused by cancelled festivals and attractions.

Introduction

The Ontario Liberal committee members would like to thank the Minister of Heritage, Sport, Tourism and Culture Industries, and all presenters who have provided oral or written submissions. We heard about the devastating impacts on the Ontarian economy from the collapse of our tourism sector.

Ontario’s Tourism Sector Facing a Difficult 2020 Season Tax Deferrals Won’t Work

At the time of the writing of this report, the COVID-19 pandemic has had extended impacts on consumer behaviour and purchasing power, which is particularly true for SMEs in the tourism and culture industries. While a portion of attractions and tourism businesses have re-opened, the regional approach to re-opening the Ontario economy has prevented intra-provincial travel. These businesses depend on seasonal revenues and may not be able to resume normal operations until we have a vaccine and it is safe for Ontarians to gather in large numbers. Both the cautious, regional approach to re-opening and the delayed action in support of these industries has meant that a large amount of seasonal revenue for Summer 2020 has been lost and cannot be recuperated.

To prevent permanent closures, further job losses, and to allow for businesses to fully recover, an effective tax relief plan is needed. Companies will not be able to pay deferred taxes in addition to accumulated debt in a matter of weeks and months. Our province needs to structure a multi-year repayment plan for deferred taxes, with an option for forgiveness of a portion which will help keep businesses from permanently closing and help build a climate of investment that will accelerate Ontario’s economic recovery.

CBRE forecasts that the tourism industry will not experience demand recovery for 24-36 months. As the province reopens, many operators will still not open their doors over concerns for liquidity issues. There needs to be a plan to bring people to our restaurants and visit our hotels and resorts if we expect them to survive. International travel remains nearly impossible into the foreseeable future with international borders closed, including our largest trading partner to the south in the USA. Thousands of Ontario residents regularly visit the USA for tourism purposes annually, especially in the winter. To address the gap in recreational travel for young Ontarians, for families, and for “snowbirds”, the Province should consider the promotion of intra-provincial tourism. We also need a grant style program that provides funding to communities to meet pandemic guidelines and bridge the revenue gap caused by cancelled festivals and attractions.

Hospitality Industry at Risk of Disappearing

The hospitality industry heavily relies on the flow and gathering of people. As we are all aware, the novel coronavirus has confined people to their homes, severely damaging this sector.

Within ten days of the pandemic's onset, the Hotel Association of Canada released a statement that their industry had crashed. In his submission to the committee, Tony Elenis of the Ontario Restaurant Hotel and Motel Association told us that 50% of Ontario hotels have closed, and 99.9 % of why most stayed open is to help "necessitate" rooms for our front-line workers. Even then, these hotels operate with skeleton staff seeing 94% year-on-year declines in revenue. A CBRE report also identified that resorts contribute to 3.6% of the province's GDP in tax revenues alone. Which, on a grand scale, may seem minuscule, but it means significant losses to Ontario. Many resorts also run in certain seasons, making them unable to access support programs like the 75% wage subsidy.

Restaurants have been able to stay open to serve take-out and delivery, and can now sell alcoholic beverages in these formats which the Ontario Liberal Party initially called for. Making this policy permanent would assist restaurants moving forward as alcohol sales provide a valuable source of revenue. Restaurants will continue to rely on takeout as capacity remains limited to allow for physical distancing and while consumer confidence is restored. However, restaurants themselves still face some challenges.

In May, Liberal MPP Simard delivered an open letter to Minister Sakaria, noting what more the Government can do for restaurants. We are yet to see action from the issues MPP Simard raised. Restaurants now heavily rely on third-party food delivery mobile applications such as "Uber Eats" or "Skip the Dishes." However, these companies have been charging commission fees as high as 30 percent of sales to deliver food into app-user's hands. Small businesses still have hard costs, and with declined revenue from the pandemic, big corporations need to do their part to protect these businesses from collapsing. Cities like New York and Los Angeles have implemented emergency orders restricting these fees to 15 percent, so why cannot Ontario? Perhaps because the Progressive Conservative Government is "for the corporations" instead of "For the People."

Our offices spoke with Sue Murano, a restaurateur who has businesses in Minister MacLeod's riding, and indicated that they are nowhere near a recovery period and have experienced significant revenue losses, with no way of regaining it. Like many other restaurateurs, she also said they are close to contemplating the worth of even trying to stay open.

Tony Elenis also pointed out that restaurants were already in a tough position to operate before the virus came along, and now need immediate support if they are to survive the course of this pandemic.

Rural and Northern Ontario

The Ontario Liberal members of the committee heard about the effects of COVID-19 on tourism in rural and northern communities in Ontario extensively during committee proceedings.

Agricultural societies have been hit hard by the pandemic, primarily because they have had to cancel all of their major agricultural fairs and exhibitions per public health guidelines. The fairs and exhibitions hosted by these organizations attract thousands of tourists every year and are responsible for promoting Ontario's rural communities' lifestyle, history, and culture.

From the Lindsay Agricultural Society (LAS), Harry Stoddart explains that agricultural events generate millions of dollars in hotels, restaurants and small business spending and credits Ontario's agricultural societies with an "aggregate impact estimated at $700 million". The LAS has been hosting yearly events since before Canada was established. They spoke about cancelling all of its events, primarily the LEX event, which draws a yearly average of about 45,000 people. Due to the cancellations and the restructuring of their exhibition, the Lindsay Agricultural Society faces a $1 million shortfall in 2020.

The Cumberland Township Agricultural Society was among organizations who needed to cancel their major events, including the 74th edition of the Navan Fair in Ottawa's East-end.