STANDING COMMITTEE ON FINANCE AND ECONOMIC AFFAIRS

FINAL REPORT:

STUDY OF THE RECOMMENDATIONS RELATING TO THE ECONOMIC AND FISCAL UPDATE ACT, 2020 AND THE IMPACTS OF THE COVID-19 CRISIS ON CERTAIN SECTORS OF THE ECONOMY

1st Session, 42nd Parliament 69 Elizabeth II

ISBN 978-1-4868-4780-8 (Print)

ISBN 978-1-4868-4782-2 [English] (PDF) ISBN 978-1-4868-4784-6 [French] (PDF) ISBN 978-1-4868-4781-5 [English] (HTML) ISBN 978-1-4868-4783-9 [French] (HTML

The Honourable Ted Arnott, MPP Speaker of the Legislative Assembly

Sir,

Your Standing Committee on Finance and Economic Affairs has the honour to present its Report and commends it to the House.

Amarjot Sandhu, MPP

Chair of the Committee

Queen's Park October 2020

STANDING COMMITTEE ON FINANCE AND ECONOMIC AFFAIRS MEMBERSHIP LIST

1st Session, 42nd Parliament

AMARJOT SANDHU

Chair

JEREMY ROBERTS

Vice-Chair

IAN ARTHUR DAVID PICCINI

STAN CHO MIKE SCHREINER

Willowdale

STEPHEN CRAWFORD SANDY SHAW

MITZIE HUNTER DONNA SKELLY*

SOL MAMAKWA DAVE SMITH

Peterborough—Kawartha

NON-VOTING MEMBERS

STEPHEN BLAIS LAURA MAE LINDO

CATHERINE FIFE KALEED RASHEED

RANDY HILLIER JOHN VANTHOF

ANDREA KHANJIN

*DONNA SKELLY was replaced by LOGAN KANAPATHI on September 14, 2020.

JULIA DOUGLAS

Clerk of the Committee

ISAIAH THORNING and CHRISTOPHER TYRELL

Clerks pro tem. of the Committee

ALEX ALTON, LAURA ANTHONY, PIA ANTHONY MUTTU, JASON APOSTOLOPOULOS, SUDE BELTAN, MONICA COP, DMITRY GRANOVSKY, SANDRA LOPES, ANDREW MCNAUGHT, ERICA SIMMONS and MICHAEL VIDONI

Research Officers

CONTENTS

APPENDIX 1 – FIRST INTERIM REPORT: ECONOMIC AND FISCAL UPDATE ACT, 2020

APPENDIX 2 – SECOND INTERIM REPORT: ECONOMIC IMPACT OF COVID-19 ON

APPENDIX 3 – THIRD INTERIM REPORT: ECONOMIC IMPACT OF COVID-19 ON

APPENDIX 4 – FOURTH INTERIM REPORT: ECONOMIC IMPACT OF COVID-19 ON

MUNICIPALITIES, CONSTRUCTION AND BUILDING

APPENDIX 5 – FIFTH INTERIM REPORT: ECONOMIC IMPACT OF COVID-19 ON

APPENDIX 6 – SIXTH INTERIM REPORT: ECONOMIC IMPACT OF COVID-19 ON

APPENDIX 7 – DISSENTING OPINION OF THE NEW DEMOCRATIC PARTY MEMBERS OF THE COMMITTEE

APPENDIX 8 – DISSENTING OPINION OF THE LIBERAL PARTY MEMBERS OF THE

APPENDIX 9 – DISSENTING OPINION OF THE GREEN PARTY MEMBER OF THE

INTRODUCTION

Following the onset of the COVID-19 pandemic in the winter of 2020, and the subsequent declaration of a province-wide emergency on March 17, two motions adopted unanimously in the House authorized the Standing Committee on Finance and Economic Affairs to

1. conduct a review of Bill 188, the Economic and Fiscal Update Act, 2020; and

2. study the impact of the COVID-19 crisis on various sectors of the provincial economy.

In accordance with its terms of reference,1 the Committee held virtual public hearings in June, July, and August 2020 and issued six interim reports, as follows:

· First Interim Report: Economic and Fiscal Update Act, 2020

· Second Interim Report: Economic Impact of COVID-19 on Tourism

· Third Interim Report: Economic Impact of COVID-19 on Culture and Heritage

· Fourth Interim Report: Economic Impact of COVID-19 on Municipalities, Construction and Building

· Fifth Interim Report: Economic Impact of COVID-19 on Infrastructure

· Sixth Interim Report: Economic Impact of COVID-19 on Small and Medium Enterprises

This document is a compilation of these reports and constitutes the Committee's Final Report. The six interim reports are reproduced in Appendices 1 to 6.

Each interim report is summarized in the Executive Summary that follows.

The Committee wishes to express its appreciation to all of the individuals and organizations who took the time to share their views and personal experiences. In addition, the Committee would like to thank the legislative staff who supported its work.

EXECUTIVE SUMMARY

This section summarizes the testimony received during public hearings held in June, July, and August 2020 and reported in the Standing Committee's six interim reports. More than 500 witnesses made presentations through the virtual hearings process. In addition, the Committee received over 130 written submissions from individuals and groups who did not appear before the Committee.

It should be noted that the summary does not include Committee recommendations; these appear in the last section of each interim report (as reproduced in Appendices 1 to 6).

First Interim Report: Economic and Fiscal Update Act, 2020

On June 1, 2020, the Committee held one day of hearings to fulfill the first part of its mandate, which was to consider the Economic and Fiscal Update Act, 2020, together with letters filed by party leaders and independent Members containing recommendations relating to the Act.

As provided in its terms of reference, the Minister of Finance appeared as the Committee's first witness. Describing the COVID-19 crisis as an "extraordinary threat" to the health of Ontario's economy, the Minister reported that over one million jobs had been lost in March and April of 2020, and outlined a series of measures the government has taken to address the crisis. These include frontline worker compensation, healthcare capacity expansion, and commercial rent assistance.

Committee members questioned the Minister on a variety of topics, focusing on the importance of financial assistance in the face of uncertain times. Topics of discussion included direct assistance to businesses (rent subsidies, tax deferrals, support for reopening costs) and individuals (regulation of insurance premiums, reduced electricity costs). The Minister also responded to questions about the effect of anti-black racism on access to business loans and the impact of the pandemic on Indigenous communities.

In concluding remarks, the Minister provided an update on the phased reopening of the economy and new workplace safety guidelines, and emphasized that testing and contact tracing will be essential preconditions for restarting the economy. He also noted that the government has created contingency and reserve funds to meet additional spending requirements.

Ontario's Financial Accountability Officer (FAO) appeared as the Committee's second witness. The FAO shared his projections, forecasting a drop of 9% in Ontario's GDP in 2020, and a deficit of $41 billion for the 2020-21 fiscal year. Committee questions focused on discrepancies between figures for pandemic- related spending, as reported by the government and the FAO; the FAO's

modelling methodology; and the Province's contingency funding. The Committee also asked the FAO to track and analyze bankruptcies in the province, and to provide information on pandemic-related spending at each level of government.

Second Interim Report: Economic Impact of COVID-19 on Tourism

Ontario's tourism sector comprises a variety of activities across the province, including the hospitality industry (hotels and restaurants), tour operators, events and attractions (museums, festivals, theatres, and amusement parks), lodges, outfitters, campgrounds, and transportation services.

In her opening statement to the Committee, the Minister of Heritage, Sport, Tourism and Culture Industries described a sector that has been "shattered." Whereas tourism in pre-pandemic Ontario had registered a "spectacular" economic and social bottom line, Ministry figures showed sector losses of at least

$20 billion since the economic shutdown. According to one study, four of the hardest hit industries fell within the Ministry's purview—transportation and sightseeing tours; air transportation; accommodations and food services; and arts, recreation and entertainment.

The Minister outlined several several steps the Ministry has taken to address the effects of COVID-19, including initiating telephone town halls with thousands of stakeholders, working with Destination Ontario and other organizations to develop a tourism marketing plan, and continuing to flow funds to the tourism sector.

As a concluding observation, the Minister suggested that the everyday realities of COVID-19 (social distancing, bans against mass gatherings, and the fear and stigma associated with a return to dining in restaurants or attending festivals and sporting events) may necessitate long-term and fundamental changes to the tourism sector.

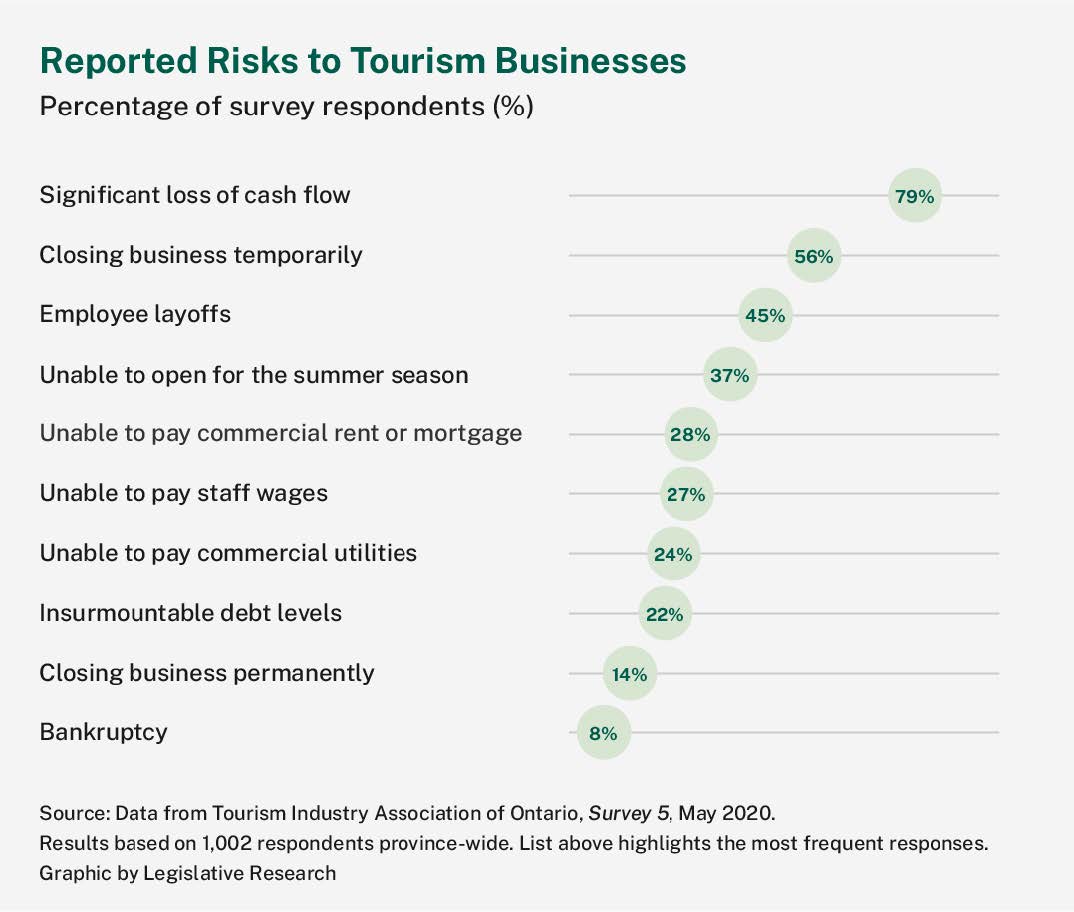

According to stakeholders surveyed by the Tourism Industry Association of Ontario in the spring of 2020, the greatest risks facing tourism businesses included uncertainty around when and how they will be able to reopen, lack of clarity on travel restrictions, ineligibility for government financial assistance, and insurmountable debt levels and severe disruptions to cash flow. These concerns surfaced throughout the hearings.

For example, stakeholders reported that the early reopening stages were marked by confusion, inconsistency, and uncertainty regarding reopening dates and the criteria and standards that had to be met in order for a business to reopen.

Tourism businesses in the border communities of Niagara Falls and Northwestern Ontario said that uncertainty about the lifting of travel restrictions had a crippling effect on operators who rely on American visitors.

Other testimony focused on the nature of government financial relief that has been made available to pandemic-affected businesses. Although appreciative of this support, stakeholders said the programs were not tailored to the seasonality or other unique aspects of the tourism sector, with the result that many businesses were not eligible for assistance. Moreover, much of the aid on offer is repayable, and may only add to the borrower's financial burden.

Unions representing thousands of workers in restaurant and food services, as well as the airport, hotel, and car rental industries, testified that those who have been laid off or had their hours of work reduced as a result of the pandemic may need training to meet the post-pandemic requirements of their jobs, or to move into emerging areas of employment.

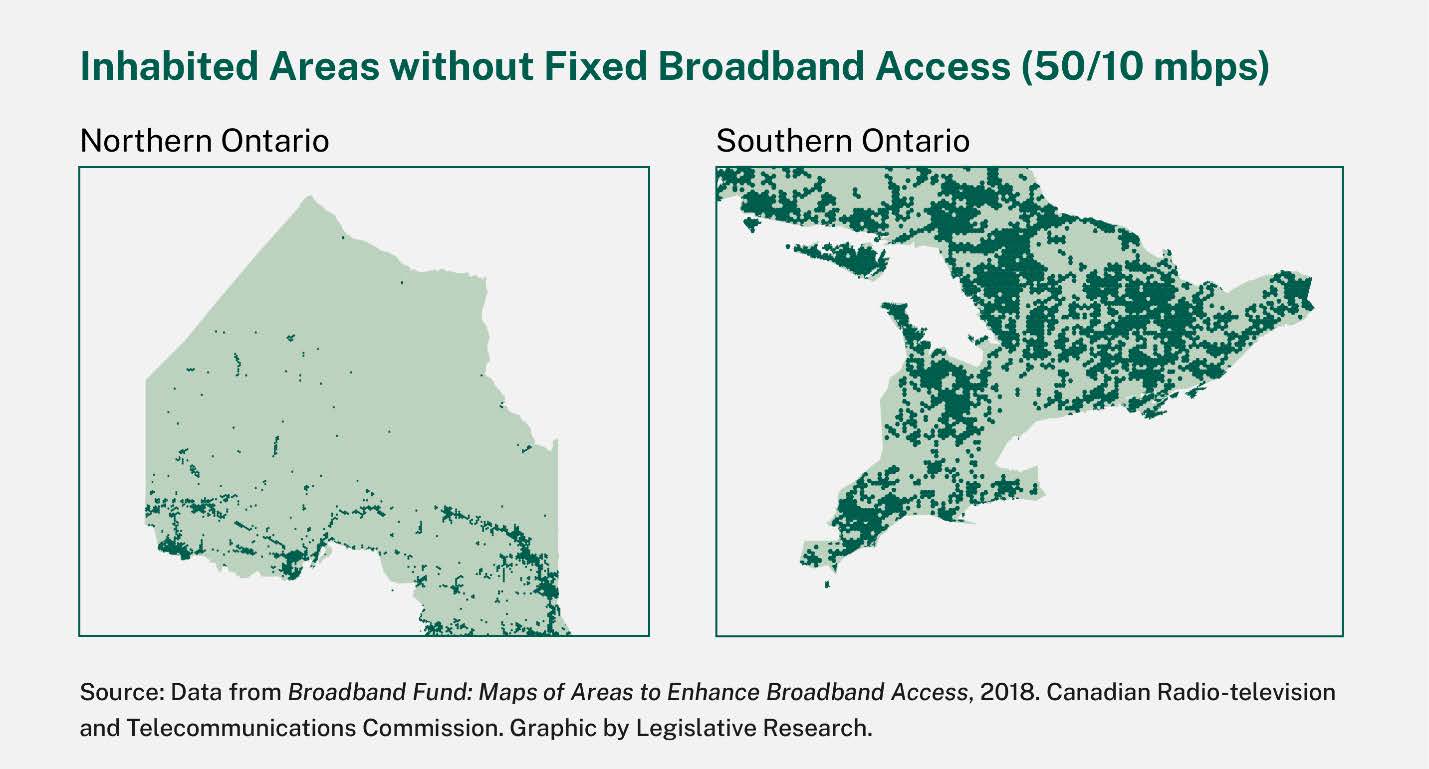

Several groups stressed that access to reliable and affordable broadband internet and cell phone service in rural, northern, and Indigenous communities will be key to the survival and growth of the tourism sector outside of urban Ontario. They urged cooperation with the federal government in the development of broadband services.

Ontario's Indigenous sport body, as well as the province's main Indigenous tourism organization, reported that they are struggling to cope with the effects of COVID-19. A recovery plan for these activities and businesses, they said, may require resources above and beyond what has been made available to non- Indigenous recipients of government support.

The Committee also received a number of industry-specific submissions. Grape growers, wine producers, and craft brewers—all of which reported major losses early in the pandemic—proposed regulatory and policy changes to support these industries. Similarly, organizations representing the aviation industry said that COVID-19's impact on the industry "has been nothing short of devastating." The Committee was asked to consider several measures the province could take to assist this federally regulated industry.

Finally, according to the operator of a long-running camp in Muskoka, "Ontario's century-long history of providing a rewarding summer camp experience to over 400,000 Ontario children each year is now in peril." He proposed a revenue- based funding model to ensure the survival of these camps.

Third Interim Report: Economic Impact of COVID-19 on Culture and Heritage

Witnesses from the multifaceted culture and heritage sector included umbrella organizations for dance, theatre, visual arts, and publishing; artists and arts and culture organizations, arts councils and galleries, magazine and book publishers, libraries, tourism organizations, sports organizations, municipalities, venues; animation, film and television companies; museums, heritage sites and organizations; film, theatre, music, dance and other festivals, and many more.

In a report to the Committee, the Financial Accountability Office of Ontario estimated that tourism, culture and heritage activities directly contributed approximately $28.1 billion to the Ontario economy in 2019. The sector indirectly contributed $15.6 billion in economic benefits through the provincial supply chain. In total, tourism, culture and heritage activities generated $43.7 billion in economic activity in 2019, representing 4.9% of Ontario's GDP.

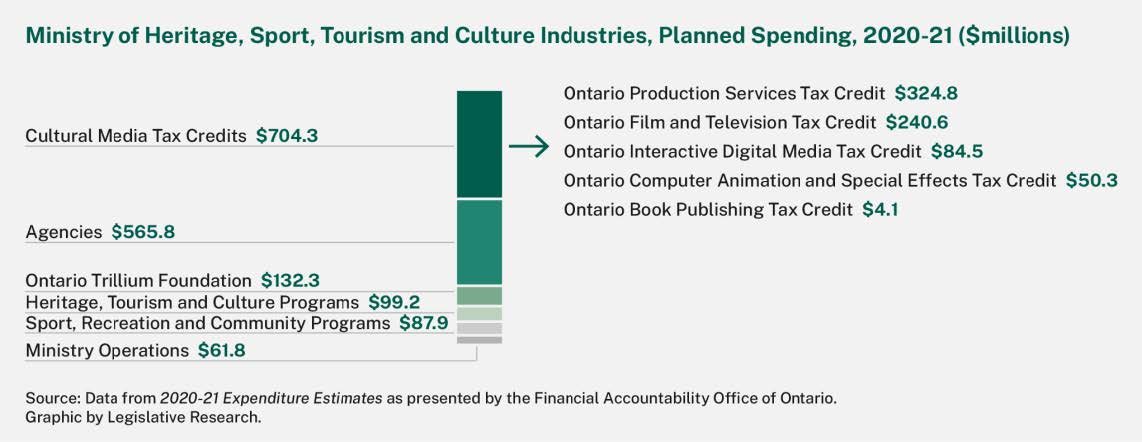

In her presentation to the Committee, the Minister of Heritage, Sport, Tourism and Culture Industries said that along with its significant contribution to the Ontario economy, this sector is vital to social cohesion and overall wellbeing. "Culture, heritage and sports are what makes our communities come alive," the Minister explained, but these same sectors "were hit first, hardest, and will take the longest to recover" from the COVID-19 shutdown and its aftermath. The Minister outlined a number of funding initiatives and regulatory changes undertaken to help the sector adapt to the COVID-19 environment.

Although the culture and heritage sector has made the transition to online programming with the creativity and innovation that is its hallmark, witnesses described the "devastating," "seismic," and "catastrophic" impact of the COVID- 19 shutdown. The abrupt loss of revenue streams and employment affected culture, heritage, and sports organizations and businesses large and small in every part of the province. Non-profit organizations that derive most of their revenues from ticket sales, philanthropic donations and sponsorships saw this revenue vanish overnight. Many organizations and companies had to lay off staff, while other staff and executives took substantial pay cuts.

Virtually all witnesses noted an urgent need for emergency financial support for culture and heritage organizations as well as for individual artists and culture workers. Witnesses also suggested encouraging private philanthropy through matching donation programs and tax credits.

Many culture and heritage attractions, festivals, live performances and events across the province depend on large audiences and gatherings. The sector is a core driver of tourism, attracting thousands of visitors from across Ontario, Canada, the United States and other countries, and generating significant economic and employment benefits for local communities.

As Ontario reopens, however, physical distancing requirements that reduce the maximum allowable capacity for venues and events, and limits on other large gatherings, will hinder the sector's recovery. Witnesses from the sector indicated that they are eager to "confidently reopen when the time is right" but explained that they need sector-specific public health guidance, along with financial assistance, to protect the health and safety of patrons, clients, employees, and the public.

Presenters from across the culture and heritage sector described the steep learning curve and heavy financial costs of suddenly having to move programming online, and outlined requests for funding for digital infrastructure including new technology, expertise, and organizational resources.

Ontario's film and television industry ranks third in North America. Presenters explained that one of the most significant hurdles for the resumption of film and television production is the lack of insurance to cover COVID-19-related production shutdowns. These witnesses emphasized the need for government support regarding insurance as well as via tax credits and incentives.

Ontario's heritage sector includes hundreds of small community-based and volunteer-run museums, sites, festivals, and organizations. The Committee heard that this sector contributes to education, economic development, and community vitality across the province. The sector typically attracts thousands of tourists and visitors from across North America but the shutdown has meant a loss of revenue from visitors, tours, and events.

Witnesses suggested that targeted investments to develop digital infrastructure and events, and to fund conservation and restoration work on deteriorating heritage buildings, would help to kick-start local economies. The Committee also heard requests to give municipalities the authority to exempt museums, as well as heritage buildings and sites, from property taxes. Other witness recommendations included the creation of incentives and tax credits to encourage private sector donations, and rapid granting programs to address the immediate and significant loss of revenue during the COVID-19 shutdown.

Fourth Interim Report: Economic Impact of COVID-19 on Municipalities, Construction and Building

Municipalities

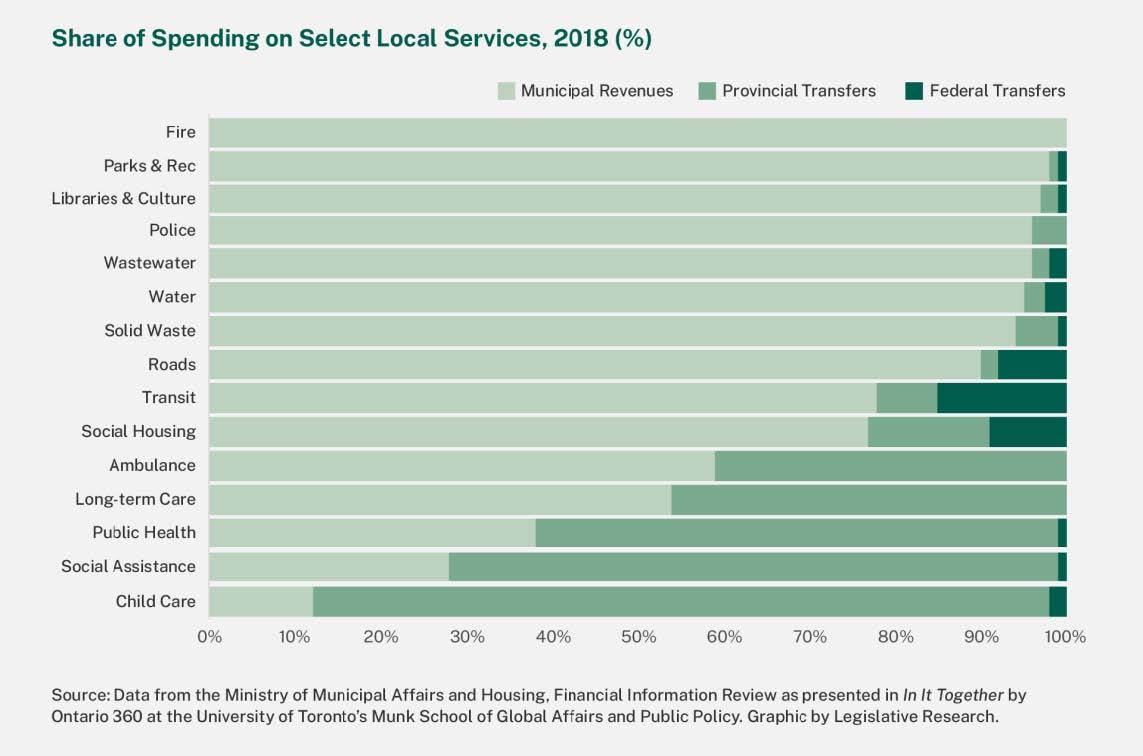

Ontario's 444 municipalities are responsible for many "on the ground" services, including public transit, fire and police services, public health, and social housing. Municipalities provide the largest share of funding for many of these services.

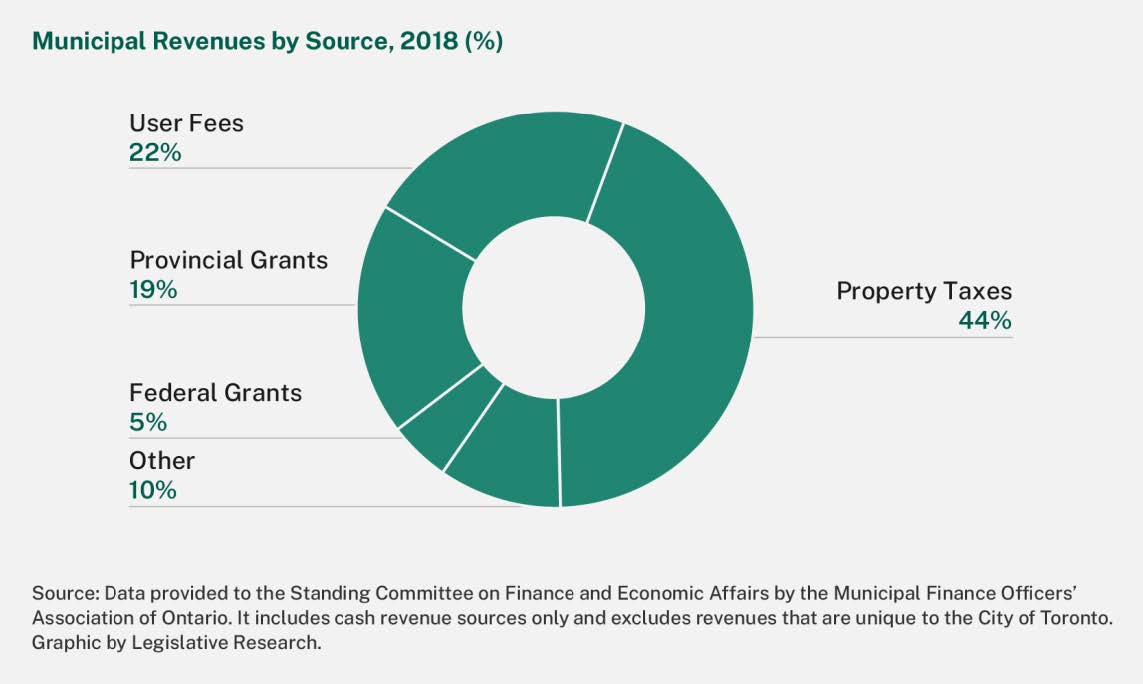

Local governments collectively spend more than $64 billion every year on public services, with as much as 80% of this funding derived from municipal "own- source revenues," such as property taxes, user fees, and non-tax revenue (e.g., parking fines). Provincial and federal government grants and subsidies are the second largest contributor to municipal revenues.

In his presentation to the Committee, the Minister of Municipal Affairs and Housing emphasized that collaboration with municipalities was key to the Province's early response to COVID-19, and said that continued cooperation with municipal partners will be important as the Province moves into the economic recovery phase. The Minister then outlined several steps his Ministry has taken to address the effects of COVID-19 at the local level. These include passing (with

unanimous consent) the Municipal Emergency Act, 2020, regular conference calls and virtual meetings with mayors across the province, and a temporary pandemic pay increase for front-line workers, which helped deliver services in emergency shelters and supportive housing facilities.

According to the Minister, the provincial government has provided $450 million to municipalities so far, including $350 million for the Social Services Relief Fund and $100 million for public health expenditures municipalities have made as a result of the pandemic. In addition, the Province joined the Federation of Canadian Municipalities in calling on the federal government for emergency funding. Ontario's position is that it should receive a per capita share.

Municipal representatives outlined the frontline support they have been delivering to their communities during the pandemic. As described to the Committee, municipalities—despite best efforts to mitigate losses—are experiencing budgetary shortfalls due to the severe impact of the pandemic on municipal revenue sources and a sudden increase in operating costs to maintain public health protocols. In many cases, municipalities have had to dip into capital reserves to pay for pandemic-related operating expenses.

Witness testimony stressed that local governments have a limited capacity to raise funds and are prohibited by law from running operating deficits. In the absence of adequate federal-provincial emergency relief, municipal councils will be forced to consider a number of difficult options, including property tax increases, cuts to services, more layoffs, and postponement of capital projects. Municipalities are seeking additional revenue generating powers and emergency funding from the Province.

In July 2020, the federal government announced the Safe Restart Agreement, a

$19 billion program to help provinces and territories safely restart their economies over the following six to eight months. The Ontario government subsequently announced up to $4 billion in one-time assistance to Ontario's 444 municipalities.

Construction and Building

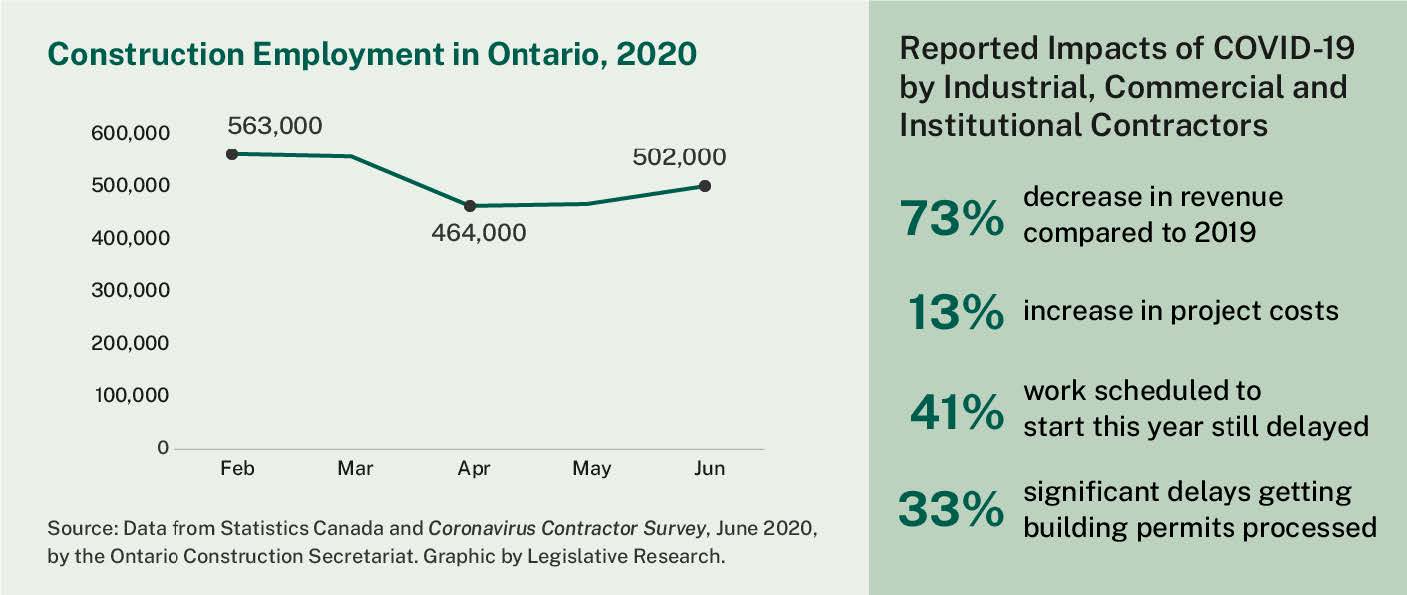

Ontario's diversified construction and building sector includes many trades directly engaged in construction activities. Related subsectors include building material producers and distributors, trucking, professional services, real estate, finance, planning, and engineering. Statistics Canada estimated that as of March 2020, 563,000 Ontarians worked in the construction sector.

In his testimony to the Committee, the Minister reviewed several measures that have been taken to ensure that construction activities continue during the pandemic. Among other things, the Ministry imposed temporary restrictions on municipal noise by-laws to allow for longer construction days and staggered shifts. Amendments to the Building Code have allowed inspectors to continue to review permits and conduct inspections. Initial restrictions on construction were

incrementally eased, so that as of May 2020, all types of essential construction activity are permitted.

The Minister also outlined housing-related initiatives that have been introduced in response to the pandemic. These include $350 million in social service relief for housing partners, and a moratorium on residential evictions. An investment of

$150 million in housing and homelessness supports will be made through the Social Services Relief Fund.

Stakeholders testified to the effects of COVID-19 on the construction sector. They described a general slowdown in construction activity, project delays, extra costs due to safety measures, and supply chain disruptions for critical building components. Some noted the uncertainty that prevails within the sector about whether major infrastructure work will proceed as planned. Many witnesses suggested that investments in housing would not only address longstanding housing shortage concerns, but would also act as a driver of economic recovery. Embedded taxes, fees, and charges were flagged as barriers to development, particularly in housing.

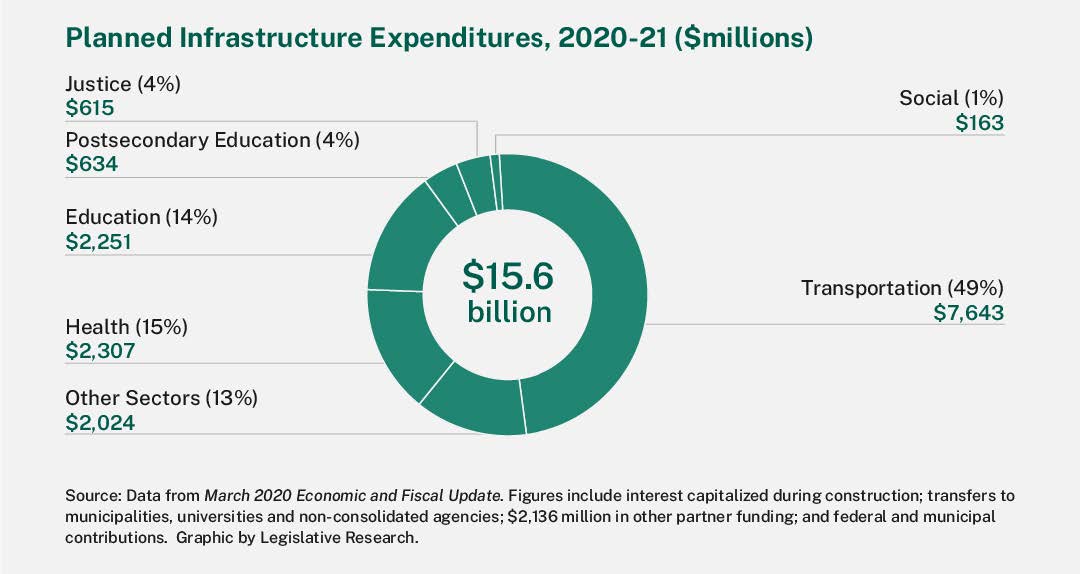

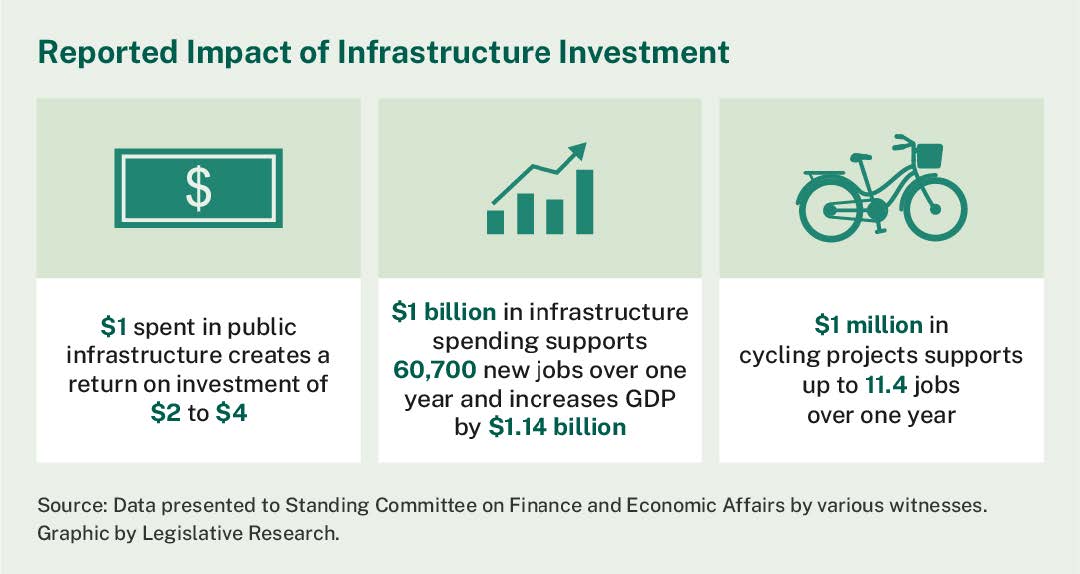

Fifth Interim Report: Economic Impact of COVID-19 on Infrastructure

As in other areas of the economy, the shutdown necessitated by COVID-19 has exacted a toll on the province's infrastructure sector. One consequence of the resulting economic uncertainty is that the Ontario government has had to reassess its infrastructure priorities, as the Minister of Infrastructure highlighted in her testimony to the Committee.

A decision that has already been made, she noted, is to accelerate major public infrastructure projects. In addition, the province has assured municipalities and other infrastructure partners that the government remains committed to key infrastructure programs, and intends to proceed with 37 major public-private partnership (P3) projects that are currently in the P3 "project pipeline."

The Minister also addressed the so-called "digital divide," a situation that pre- dates the pandemic, but which has become one of the province's pressing infrastructure issues. Ministry figures show that up to 12% of Ontarians (1.4 million people) living mostly in rural, remote, or northern areas lack high-speed internet service (broadband). "Now, more than ever," the Minister said, reliable broadband is an essential service for those living and working outside of urban Ontario.

Although telecommunications is largely a federal responsibility, the Minister underscored that the Province and municipalities have a role to play in developing broadband service in Ontario. She highlighted two provincial programs that will fund broadband infrastructure in under-serviced areas.

Infrastructure Ontario (IO), the Ministry agency that oversees procurement for major public infrastructure projects and manages the government's real estate portfolio, outlined for the Committee how the agency has been supporting the Province's response to the COVID-19 crisis. IO also noted that its immediate priorities are to maintain and accelerate critical health care projects in its pipeline, and to maintain the momentum for critical transit projects.

Stakeholder testimony addressed a variety of topics. One organization presented several options for restoring certainty and stability to the infrastructure sector.

Many witnesses, including home builders, the waste management industry, and municipalities, made proposals for cutting red tape as a way to kick-start the economy. Internet service providers identified red tape around access to utility poles and other municipal infrastructure as a barrier to the development of broadband service in rural communities. Several rural municipalities testified that their top priority is being able to maintain basic infrastructure, such as roads and bridges.

One of the trends revealed during the hearings is that residents and community groups are becoming more involved in the planning and implementation of projects. Witnesses asked the Committee to consider ways of entrenching community participation in project development. Testimony also revealed that the pandemic has reinvigorated advocates for a greener economy. Green infrastructure and "active transportation" were the subject of several presentations.

A number of community-based groups observed that COVID-19 has exposed pre-existing deficiencies and inequalities in the areas of social services and

affordable housing. Their request is that priority be given to infrastructure projects that factor these issues into the planning process. Similarly, the pandemic was described as an opportunity to invest in the development of the skilled trades.

Several witnesses commented on the importance of promoting the skilled trades as a career for youth, the marginalized, and women.

Indigenous organizations requested funding for Indigenous-owned businesses, support for Indigenous housing, and training to support the development of professional technical capacity in Indigenous communities. A specific request was made for assistance with the construction of a new instructional building for the First Nations Technical Institute.

Executives from the nuclear industry urged continued support for this sector, noting that nuclear power has proven to be a low-cost, clean, and reliable source of electricity throughout the pandemic. The industry was also described as a major employer that can play an important role in an economic recovery.

The last section of the report, "Changing the Way We Do Things," sets out a number of regulatory and policy changes proponents say would make it easier to

identify priority projects, assist in the move to a greener economy, and generally make the infrastructure process more efficient.

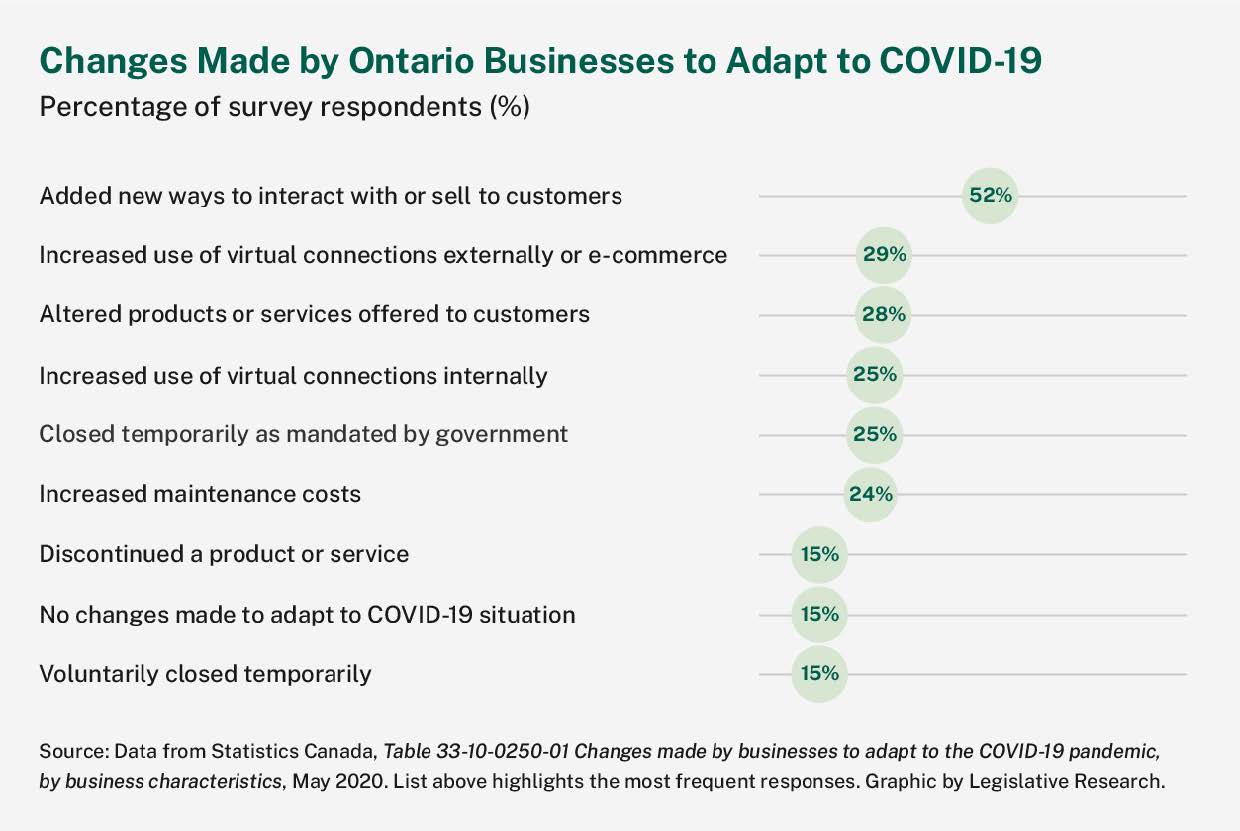

Sixth Interim Report: Economic Impact of COVID-19 on Small and Medium Enterprises

The impact of the COVID-19 pandemic on Ontario's small and medium enterprises (SMEs) has been widespread and devastating. Many witnesses stated that SMEs were "the least prepared for" and "the most affected by the pandemic."

The Minister of Economic Development, Job Creation and Trade explained that with support from the $50-million Ontario Together Fund, manufacturers have quickly pivoted to produce supplies and equipment needed in hospitals, long- term care homes, and other critical public services. The Province hopes to restore consumer confidence through the Ontario Made program (administered by Canadian Manufacturers & Exporters), which helps consumers support homegrown manufacturers, and through the creation of a new agency, Invest Ontario, which promotes Ontario as an attractive investment destination.

These initiatives were described as essential by the Associate Minister of Small Business and Red Tape Reduction, who explained that organizations with fewer than 100 employees have a significant impact on Ontario's economy. They account for 98% of all businesses in the province, employ 2.4 million people, and produce 40% of the province's GDP. The Ministry consulted with the sector in 80 virtual roundtables and the Associate Minister identified three key issues facing small business: cash flow and liquidity, consumer confidence, and the continuation of government supports.

Business owners related the mental and emotional toll that they are experiencing due to the threat of losing their life's work and livelihood. The Committee heard about companies that were unable to open following the initial shutdown and about those who reopened, but could not recoup sufficient revenues to replace the lost income and accumulated expenses. Not-for-profit organizations described the challenges of dealing with increased demands for their services while receiving fewer private donations.

While grateful for current government relief programs, SMEs asked for a more streamlined applications process, extensions for the duration of the pandemic, industry-specific grants and loans, and bankruptcy protections from personal guaranteed loans. Witnesses were particularly concerned about the limitations of the Canadian Emergency Commercial Rent Assistance program, which they recommended should provide rent relief directly to tenants. Witnesses reminded the Committee that female, Indigenous, Black and minority-owned businesses face unique barriers, and suggested that initiatives targeting these groups could pay larger economic and social dividends. Organizations representing specific

industries also provided the Committee with an overview of issues and recommendations to revitalize their sectors.

A common concern echoed throughout the testimony was how to rebuild consumer confidence to encourage Ontarians to resume their normal activities. SMEs explained that they often felt frustrated and confused by the public health guidelines. Witnesses noted that inconsistent business classifications as "essential" or "non-essential" unduly favoured large business. SMEs appreciated the government's recent efforts to reduce the regulatory burden for small businesses. However, witnesses stressed that further streamlining of regulatory processes is both "revenue neutral" and essential to Ontario's economic recovery.

A number of witnesses noted that this unprecedented time presents an opportunity to do things differently to spur economic growth. For example, the Province could invest in manufacturing to strengthen the supply chains of essential goods and services, and work to reduce interprovincial and international trade barriers. Some witnesses proposed that government procurement be simplified, made more transparent, and be more inclusive of SMEs. A number of sectors were highlighted as a potential focus of procurement efforts, including advanced manufacturing, technology and health sciences.

Other testimony focused on supporting start-ups and entrepreneurial talent through direct financing and tax incentives to spur private sector investment. The Committee was informed that Ontario needs to place more value on companies rich in intellectual property and develop an intellectual property strategy. The Committee also received testimony about the importance of retaining and attracting highly skilled labour.

With improved government support and policies, the Committee learned that SMEs have the resilience and agility to bounce back and seize the opportunities that this crisis presents.

COMMITTEE RECOMMENDATIONS

The Standing Committee on Finance and Economic Affairs recommends that:

1. The Province should increase funding for the Tourism Development Fund.

2. The Province should increase funding for Ontario festivals in 2021.

3. The Province should increase funding for the Experience and Explore program so that the age cap on children who can enter for free can be raised.

WITNESS LIST

|

Organization/Individual |

Date of Appearance |

|

Financial Accountability Office of Ontario |

Written Submission |

APPENDIX 1 FIRST INTERIM REPORT:

ECONOMIC AND FISCAL UPDATE ACT, 2020

CONTENTS

Ontario's Action Plan: Responding to COVID-19 (March 2020 Economic and Fiscal Update)

Bill 188 (the Economic and Fiscal Update Act, 2020)

Letters Filed by Party Leaders and Independent Members

Financial Accountability Officer

APPENDIX A: TERMS OF REFERENCE*

APPENDIX B: LETTERS FILED BY PARTY LEADERS AND INDEPENDENT MEMBERS

APPENDIX C: SUBMISSION OF THE FINANCIAL ACCOUNTABILITY OFFICER

INTRODUCTION

The Standing Committee on Finance and Economic Affairs is pleased to present its first interim report on the Economic and Fiscal Update Act, 2020, and the impact of the COVID-19 crisis on the Ontario economy.

This document addresses the first part of the Committee's mandate, which is to consider the Economic and Fiscal Update Act, 2020, together with letters filed by party leaders and independent Members containing recommendations relating to the Act.

In accordance with the Committee's terms of reference, the Minister of Finance appeared as the Committee's first witness on June 1, 2020. Ontario's Financial Accountability Officer also made a presentation and answered questions.

The interim report summarizes the testimony of these witnesses, and sets out the Committee's comments and recommendations.

Further interim reports will follow over the course of the summer as the Committee moves on to study the impact of the COVID-19 crisis on specific sectors of the economy. A final report will be tabled in the fall of 2020.

COMMITTEE MANDATE

Motions adopted unanimously by the House on March 25 and May 12, 2020 established a two-part mandate for the Committee.

When the House passed Bill 188, the Economic and Fiscal Update Act, 2020, on March 25, 2020, it also adopted a motion providing that party leaders and independent Members may file letters with the Speaker, setting out their recommendations for economic and fiscal measures that should be included in the Bill. The motion further provided that when committees of the Legislature resume, the Standing Committee on Finance and Economic Affairs would be authorized to consider the Act, together with the letters filed by the leaders and independent Members, and that the Minister of Finance would be the Committee's first witness when it commenced its review.

The motion passed on May 12, 2020, authorized the Committee to begin consideration of the matters that had been referred to it on March 25. In addition, it empowered the Committee to study the impact of the COVID-19 crisis on specific sectors of the provincial economy, including "measures which will contribute to their recovery." The sectors identified in the motion are:

· tourism;

· culture and heritage;

· municipalities, construction and building;

· infrastructure;

· small and medium enterprises; and

· other economic sectors selected by the Committee.

The Committee is specifically authorized to release interim reports, as it sees fit. Interim reports are to be presented to the House, and a copy of each report is to be provided to the Chair of Cabinet's Ontario Jobs and Economic Recovery Committee. Interim reports will not be placed on the Orders and Notices paper for further consideration by the House, and the Government will not be required to table a comprehensive response to them.

A final report will be tabled, and a copy delivered to the Chair of the above-noted Cabinet committee, by October 8, 2020.

Appendix A to this report reproduces the Committee's mandate in full.

BACKGROUND

Ontario's Action Plan: Responding to COVID-19 (March 2020 Economic and Fiscal Update)

As a result of the global impact of the COVID-19 pandemic, the economic outlook used to develop the 2020 Ontario Budget was revised. In response to the revised outlook, and the health and economic consequences of the crisis, on March 25, 2020 the Ontario government released Ontario's Action Plan: Responding to COVID-19 (March 2020 Economic and Fiscal Update).

The Ministry of Finance has posted two documents on its website: the March 2020 Economic and Fiscal Update and Ontario's Action Plan: Responding to COVID-19. The main provisions of these documents are outlined below.

Economic and Fiscal Update

The Economic and Fiscal Update provides a one-year outlook based on economic projections as of March 2020, and focuses on the effects of the coronavirus pandemic on the Ontario economy, and the fiscal remedies proposed by the government. The Update was released instead of a full budget. A full, multi-year budget will be introduced in the Legislature by November 15, 2020.

Key numbers in the Update are as follows.

Fundamentals, Revenues and Expenses

The Ontario Ministry of Finance reports that real Gross Domestic Product (GDP) increased by 1.6% in 2019. The Ministry is forecasting real GDP to remain unchanged in 2020, and to increase by 2% in 2021. The forecast assumes an improvement in economic growth starting in the second half of 2020. The province added over 200,000 jobs in 2019, with the unemployment rate steady around 5.6%. Employment growth is expected to slow in 2020, with the unemployment rate projected to increase to 6.6% and remain at that level through 2021.

The total revenue for 2019-20 is expected to be $156.7 billion, with the primary sources of income (in order of magnitude) being Personal Income Tax, Sales Tax, and Federal Transfers. Revenue is forecast to decrease to $156.3 billion in

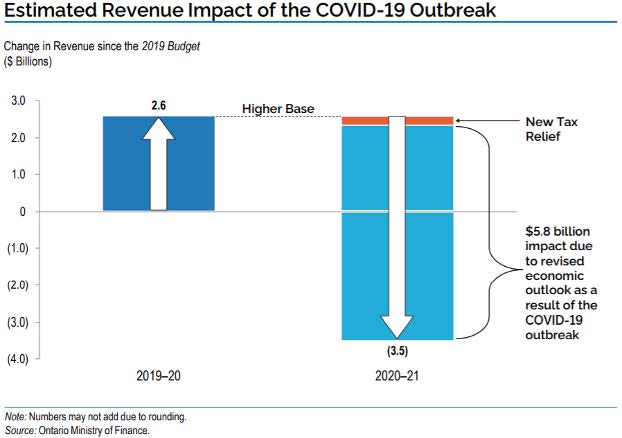

2020-21, mostly as a result of lower corporate and income taxes collected, as well as less income from Government Business Enterprises (GBEs). The drop in revenue is expected to be somewhat offset by an increase in Federal transfer payments. Overall, projected revenues for 2020-21 are $3.5 billion lower than the 2019 Budget projection, with the negative impact of COVID-19 estimated at $5.8 billion (see Figure 1).

Figure 1: Revenue Adjustment, 2020-21

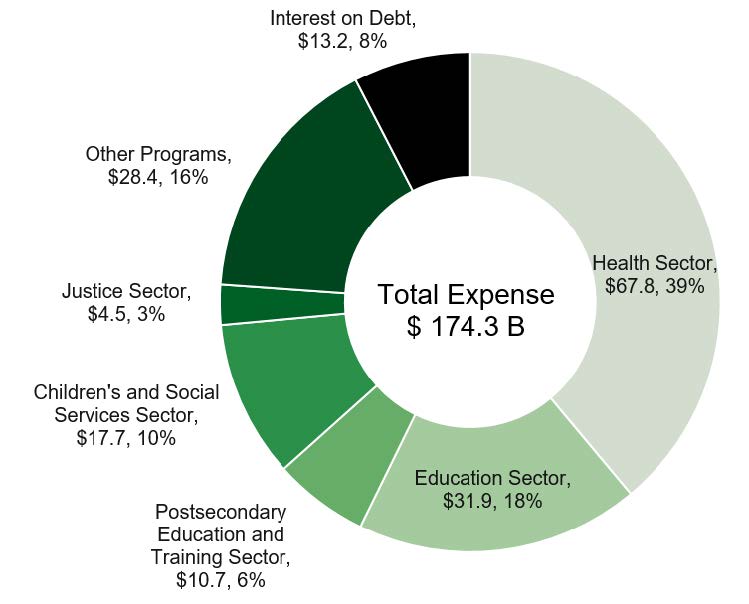

Expenses are estimated to total $165.7 billion in 2019-20, and increase to $174.3 billion in 2020-21 (see Figure 2 for breakdown). The growth in expenses is attributed mainly to the health sector, where additional funding ($0.9 billion in 2019-20 and $3.3 billion in 2020-21) is expected in response to the COVID-19 outbreak. Other sectors receiving additional funding as a result of the pandemic include the Children's and Social Services sector, the Justice sector, Education and Post-secondary Education, as well as Other Programs (See Figure 2).

Source: Ministry of Finance, March 2020 Economic and Fiscal Update, p. 25

Figure 2: Projected Expenses, 2020-21 ($Billion)

Source: Data from March 2020 Economic and Fiscal Update, chart by Legislative Research and Legislative Library

Net Debt and Deficit

The net debt for 2019-20 is estimated at $355.2 billion, increasing to $379.2 billion in 2020-21. The interest payment to service the debt was $12.6 billion in 2019-20 and is expected to increase to $13.2 billion in 2020-21 (representing 7.6% of total expenses). The net debt‐to‐GDP ratio for 2019-20 is expected to equal 39.9%, and is forecast to grow to 41.7% in 2020–21.

The Ministry is projecting a deficit of $9.2 billion in 2019-20, and a further deficit of $20.5 billion in 2020-21. The sharp increase in the deficit is expected as a result of higher program spending, alongside lower expected revenues following the economic downturn caused by the COVID-19 pandemic. The government borrowed a total of $36 billion in 2019-20.

Tax-Related Measures

The government is proposing new tax-related measures to address the financial hardship experienced by individuals and businesses during the COVID-19 pandemic, including:

· A temporary doubling of the employer health tax exemption — the Employer Health Tax (EHT) exemption will be retroactively increased from $490,000 to $1 million for 2020, returning to the current level in 2021. The change will result in 57,000 businesses paying less EHT.

· Providing interest and penalty relief — starting April 1, 2020, for a period of five months, penalties and interest will not apply to businesses that miss filing or remitting provincially administered taxes. The measure is expected to provide up to $6 billion in liquidity support for 100,000 businesses in Ontario.

· Introducing the Regional Opportunities Investment Tax Credit — a new, 10% refundable Corporate Income Tax credit for capital investments between $50,000 and $500,000, subject to some conditions is being introduced.

· Postponing planned property tax reassessment — the reassessment scheduled for spring 2020 is postponed. Assessments for the 2021 taxation year will continue to be based on the same valuation date that was in effect for the 2020 taxation year.

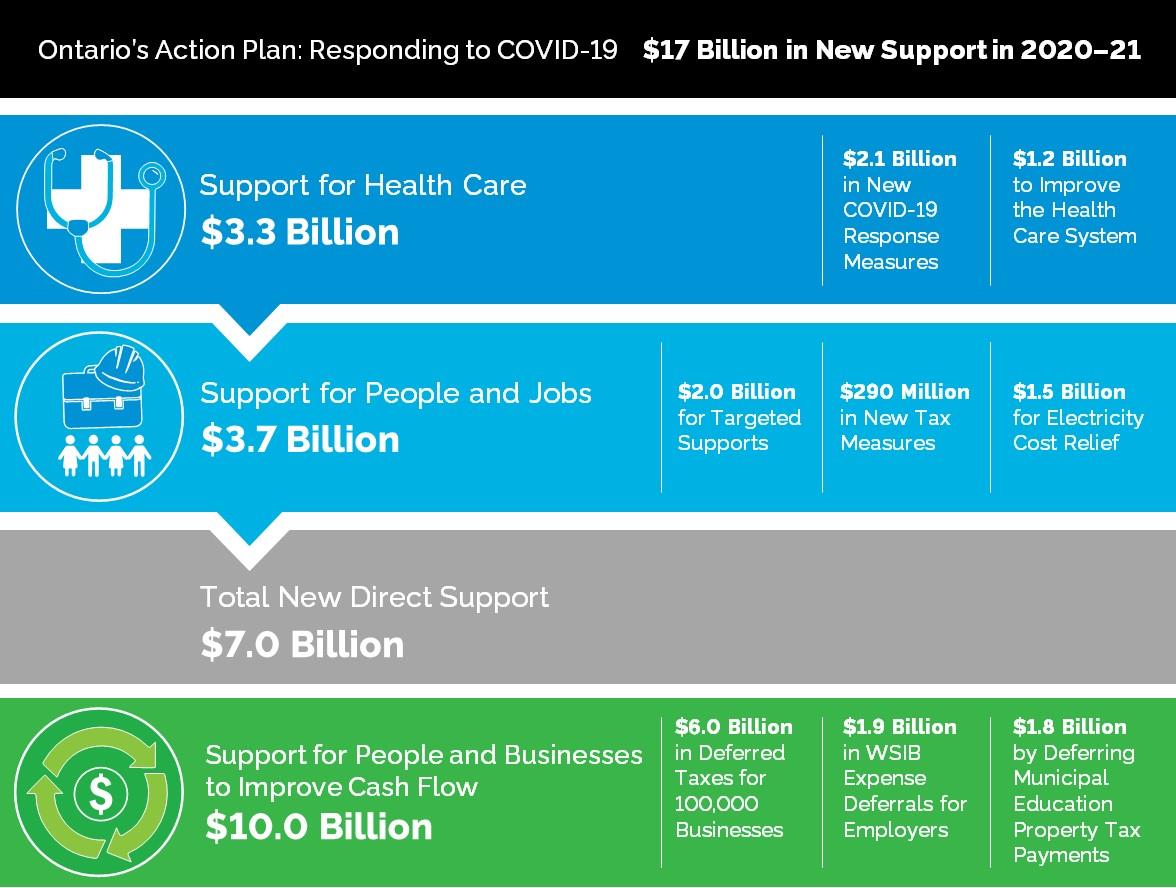

Ontario's Action Plan

At the heart of Ontario's Action Plan: Responding to COVID-19 is the government's stated $17 billion in supports, comprised of $7 billion for health care and support for people and jobs, and $10 billion in tax credits and tax deferrals. The main elements of the Action Plan are highlighted in Figure 3.

Figure 3: Highlights of Ontario's Action Plan: Responding to COVID-19

Source: Ontario's Action Plan: Responding to COVID-19

Bill 188 (the Economic and Fiscal Update Act, 2020)

Bill 188, the Economic and Fiscal Update Act, 2020, was introduced, passed, and received Royal Assent on March 25, 2020. The legislation implemented several measures aimed at mitigating the effects of the COVID-19 crisis, including measures mentioned in the Economic and Fiscal Update March 2020 and Ontario's Action Plan: Responding to COVID-19.

In addition to amendments to the Employer Health Tax Act (doubling the exemption amount for employers) and the Taxation Act, 2007 (establishing the Regional Opportunities Investment Tax Credit), Bill 188

· enacted the Hearings in Tribunal Proceedings (Temporary Measures) Act, 2020, which enables administrative tribunals to determine the way in which they hold hearings; the key provision states: "A tribunal may conduct a hearing in person, electronically, in writing or by a combination of any of them, as the tribunal considers appropriate";

· amended the Ontario Guaranteed Annual Income Act to provide that the maximum amount payable to low income seniors is doubled for the six- month period beginning April 1 and ending September 30, 2020; and

· enacted the Ontario Loan Act, 2020, authorizing the province to borrow a maximum of $31.2 billion.

Letters Filed by Party Leaders and Independent Members

The House motion of March 25 provides that the Committee's review is to include consideration of letters from the party leaders and independent Members, "containing their recommendations to the Minister of Finance with respect to the economic and fiscal measures they proposed to be included in the provisions of Bill 188."

Three party leaders and one independent Member filed letters with the Speaker in late March 2020. The main recommendations contained in these letters are noted below; the letters themselves are reproduced in full in Appendix B.

Letter from the Leader of the New Democratic Party

The letter groups recommendations under four main headings:

· Bolstering our healthcare system, including an immediate boost to hospital funding for the coming year by a minimum of $1 billion, a halt to all plans for public health restructuring, and dedicated funding for childcare for health care and essential workers.

· Supporting households, including the establishment of an Ontario Emergency Income program to support households experiencing unemployment or lost income, and interest-free utility bill deferrals for people in financial need.

· Bolstering small and medium-sized businesses, including working with other levels of government to halt the collection of all payroll, property, sales, and income taxes from small and medium-sized businesses.

· Support for municipalities, including ensuring that municipalities that defer the collection of property taxes may also defer the payment of taxes owed to the province.

Letter from the Leader of the Ontario Liberal Party

The letter focuses on three areas: health and safety, economic security, and economic recovery. Specific proposals include a crack-down on price gouging, removal of barriers to community-spread COVID-19 testing, testing of all long- term care home staff, financial relief for low income wage earners, suspension of provincial payroll taxes, further relief from electricity prices, a clear strategy for preserving the school year, and more funding for mental health programs.

Letter from the Leader of the Ontario Green Party

Recommendations address the need for a basic income, manufacturing solutions to increase public health supplies, enhanced wage support for businesses and non-profits, job-protected sick leave, childcare for essential service workers, deferral of residential and commercial rent, electricity bill, and municipal education tax payments, an emergency response plan for shelters and prisons, an emergency fund for municipalities and Indigenous communities, and a stabilization fund for food security organizations.

Letter from Independent MPP

MPP Randy Hillier would like the Committee to examine four aspects of Bill 188 and the Economic and Fiscal Update: the government's forecasts; the $4.8 billion in reserve funds; the $32 billion in authorized borrowings; and the implications for personal privacy.

WHAT THE COMMITTEE HEARD

Minister of Finance

The Minister of Finance, the Honourable Rod Phillips, appeared before the Committee on June 1, 2020.

At the outset, and on a personal note, the Minister observed that the COVID-19 crisis "is an extraordinary threat to the health of the economy of Ontario, the biggest that we've faced in my lifetime. It demands an extraordinary response from all of us, because we are all in this together."

After reviewing key aspects of the Economic and Fiscal Update and Ontario's Action Plan, the Minister informed the Committee that the government will be releasing its next update before August 15, and that a multi-year budget will be presented to the Legislature by November 15, 2020.

The Minister outlined a series of measures the government has taken since

Ontario's Action Plan was released last March. These include:

· expanding hospital capacity to deal with the COVID-19 outbreak, including thousands of acute and critical care beds and ensuring that hospital staff are available to deal with surges of patients;

· providing frontline workers with a temporary pandemic pay of $4 per hour on top of regular wages;

· providing monthly lump sum payments of $250 for four months to frontline workers who work more than 100 hours per month;

· providing emergency funding of up to $12 million to immediately expand online and virtual mental health supports;

· creating the $20-million Ontario COVID-19 Rapid Research Fund (currently supporting "15 high-quality and promising proposals to prevent, detect and treat COVID-19");

· doubling the amount paid to low-income seniors under the Guaranteed Annual Income System for a period of six months to cover essential expenses during the pandemic (see Bill 188); and

· contributing $241 million to the Canada Emergency Commercial Rent Assistance program, which will provide relief to small businesses and their landlords.

The Minister also provided an update on the work of the Ontario Jobs and Recovery Committee (OJRC), a Cabinet committee convened by the Minister at the Premier's request and comprised of the ministers responsible for those areas of the economy that have been most affected by the pandemic.2 According to the Minister, the OJRC's "first order of business" is to plan for the reopening of the economy. Toward this end, it has sought the advice of businesses, unions, not-for-profit organizations, and individuals. In addition, a new digital consultation initiative will allow for direct consultation with the public.

On a sobering note, the Minister reported that 402,800 Ontarians had lost their jobs in March, and that a further 689,200 had been lost in April. "Those job numbers," he said, "underscore the significant economic impact of COVID-19 and serve as a stark reminder of the personal impacts that this crisis is having, in addition to those who have been affected by the health issues related to the virus."

Minister Phillips concluded his opening remarks with some clarifications of the government's framework for reopening the province, announced at the end of April. Currently, the province is in the first stage of the three-stage reopening plan. In this first stage, businesses such as golf courses, nurseries, and marinas, as well as retail stores with a street entrance have been allowed to reopen. Certain health and medical services, and work at all construction sites has also resumed.

Before moving to the next stage, there must be progress in controlling the pandemic for a two- to four-week period. Within each stage, businesses will be permitted to open if they meet public health guidelines. To assist businesses in this regard, the government has published more than 90 workplace safety guidelines.

The Minister stressed that the reopening process will be guided by advice from Ontario's public health officials.

Questions from the Committee

Committee members questioned the Minister on a wide range of issues. Questioning related specifically to the Economic and Fiscal Update included the following:

· Commercial Tenancies — To date the main support for commercial tenancies has been the Canada Emergency Commercial Rent Assistance (CECRA) program. Ontario's contribution to the program is $241 million. CECRA provides forgivable loans to landlords to cover 50% of monthly rent owed by small business tenants during the three-month period of April, May, and June 2020; tenants are responsible for covering up to 25% of rent. CECRA is a voluntary program, and according to feedback received by some Committee members, the early signs are that commercial landlords are reluctant to participate. The Minister was therefore asked if the government is prepared to take action beyond its participation in CECRA; for example, would it consider an Ontario commercial rent subsidy, a freeze on commercial rents, and/or a temporary ban on commercial tenancy evictions? The Minister responded that it is too early to say whether CECRA is working, since it was launched only at the end of May. He said that first indications are good, as in its first few days the program received over a thousand applications from landlords. The Government will continue to monitor program participation.

· Tax Payment Deferrals — Ontario's Action Plan provides $10 billion in deferrals, including $6 billion in deferrals of most provincial taxes for 100,000 businesses. Deferrals are for a period of five months, and are intended to improve the cash flows of Ontario businesses. According to one Committee member, "the business community is not impressed with deferred payments. They just see that as debt that will be like an albatross around their neck in six months, and that will compromise our ability to recover as an economy." By contrast, another member quoted the following statement from the Ontario Chamber of Commerce: "A six-month deferral on WSIB premiums for employers will provide relief to many businesses struggling to keep their lights on. Similarly, the deferral of the 10 provincially-administrated taxes from April 1 to August 31 will help support businesses as they try to stay afloat." The Minister was asked if he believes deferrals are an adequate form of support in the longer term, and whether the government would consider either extending deferral periods or implementing a debt forgiveness program. The Minister responded that the deferral program has, in fact, "been widely heralded by the business community as an appropriate support." He also stressed that relief measures such as the tax payment deferral program have been implemented in coordination with all levels of government, and have been undertaken, in part, at the request of Canadian businesses, which have told governments, "please, be clear and be coordinated as much as you can."

· Costs of Reopening — Committee members have heard from small business owners that they may need assistance in covering the costs of reopening. The cost of fitting taxi cabs and restaurants with plexiglass was cited as one example. Asked if the government would consider dedicated funding to assist with these costs, the Minister said this is "one of the most important issues" businesses will face as the economy reopens, and noted that the government has provided a range of support in this regard, including funding the allocation of personal protective equipment (PPE) to private businesses. In addition, the Ministry of Finance has provided information to small and large businesses on best practices for reopening (the Minister referenced 90 guidelines for this in his opening remarks). The agriculture sector has received over $2 million in supports to ensure continued operations in current conditions.

· Insurance — Committee members noted that one of the side-effects of the economic shutdown has been a dramatic decline in the types of activities covered by insurance; for example, fewer people are driving to work. As a result, it might be assumed that insurance companies have seen a sharp drop in claims and claims costs. The Committee therefore asked the Minister if he would be considering regulatory measures requiring insurers to provide premium relief for businesses such as taxi cab companies that are simply "trying to stay alive." The Minister agreed that the insurance industry "needs to do more," and said that this is why the government recently met with industry representatives to find out why drivers were not receiving rebates. When the industry said that rebates required regulatory changes, the government responded within a week. Seven of the 14 companies that account for 97% of the province's auto insurance market are now offering rebates. The Minister also assured the Committee that the government "will continue to apply the appropriate pressure and we will continue to make the point that the customers at the auto insurance companies now will be their customers in the future. Driving behaviour has clearly changed and we expect to see action."

· Anti-Black Racism — Committee members report hearing from Black business owners that anti-Black racism has historically made it difficult for these businesses to access capital, and that the current pandemic has only heightened concerns around this issue. The Committee asked if the government would consider a designated emergency fund to help these businesses survive the economic shutdown. The Minister in response noted that he had recently participated in a round table with the Premier and the Canadian Black Chamber of Commerce to discuss a range of options, including the possibility of a designated emergency fund. He acknowledged that anti-Black racism is an issue in Ontario and said that the government will be considering all options as the situation evolves.

· Indigenous Communities — The Minister responded to a request for an update on direct funding programs for Indigenous communities in the Far North. To date, the government has provided a total of $37.8 million in support, including $16.4 million in emergency funding through the Ministry of Indigenous Affairs for food, household goods, critical supplies, and transportation. An additional $10 million has been provided through the Ministry of Children, Community and Social Services to support Indigenous communities and agencies, and a further $11 million through the Ministries of Municipal Affairs and Transportation to support Indigenous people living off-reserve.

· Education — According to the Economic and Fiscal Update, funding for the education sector is projected to increase by $100 million in 2019–20 and by $500 million in 2020–21, mainly to support higher student enrolment and investments in child care programs. The Committee asked how the COVID- 19 crisis might affect these numbers; for example, has the government considered the fact that social distancing protocols may require smaller, not larger, class sizes, or that school facilities such as washrooms may require modification? The Minister agreed that the province will need to "adapt and adjust" to the evolving situation in the education sector and to "keep parents directly informed with regard to how we are going to proceed, how our classes are going to proceed and how they are going to be done safely." The August update will provide additional information.

· Electricity Rates — The Economic and Fiscal Update indicates that "additional funding" will support electricity cost relief programs, including the Ontario Electricity Rebate for eligible residential, farm, and small business consumers. Committee members questioned whether this "additional funding" is, in fact, new funding, given that it was announced in January 2020. According to the Minister, the additional funding is $1.5 billion in new money in this fiscal year, and is in addition to the funding necessary to cover the elimination of time-of-use pricing. The funds announced in the March update bring the total hydro subsidy to $5.6 billion, and are intended to assist Ontarians who will be spending more time at home during the pandemic and therefore using more electricity.

· Testing and Contact Tracing — As noted by the Minister, one of the key pre- conditions for restarting the economy is ensuring that the province is meeting its COVID-19 testing targets, and that it is able to conduct adequate contact tracing, especially in the event of a "second wave" or "flare ups." The Minister expressed support for a national approach to contact tracing, including a possible contact tracing application (app). Knowing that these measures are in place, he said, will go a long way towards restoring consumer confidence. Committee members asked if "cuts" to the public health budget in 2019 have made it more difficult for the province to meet these goals. The Minister responded that the government has "provided $100 million of direct additional support through our municipal partners as part of the quarter of a billion dollars that was provided to municipalities, and an additional $60 million to support the broader public health initiative."

· COVID-19 Contingency Fund — The Economic and Fiscal Update establishes a COVID‐19 health sector response contingency fund of $1 billion, "for any emerging needs to support the Province's timely response to the outbreak." Asked for more details on the purpose of this fund, the Minister noted that when the government was preparing its one-year update, "we knew less then than we know now" about how the pandemic would unfold. Accordingly, it was decided that there should be adequate resources to address a rapidly changing environment, particularly in the area of health. For example, the fund could support the purchase of additional PPE and additional COVID-19 testing. The Minister also noted the government has created a $1.3-billion general contingency fund and a $2.5-billion reserve fund, "larger than it has ever been in the history of this province." These funds will support additional spending requirements in health and other vital areas, as well as help address pressures on the revenue side.

· Effect of Global Markets — In light of the global nature of the COVID-19 crisis, the Committee asked: To what extent is an economic recovery in Ontario dependent on global markets? The Minister prefaced his response by conceding that Ontario "is very, very reliant on global trade and, in particular, reliant on trade with the United States"; for example, he noted that Ontario is the number one trading partner for 19 states. Cabinet's Jobs and Recovery Committee, he said, is well aware of the importance of our relationship with the United States, and is conducting an analysis of how to sustain the supply chain between Ontario and US jurisdictions. At the same time, the Minster emphasized that "we will never again be caught in a situation where we are dependent on a border to get the vital PPE that's needed to Ontario health care professionals and others."

Financial Accountability Officer

Ontario's Financial Accountability Officer (FAO), Peter Weltman, appeared before the Committee on June 1, 2020, as the Committee's second witness (the FAO's submission is reproduced in Appendix C).

The Financial Accountability Office of Ontario (Office) provides analysis of the provincial economy and the government's fiscal position, as well as projections on the financial impact of its policies and programs. The Office supports MPPs and encourages transparency in budgeting and financial reporting. The FAO presented the Committee with a point-in-time overview of Ontario's economic and budget outlook that he said can be used as a baseline for measuring future developments. The outlook is heavily dependent on the pace and timing of the reopening of the economy in the months ahead.

The FAO projected that real Gross Domestic Product (GDP) would decline by 9% in 2020, and partially rebound, by 8.5%, in 2021. This projection is based on the assumption that the current shutdown continues into the summer, and is gradually lifted throughout the fall. On the labour market front, data from March and April suggest that 2.2 million Ontario workers have been affected by the pandemic-related shutdown, with 1.1 million losing their jobs, and a further 1.1 million having their working hours reduced. Consequently, the unemployment rate in Ontario reached 11.3% in April.

The shutdown is expected to affect Ontario's fiscal position in two ways: loss of tax revenue from business shutdowns and loss of jobs, and increased spending in response to the pandemic. The overall impact is a budget deficit of $41 billion (5% of GDP) in 2020-21. The deficit is expected to decrease to $25.3 billion in 2021-22 ($37 billion if the recovery is slow), with cumulative debt reaching $435 billion by the end of the 2020-21 fiscal year. The increase in debt is projected to result in Ontario's debt-to-GDP ratio rising to 48.7% in 2021-22. Lower interest rates will reduce the province's borrowing costs, with debt servicing payments increasing by 4.5%.

Committee members inquired about the apparent discrepancy between figures reported by the government and the FAO for direct funding amounts in response to the pandemic, and the expected deficit. As noted earlier, in March 2020 the government reported $7 billion in direct supports in response to the pandemic.

An independent FAO analysis stated that $4.5 billion of that amount was new, direct funding in response to the pandemic; however, the remaining $2.6 billion (funding for hospitals and electricity bill subsidies) was said by the FAO to be ongoing funding, which had been earmarked for the 2019-20 fiscal year prior to the pandemic. In addition, some funds were provided to reverse cuts to healthcare and public health announced in the 2019 Budget.

The FAO also stated that some of the inconsistency in the reporting of the deficit could be the result of the government publishing its outlook a few months earlier than the FAO, before additional financial data became available. The FAO is currently working on producing a document detailing how the government borrows money, as well as a regional demographic breakdown of the effects of the electricity subsidy on household finances.

The Committee also requested details on the FAO's modelling methodology. The FAO explained that his Office takes into account programs implemented by the federal government to address the pandemic, and incorporates factors such as the federal wage subsidy into its projections. Further, the FAO is implementing a gender-based analysis, assessing the impact of the pandemic on jobs, broken down by gender. The Committee heard that the hardest-hit sectors of the economy are "public-facing" (retail, restaurants, hospitality), where women, immigrants, and youth comprise a relatively higher proportion of employment.

Asked to elaborate on the province's contingency funding, the FAO said that the term can refer to two types of funds: a "contingency fund" is held at the Treasury Board and is used to supplement programs requiring extra funding; "unallocated funds" are also given to ministries to hold in reserve. The FAO will be providing quarterly spending updates that will specify amounts spent in different areas.

The 2019 Q4 report is expected in early July, with the 2020 Q1 report to follow later in the summer. Commenting on the importance of regular financial reporting, the FAO said that transparency is a critical link to maintaining the trust between governments and their citizenry. The FAO agreed with the Committee that performance measurement should include factors beyond just the amount of money spent, including for example, factors such as service levels.

Responding to Committee questions on "fiscal capacity," the FAO explained that the term refers to the limit of how much a government can borrow before its bonds become unattractive to investors. The FAO said that the federal government has a significantly higher fiscal capacity than the Province.

The Committee requested that the FAO

· track and analyze bankruptcies that occur in the Province during the Committee's period of study, also tracking the themes covered in the study, and provide the Committee with this information; and

· provide the Committee with a breakdown of Ontario and federal government pandemic responses, focusing on the proportion of investment made by each level of government.

COMMITTEE RECOMMENDATIONS

The Standing Committee on Finance and Economic Affairs recommends that:

1. The House should partake in the opportunity to contribute to the consultations of the Ontario Jobs and Recovery Committee, and host local consultations to determine the impact of the COVID-19 crisis and how the government can best support an economic recovery, and report to the Minister of Finance on the number and results of those consultations.

2. The Province should continue to work collaboratively with the federal government and municipalities to address the effects of the COVID-19 crisis, with an emphasis on those areas of the economy most affected by it.

3. The Government should provide the Legislative Assembly of Ontario and the public with regular fiscal updates as it responds to the changing nature of the COVID-19 crisis.

APPENDIX A: TERMS OF REFERENCE*

That the Leaders of the parties represented in the Legislative Assembly as well as Independent Members may file copies of letters with the Speaker, who shall cause them to be laid upon the Table, containing their recommendations to the Minister of Finance with respect to the economic and fiscal measures they proposed to be included in the provisions of Bill 188, and such letters shall be deemed to be referred to the Standing Committee on Finance and Economic Affairs; and

That when the committees of the Legislature resume meeting, the Standing Committee on Finance and Economic Affairs shall be authorized to consider the Party Leader and Independent Member letters, together with An Act to enact and amend various statutes as passed by the Legislature today, with the first witness during such consideration to be the Minister of Finance;

*Votes and Proceedings, March 25, 2020, 42nd Parliament, 1st Session

That, notwithstanding any Standing Order or Special Order of the House, the Standing Committee on Finance and Economic Affairs, and all other committees when they are authorized to resume meeting pursuant to the Order of the House dated March 19, 2020, are authorized to use electronic means of communication when meeting, and committee members, witnesses, and/or staff are not required to be in one physical place, in accordance with the following guidelines:

a) The electronic means of communication is approved by the Speaker;

b) The meeting is held in a room in the Legislative Building, and at least the Chair/Acting Chair, and the Clerk of the Committee are physically present;

c) Other Members of the committee participating by electronic means of communication, whose identity and location within the Province of Ontario have been verified by the Chair, are deemed to be present and included in quorum;

d) The Chair shall ensure that the Standing Orders and regular committee practices are observed to the greatest extent possible, making adjustments to committee procedures only where necessary to facilitate the physical distancing and electronic participation of Members, witnesses, and staff; and

That, notwithstanding the Order of the House dated March 19, 2020, the Standing Committee on Finance and Economic Affairs is authorized to meet at the call of the Chair to consider its Order of Reference dated March 25, 2020, respecting the Economic and Fiscal Update Act, 2020 (Bill 188); and

To study the impacts of the COVID-19 crisis on the following sectors of the economy and measures which will contribute to their recovery:

a) Tourism

b) Culture and Heritage

c) Municipalities, Construction, and Building

d) Infrastructure

e) Small and Medium Enterprises

f) Other economic sectors selected by the Committee

- The committee shall study Bill 188 and each specified economic sector for up to 3 weeks with one additional week allotted for report-writing for each.

- The Sub-committee on Committee Business shall determine the method of proceeding on the study, and at its discretion, may extend each sectoral study by one week where a public holiday may fall during the scheduled time for the sectoral study.

- The Legislative Research Service shall make itself available to the Committee collectively, and to members of the Committee individually, on a priority basis.

- That in accordance with s. 11 (1) of the Financial Accountability Officer Act the Financial Accountability Officer shall make the resources of his office available to the Committee collectively, and to members of the Committee individually, on a priority basis.

- The time for questioning witnesses shall be apportioned in equal blocks to each of the recognized parties and to the Independent Members as a group.

- The Committee may present or, if the House is not sitting, may release by depositing with the Clerk of the House, interim reports, and a copy of each interim report shall be provided by the Committee to the Chair of the Ontario Jobs and Economic Recovery Cabinet Committee; and

- The Committee shall present or, if the House is not sitting, shall release by depositing with the Clerk of the House, its final report to the Assembly by October 8, 2020 and a copy of the final report shall be provided by the Committee to the Chair of the Ontario Jobs and Economic Recovery Cabinet Committee; and

That notwithstanding Standing Orders 38 (b), (c), and (d) the interim reports presented under this Order of Reference shall not be placed on the Orders and Notices Paper for further consideration by the House nor shall the government be required to table a comprehensive response; and

That notwithstanding Standing Orders 116 (a), (b) and (c), the membership of the Standing Committee on Finance and Economic Affairs for the duration of its consideration of the Order of Reference provided for in this motion shall be:

Mr. Sandhu, Chair [Sub-committee Chair]

Mr. Roberts, Vice-Chair

Mr. Arthur

Mr. Cho (Willowdale) [Sub-committee Member]

Mr. Crawford

Ms. Hunter [Sub-committee Member]

Mr. Mamakwa

Mr. Piccini

Mr. Schreiner

Ms. Shaw [Sub-committee Member]

Ms. Skelly [Sub-committee Member]

Mr. Smith (Peterborough—Kawartha)

Ms. Andrew (non-voting member)

Mr. Blais (non-voting member)

Ms. Fife (non-voting member)

Mr. Hillier (non-voting member)

Ms. Khanjin (non-voting member)

Mr. Rasheed (non-voting member)

Mr. Vanthof (non-voting member); and

That, should the electronic participation of any voting Member of the Committee be temporarily interrupted as a result of technical issues, a non-voting Member of the same party shall be permitted to cast a vote in their absence.

*Votes and Proceedings, May 12, 2020, 42nd Parliament, 1st Session

APPENDIX B:

LETTERS FILED BY PARTY LEADERS AND INDEPENDENT MEMBERS

Sunday, March 22, 2020

To: Doug Ford, Premier of Ontario Rod Phillips, Minister of Finance

Paul Calandra, Government House Leader

From: Andrea Horwath, Leader of the Official Opposition New Democrats

Subject: New Democrat Suggestions for the Financial Statement

On Friday, the Government House Leader informed New Democrat House Leader Gilles Bisson that the government would be willing to accept suggestions with regards to the upcoming Financial Statement provided they were delivered before the end of the weekend.

New Democrats support the Finance Minister's decision not to present a full Budget given economic uncertainty amidst the COVID-19 pandemic. However, the government should act urgently to bolster healthcare funding to fight the pandemic, protect Ontario's economy and support families and businesses facing significant economic disruption.

This submission lays out key measures the government should urgently take to address the current crisis.

Bolstering our healthcare system

Our health care system needs immediate investment and support. In last year's Budget, the government's healthcare investment barely kept pace with inflation and hospital funding was

effectively frozen. The Financial Accountability Office analysis noted that the 2019 budget cut overall health spending by $2.7 billion over the next two years as compared to the 2018 budget plan. We now need urgent investment:

· Immediately enhance hospital funding for the coming year by a minimum of $1 billion. The Ontario Hospital Association indicated in their pre-Budget submission, before the COVID-19 outbreak, that this amount (a 4.85 per cent increase in hospital sector funding) was needed simply to address underlying inflationary pressure, and the need to increase service volume and create capacity at the local level.3

· Halt all plans for public health restructuring and increase financial support. Provide 100 per cent provincial funding to public health units, so that they are not relying on municipalities for 30 per cent of their funding, especially while municipalities have paused revenue tools like property tax payments.

· Create a fund to recruit back and retain Personal Support Workers (PSWs), many of which have left the profession. The PSW shortage in Ontario was already hurting home care and long-term care before the COVID-19 outbreak. Now it risks hindering COVID-19 containment efforts. Trained PSWs have left the field for other professions4 and now urgently need to be encouraged to return. Wage and benefit enhancements with longer-term plans to provide greater job stability would help achieve this.

· Offer dedicated funding for child-care and other supports for health care, emergency and any other workers deemed essential. The Government's new Employment Standards Amendment Act (Infectious Disease Emergencies) specifically reserves the right of the government to exempt any class of workers deemed essential. New Democrats agreed to this provision but now it is incumbent on us as a province to provide whatever support these essential workers need as they do their part in this pandemic.

· Provide necessary funding in-home and community care to ensure no disruption to critical services like dialysis and cancer treatment. The Government has announced plans to ramp down non-urgent services in hospitals and free up hospital beds by moving patients to community settings. While it is important that hospitals get all the resources they need to respond to COVID-19, the government still needs to ensure they will not reduce or cut critical, lifesaving services provided in the community.

· Set aside additional, dedicated funding to enact measures to protect seniors. Seniors are a vulnerable population measures here should include:

- Enhanced supports for screening at all centres that provide health care services to seniors (long- term care homes, retirement homes, supportive housing, and assisted living)

- Ensure that seniors have access to medication they need and that they may receive at home, so they do not put themselves at risk by going in public to get their medication.

Supporting Households

The COVID-19 pandemic has had a devastating impact on millions of Ontario households and the overall economy. Economists estimate that we are now seeing the highest number of Employment Insurance claims ever and the largest employment drop in Canadian history5. Urgent action is needed to supplement federal support that will not be adequate or timely enough to meet people's needs:

- · Establish an Ontario Emergency Income program to provide households experiencing unemployment or lost income.

o With an Ontario Emergency Income, any household experiencing unemployment or reduced income would be able to apply for a one-time $2,000 cheque or direct deposit.

o Individuals already enrolled in support programs, including Ontario Works, Ontario Disability Support Program, Employment Insurance, and the federal Emergency Care Benefit should be automatically enrolled.

o Families with dependents would qualify for an additional $250 per child.

o Payments should be received by April 1, making it possible for monthly expenses due on the first of the month to be paid.

o Enrollment should be available by phone and online to anyone who declares a need.

o People who take advantage of the fund that have not lost their job or had their income reduced will have payments clawed back on their provincial taxes. New Democrats are ready to work with the government and the Ministry of Finance to determine exact criteria.

o This emergency benefit will help households in the immediate term. The government should then work with the federal government to bring in a program for ongoing income support for Ontarians throughout the COVID-19 pandemic.

· Order all utilities to provide interest-free bill deferrals of up to six months to anyone who cites financial need, with penalty-free repayment plans.

· Immediately cancel Time Of Use hydro billing.