STANDING COMMITTEE ON PUBLIC ACCOUNTS

VALUE-FOR-MONEY AUDIT: FINANCIAL SERVICES REGULATORY AUTHORITY: REGULATION OF PRIVATE PASSENGER AUTOMOBILE INSURANCE, CREDIT UNIONS AND PENSION PLANS

(2022 ANNUAL REPORT OF THE OFFICE OF THE AUDITOR GENERAL OF ONTARIO)

1st Session, 44th Parliament 4 Charles III

The Honourable Donna Skelly, MPP

Speaker of the Legislative Assembly

Madam,

Your Standing Committee on Public Accounts has the honour to present its Report and commends it to the House as agreed by the Committee on Monday, May 26, 2025, that the report adopted by the Standing Committee on Public Accounts on Monday, November 18, 2024, as the Committee’s Report on Value-for-Money Audit: Financial Services Regulatory Authority: Regulation of Private Passenger Automobile Insurance, Credit Unions and Pension Plans (2022 Annual Report of the Office of the Auditor General of Ontario) shall be re-adopted, shall be bilingual and shall be reported to the House.

Tom Rakocevic, MPP Chair of the Committee

Queen's Park

October 2025

Standing Committee on Public Accounts

MEMBERSHIP LIST

1st Session, 44th Parliament

TOM RAKOCEVIC

Chair

DAVID SMITH

Scarborough Centre

First Vice-Chair

LEE FAIRCLOUGH

Second Vice-Chair

JESSICA BELL MICHELLE COOPER

GEORGE DAROUZE JESS DIXON

MOHAMED FIRIN BILL ROSENBERG

THUSHITHA KOBIKRISHNA

Clerk of the Committee

LAUREN WARNER

Research Officer

STANDING COMMITTEE ON PUBLIC ACCOUNTS

VALUE-FOR-MONEY AUDIT: FINANCIAL SERVICES REGULATORY AUTHORITY: REGULATION OF PRIVATE PASSENGER AUTOMOBILE INSURANCE, CREDIT UNIONS AND PENSION PLANS

(2022 ANNUAL REPORT OF THE OFFICE OF THE AUDITOR GENERAL OF ONTARIO)

1st Session, 43rd Parliament 3 Charles III

The Honourable Ted Arnott, MPP

Speaker of the Legislative Assembly

Sir,

Your Standing Committee on Public Accounts has the honour to present its Report and commends it to the House.

Tom Rakocevic, MPP Chair of the Committee

Queen's Park

December 2024

STANDING COMMITTEE ON PUBLIC ACCOUNTS

MEMBERSHIP LIST

1st Session, 43rd Parliament

TOM RAKOCEVIC

Chair

DONNA SKELLY

Vice-Chair

RICK BYERS LUCILLE COLLARD

RUDY CUZZETTO JESS DIXON

FRANCE GÉLINAS ROBIN MARTIN

SHEREF SABAWY EFFIE J. TRIANTAFILOPOULOS

CATHERINE FIFE regularly served as a substitute member of the Committee.

TANZIMA KHAN

Clerk of the Committee

LAUREN WARNER

Research Officer

STANDING COMMITTEE ON PUBLIC ACCOUNTS

SUPPLEMENTAL MEMBERSHIP LIST

1st Session, 43rd Parliament

WILL BOUMA (August 10, 2022 – October 21, 2024)

HON. STEPHEN CRAWFORD (August 10, 2022 – October 21, 2024)

LOGAN KANAPATHI (August 10, 2022 – April 12, 2024)

LISA MACLEOD (February 29, 2024 – October 21, 2024)

HON. TODD J. McCARTHY (August 10, 2022 – September 26, 2023)

LAURA SMITH (August 10, 2022 – April 12, 2024)

Thornhill

LISE VAUGEOIS (August 23, 2022 – February 29, 2024)

DAISY WAI (April 11, 2024 – October 21, 2024

Contents

Overview of Key Regulated Sectors 1

2022 Audit Objective and Scope 2

Issues Raised in the Audit and Before the Committee 2

Territory as an Auto Insurance Rate Variable 4

Insurer Profits and Rate Regulation 5

Oversight of Health Service Providers 6

Ontario’s Model for the Treatment of Auto Accident Victims 6

Recent Changes in the Auto Insurance Sector 8

FSRA’s Regulatory Powers in Auto Insurance 8

Multi-Employer Pension Plans 10

Consolidated List of Committee Recommendations 12

Introduction

On September 25, 2023, the Standing Committee on Public Accounts held public hearings on the value-for-money audit of the Financial Services Regulatory Authority: Regulation of Private Passenger Automobile Insurance, Credit Unions and Pension Plans (2022 Annual Report of the Office of the Auditor General of Ontario). The Ministry of Finance (Ministry) oversees the Financial Services Regulatory Authority (FSRA).

The Committee welcomes the Auditor’s findings and recommendations and now presents its own findings, views, and recommendations. The Committee requests that the Ministry and FSRA provide the Clerk of the Committee with written responses to the recommendations within 120 calendar days of the tabling of this report with the Speaker of the Legislative Assembly, unless otherwise specified.

Acknowledgements

The Committee extends its appreciation to officials from FSRA and the Ministry. The Committee also acknowledges the assistance provided by the Office of the Auditor General, the Clerk of the Committee, and Legislative Research.

Background

The Financial Services Regulatory Authority of Ontario (FSRA) is a self-funded Crown agency. It operates under the Financial Services Regulatory Authority of Ontario Act, 2016 and reports to the Minister of Finance.

FSRA is the primary regulator of non-securities related financial services in Ontario. FSRA assumed the responsibilities of two predecessor organizations—the Financial Services Commission of Ontario (FSCO) and the Deposit Insurance Corporation of Ontario (DICO) in 2019.

Overview of Key Regulated Sectors

The 2022 audit focused on FSRA’s regulation of private passenger automobile insurance (auto insurance), credit unions, and provincially registered pension plans. In the auto insurance sector, FSRA regulates insurance companies and insurance agents for compliance with the Insurance Act and the requirements of their licence. FSRA also approves applications from auto insurers seeking to change the rates they use to calculate premiums and the customer rating variables insurance companies use.

FRSA also regulates approximately 60 credit unions and caisses populaires, which provide similar financial services as banks for their members. As of June 2022, Ontario’s credit unions and caisses populaires held about $69 billion in deposits, employed about 8,000 staff, and served about 1.7 million Ontarians.

In the provincially registered pension plan sector, FSRA’s mandate is to promote good pension administration and protect and safeguard the benefits and rights of pension plan beneficiaries. As of June 2022, FSRA was responsible for overseeing about 4,630 pension plans that were collectively managing around $800 billion in assets and had a total of 4.3 million members.

Although FSRA has some rule-making authority, it does not have the power to make legislative changes over the sectors it regulates. Rather, the Ministry of Finance is responsible for setting the overall policy direction for the regulated sectors and for establishing the legislative framework in which FSRA operates.

2022 Audit Objective and Scope

The audit objective was to assess whether FSRA “has effective and efficient regulatory processes and systems in place for the private passenger automobile insurance, credit union and regulated pension plan sectors to:

· protect consumers and contribute to public confidence in these sectors through its regulatory and supervisory activities (licensing, registration, monitoring compliance, investigation, enforcement and education for consumers) in accordance with legislation, rules and policies; and

· measure and publicly report its effectiveness in achieving its mandate.”

The audit was conducted between December 2021 and August 2022.

Audit Conclusions

Overall, the audit concluded that FSRA “continues to be a work in progress and needs to accelerate its efforts to fully protect consumers” and increase public confidence in the private passenger auto insurance, credit union, and provincially registered pension plan sectors. In particular, the audit found the following:

· Ontarians pay the highest private passenger auto insurance premiums in the country, and FSRA’s actions have not significantly reduced the high cost or provided Ontarians with equitable rates across the province.

· FSRA’s credit union inspection process did not identify or resolve governance issues at credit unions in a timely manner.

· FSRA and the Ministry of Finance have not protected multi-employer pension plan (MEPP) members from the risk of a significant and permanent reduction to their targeted benefits or clearly communicated this risk to MEPP members.

Issues Raised in the Audit and Before the Committee

The Committee heard that the government is continuing to adjust Ontario’s auto insurance system. It aims to provide consumers with more choice and options for purchase of mandatory auto insurance. The government is also addressing fraud in the auto insurance sector by requiring insurers to provide FSRA with fraud information on an ongoing basis, and it is looking at reviewing how drivers access benefits when extended health care plans are involved.

In the credit union sector, new legislation passed in March 2022 that aims to remove red tape and reduce compliance costs for credit unions and caisses populaires. The new legislation also provides FSRA with more tools to effectively regulate the credit union sector.

The Ministry and FSRA are also working to modernize the administration of pension plans in Ontario. The development of a permanent target benefit framework (which would apply to eligible MEPPs) is a key priority for the Ministry. In March 2023, the Ministry launched consultations on regulations to implement such a framework, which are continuing in the fall.

The Committee also heard that FSRA is committed to a vision of financial safety, fairness, and choice for Ontarians, achieved through dynamic, principles-based regulation. FSRA takes a principles-based approach to supervision that is outcomes-based, proportional, and situational, rather than prescriptive.

FSRA said that protecting consumers is at the heart of everything it does; FSRA works dynamically with consumers, regulated entities, the government, and other regulators to help ensure that Ontarians get the financial products and services that meet their needs.

Auto Insurance Rates

As noted above, the audit found that Ontarians pay the highest premiums in the country for private passenger auto insurance. The audit also noted that FSRA and the Ministry have not acted on a number of recommendations from past reports on auto insurance that could result in lower rates for Ontarians.

FSRA told the Committee that making sure that auto insurance rates are fair, reasonable, and not excessive is of central importance to it. In addition, FSRA committed to developing a strategy for reforming the regulation of auto insurance rates and underwriting rules in its 2023-24 priorities.

The Committee asked about information from the audit report that shows that actual premiums in Ontario rose above the rate of inflation from 2002-2020 and that actual claims costs were below the premiums charged during most of that period. The Committee also asked why FSRA has not capped rates.

FSRA said that it spends a great deal of time ensuring that rates are just, reasonable, and not excessive, but that it is not its role to cap rates. Rather, it has a rigorous rate approval process. It uses internal and external actuarial resources to achieve a fair outcome for rates.

FSRA further noted that over the last five years, insurance rates have been rising at a lower rate in Ontario than in other comparable jurisdictions. Over the last five years, there was a 12% cumulative increase in Ontario, a 21% increase in Alberta, and a 25% increase in Atlantic Canada. FSRA also said that approximately $1.8 billion was provided in consumer relief between 2020 and 2022, primarily through rate reductions and premium rebates during the pandemic.

Following the hearings, on March 25, 2024, the Committee sent a letter to FSRA and asked for a detailed breakdown of the rebates and savings provided between 2020 and 2022. On April 8, 2024, FSRA provided an estimate of net COVID relief by insurer and accident year. On October 22, 2024, the Committee requested a breakdown and quantification of the type of consumer relief provided (e.g., rate reductions, rebates, drivers changing their coverage to lower premiums) for 2020, 2021, and 2022 by each insurer. FSRA responded on November 4, 2024 that its data does not include additional information for them to provide a breakdown or quantification of the type of consumer relief provided for those years by each insurer.

The Committee also asked how Ontario could have a lower rate of auto injuries compared to most other provinces, but the highest auto insurance premiums in the country. The Ministry said that when one compares rates across jurisdictions, it is important to keep in mind that the insurance systems are different across the country. Ontario has “some of the most generous mandatory coverages” and this is reflected not only in the premiums that people pay, but also the benefits that they derive from their policies.

As to why FSRA and the Ministry have not acted on recommendations from past reports on auto insurance that could result in lower rates, the Ministry said that it is “constantly taking action in respect of working with both the government and the regulator in terms of ongoing reforms to the system.”

The Ministry also noted that it is working with FSRA to implement the Blueprint for Putting Drivers First Plan, which was announced in the 2019 Budget. The Ministry’s timeline for performing a comprehensive review of past auto insurance reform reports (as recommended by the Auditor) is one year (April 2024), and its timeline to consider identifying and prioritizing recommendations, and developing a plan for reform is two years (April 2025).

Committee Recommendations

The Standing Committee on Public Accounts recommends that:

- The Financial Services Regulatory Authority report back to the Committee once it has completed its strategy for reforming the regulation of auto insurance rates and underwriting rules.

- The Financial Services Regulatory Authority publicly disclose what conflict in the courts costs the system.

Territory as an Auto Insurance Rate Variable

The audit also noted that FSRA’s territorial framework, which outlines how insurers can provide different premiums to individuals based on where they live, results in individuals paying widely different rates across the province. Among other things, the Auditor recommended that FSRA complete the review of its territory-based underwriting framework and update it for greater equity in insurance rates throughout Ontario.

FSRA said that it has been reviewing the use of postal code-based territories. A study reviewing the legacy postal code territories has been completed by an external consultant and the first report has been published. FSRA has received the second report, and it will be published in the next few months.

FSRA also reported to the Minister on its conclusions from this review. While the details of its advice to the Minister are confidential, FSRA said that it has “concluded that the inflexible postal code-based territory guidance is outdated” and it is developing a plan to transition to a more flexible system of how to use geography in underwriting. The Committee also learned that FSRA is working on a territory-rating changes implementation plan and its expected timeframe to meet the Auditor’s recommendations in this regard is three years.

With respect to the rationale for charging different rates to people who live in different jurisdictions, FSRA said that geographic territories are one of the variables that go into an insurance rate, along with others. Geography is an important variable because a person’s predisposition to having an accident is based on where they drive and how busy the roads are. Geography is also a determinant of theft, which is another major cost.

However, FSRA explained that with inflexible territories, insurers are not able to group risks in a way that they think will result in fairer rates and there is a lack of competition between insurers about how to take geography into account. For example, some insurers may want to adopt user-based insurance, where geography becomes an unimportant or minor factor in their ratings, and FSRA wants to allow that flexibility to happen.

Insurer Profits and Rate Regulation

The Committee asked how the Ministry works to balance fairness to drivers and some level of profitability to insurers. The Ministry said that it is always looking at how policies can be improved to ensure that Ontario has a system that allows healthy competition between insurers and a balanced regulatory burden.

FSRA noted that ensuring that rates are just, reasonable, and not excessive requires a balancing of the cost to consumers with ensuring that insurers continue to write policies in Ontario. FSRA said that when jurisdictions lose insurers, it drives up rates and can make it difficult for consumers to find insurance.

FSRA also clarified that it is not a rate of return regulator. Rather, it allows insurers a 5% profit margin, also known as return on premium. In recent years, insurers have only achieved about 3-4% return on premium.

FSRA said that it requires insurance companies to submit detailed rate filing packages before it will approve a rate change. An insurer who does not have data to back up their rates will not get the rate changes approved. Every rate filing must be supported by full actuarial studies. FSRA challenges the data insurance companies provide with its internal actuaries and an external actuarial resource.

Committee Recommendation

The Standing Committee on Public Accounts recommends that:

- The Financial Services Regulatory Authority require insurance companies to provide more transparency in their data, such as providing a detailed public rationale for all rate changes listed by auto insurer and publicly disclosing the return on premium for each auto insurer on a yearly basis.

Oversight of Health Service Providers

FSRA also oversees some health service providers (HSPs) who offer medical treatment (e.g., physiotherapy) to individuals involved in motor vehicle accidents. The audit found that FSRA’s move to virtual inspections of HSPs during COVID-19 limited FSRA to relying entirely on HSP self-attestation during the inspection process.

The Auditor recommended that FSRA resume on-site inspections, and FSRA told the Committee that it would do so on a trial basis. It will then compare the costs and benefits of on-site reviews and other supervisory techniques and engage stakeholders to determine how to best verify that HSPs have corrected prior issues.

The Committee asked about the hourly rates paid to HSPs under the Statutory Accident Benefits Schedule (SABS). FSRA explained that it only regulates HSP billing practices and sets some guidelines for what they can bill. FSRA does not set hourly rates for the people who provide heath care services. Rather, it sets the maximum charges that can be billed to insurers. However, insurers are free to agree to pay more and individuals are free to go to a service provider that charges more and pay up.

FSRA also looks at whether there is balance in the supply of health care services in the marketplace, recognizing that if it increases the amount that insurers must be willing to pay for health care services, then that will increase the cost of insurance to everyone in Ontario.

Committee Recommendations

The Standing Committee on Public Accounts recommends that:

4. The Financial Services Regulatory Authority resume onsite inspections of health service providers on a trial basis as planned, and if it decides not to continue onsite inspections after the trial period, share the reasons for not doing so with the Committee.

- The Financial Services Regulatory Authority review the Professional Services Guideline on a regular basis and approve rates in line with equivalent services for non-auto victims.

Ontario’s Model for the Treatment of Auto Accident Victims

The audit noted that Ontario’s model for treatment of auto accident victims allows injured parties to claim accident benefits from their own insurance company and also sue the at-fault driver. This model creates an incentive for accident victims and lawyers to seek cash for potential health costs rather than treatment, as well as cash for legal and settlement fees, which insurance companies pay. Ultimately, these costs are passed on to policyholders.

The audit also found that other jurisdictions have treatment protocols that provide a more structured, care-based way to treat injuries rather than the payment of cash. Ontario has Minor Injury Guidelines, but they have not been reviewed since 2014. The Auditor recommended that FSRA and the Ministry of Finance develop and implement up-to-date programs of care for injuries to standardize the treatment provided after an accident and the cost of such treatment, beyond just those of minor injuries. The Committee learned that the Ministry’s expected timeframe to consider this recommendation (among others) is two years.

The Committee asked why Ontario has not moved towards greater standardization of the care of accident victims, despite that fact that this change has been recommended in past reports. The Ministry responded that some reports recommended significant structural changes, and the Ministry looks at those things when considering changes to the auto insurance sector. However, the Ministry is also looking at when the timing may be right to make changes and how they can be successfully implemented. Ontario’s auto insurance system is complex and there are many competing interests within it.

The Committee also asked about the idea of moving to a more care-based model because the cash payment system may be contributing to higher costs. The Ministry said that it looks at things like incentives and disincentives within the system intently. In addition, as a broad policy objective, it is important that people receive adequate care quickly and effectively. However, this goal also needs to be balanced against making sure that people have recourse if they do not, and that is where access to the tort (i.e., civil lawsuit) system is important. From a policy perspective, the Ministry is always working to balance competing objectives.

Committee Recommendations

The Standing Committee on Public Accounts recommends that:

- The Ministry of Finance and the Financial Services Regulatory Authority consider moving to more standardized programs of care for the treatment of auto accident injuries as has been done in some other jurisdictions, while not precluding the ability of health care providers to apply their professional judgement and expertise in treatment.

- The Financial Services Regulatory Authority require insurers to confirm that their claims adjusters have sufficient knowledge of physical and psychological impairments such that they can review claims fairly.

- The Financial Services Regulatory Authority require that insurers include a proper medical or other reason in a timely manner when they dispute a claim. When a denial does not include medical or other reasons and lacks a specific explanation of why a benefit is not reasonable and necessary, it reduces transparency for the insured, and can result in unnecessary disputes, delays, and access to care.

- The Financial Services Regulatory Authority consult with auto insurance stakeholders, health care providers, and insurers to update the Ontario Claims Form 18 (OCF 18) to ensure that insurers have sufficient and proper information to make informed decisions about the treatment required for a claimant’s recovery from auto accident injuries.

Recent Changes in the Auto Insurance Sector

The Committee also asked what changes have been put in place in recent years to help consumers. The Ministry said that it has made some changes that are intended to increase choice and convenience for consumers and enable them to better control their premiums.

For example, the government has made changes that increase consumer choice by making some aspects of auto insurance policies – such as not-at-fault property damage coverage – optional to purchase. These changes (which came into effect on January 1, 2024) allow people to choose whether paying for that coverage would be worthwhile for them.

The government has also worked to create greater opportunities for innovation through an auto insurance test and learn environment, sometimes known as a regulatory sandbox. In this type of environment, insurers can pilot products in the marketplace, which helps spur innovation and competition. A good example of this innovation is usage-based insurance, where people’s premiums are directly tied to where they drive, when they drive, and how they drive, to provide a fairer assessment and distribution of costs that is reflected in premiums.

The Ministry also highlighted FSRA’s Unfair or Deceptive Acts of Practices rule, which came into effect in the spring of 2022. The rule addresses some key stakeholder issues, including removing prohibitions against incentives, while also improving FSRA’s investigation and enforcement authority. The government has also been paying a lot of attention to oversight within the system in respect of fraud and abuse. The recent changes to the Insurance Act, which require insurers to provide fraud information to FSRA on an ongoing basis, are foundational in that regard.

The Committee also heard about FSRA’s recent report, which identified systemic non-compliance with the “Take-All-Comers” rule by 12 major insurers. Under the Take-All-Comers rule, an approved insurer must offer to insure a qualifying customer. For various reasons, some inadvertent, consumers were not getting the quotes that were available to them and, for consumers to get the lowest rate, they must get those quotes. FSRA was able to identify this issue and the insurers involved. Those insurance companies have now remediated the issue.

FSRA’s Regulatory Powers in Auto Insurance

The Committee also asked whether FSRA has all the tools it needs to ensure that Ontario drivers have access to affordable and quality insurance. FSRA said that it has very constructive dialogue with government. The fraud reporting changes (enabled by a legislative change to the Insurance Act) are one example, and the changes will provide FSRA with real information about fraud. FSRA has also been given whistle-blower powers, which will help with things like non-compliance with the Take-All-Comers rule.

In addition, FSRA is being given powers to allow more choice in the marketplace to try to bring the cost of insurance down. FSRA expects its constructive dialogue with the Ministry will continue and allow them to work with the Ministry to get the powers FSRA needs.

Accident Benefit Appeals

The Licence Appeal Tribunal (LAT) hears and decides disputes over accident benefits insurance claims between insured individuals and their insurer. The audit found that although FSRA receives data on disputes that go through the LAT, FSRA does little with the data it receives to better understand the types of cases before the tribunal or if regulatory changes or other actions would reduce the number of hearings.

The Committee heard that FSRA has reviewed its practices on the use of information it receives from the LAT to enhance conduct regulation. FSRA also plans to engage with Tribunals Ontario (of which the LAT is a part) to update its information-sharing agreement.

The Committee asked about the Auditor’s finding that one major insurance company had a disproportionately large number of applications and appeals at the LAT and whether FSRA had any concerns about this situation.

FSRA responded that it is not directly involved in the work of the LAT. However, because FSRA is a conduct regulator, the LAT is an important source of information. FSRA tries to identify trends from the data it receives that could indicate that an insurer is not honouring its obligations to such an extent that it rises to a conduct issue (and thus an issue for FSRA as the regulator), rather than a contractual dispute between an insured and their insurer. FSRA also said that the LAT information has not been a great source, to date, on identifying those conduct trends, but FSRA will continue to monitor it.

Committee Recommendation

The Standing Committee on Public Accounts recommends that:

- The Financial Services Regulatory Authority expand its analysis of the data it receives from the Licence Appeal Tribunal (LAT) to better understand the types of cases going to the LAT, why some insurers have a higher proportion of cases before the LAT than others, and identify trends and practices by industry and consumers that lead to an increased number of disputes.

Auto Theft

The Committee heard that, in addition to being inconvenient and costly to the victims, auto theft results in higher insurance rates. FSRA has been in discussions with insurers and has approved some measures, such as incentives and surcharges, to help address auto theft. In terms of incentives, there are some simple devices, such as mechanisms that disable a steering wheel, that can prevent theft. Some insurers are asking consumers to use them, and some insurers are willing to fund their cost. These protective elements can bring down cost in the system because there will be less theft.

FSRA has also approved some surcharges that can be imposed on policy renewal for consumers who choose not to implement protective elements, because a lack of protective elements creates more cost for the system. FSRA always looks for ways to take costs out of the system and one way to do that is to mitigate risk.

The Ministry also noted that there have been significant new partnerships and funding to enable the Ontario Provincial Police and other police forces to more directly allocate resources to curb auto theft across the province.

Committee Recommendation

The Standing Committee on Public Accounts recommends that:

- The Financial Services Regulatory Authority report back to the Committee on any changes that it would recommend to decrease auto theft in Ontario and the upward pressure auto theft puts on auto insurance premiums.

Credit Union Governance

The audit found that FSRA’s credit union inspections have not been thorough. For example, in some cases FSRA did not collect sufficient information to evaluate credit union governance. FSRA told the Committee that it has made strides in collecting data and assessing key governance and risk management processes at credit unions. It has also implemented the Sound Business and Financial Practices rule, which underlines the importance of good governance and risk management.

The Committee asked why it takes a long time for a new credit union to be approved and whether FSRA has identified this as an issue. FSRA responded that it recently approved the first new credit union in a long time, and that FSRA’s understanding was that the credit union involved did not think that the process took too long and that they thought the process was reasonable.

The Committee also asked what is happening at FSRA to support religious-based banking alternatives for the Muslim community. FSRA said that it is supportive of community-based, bonds-of-affinity credit unions, including those that are based on religious affiliation. FSRA also noted that the last credit union it approved was a religious-based one.

Multi-Employer Pension Plans

Multi-Employer Pension Plans (MEPPs) are a common type of pension plan for tradespeople. They represent only about 4% of defined benefit (DB) plans but about 25% of all pension plan members. MEPPs function differently than most DB plans: if investment gains are not enough to pay members their full, targeted benefit, the benefits paid can be reduced. However, the audit found that current required disclosures to MEPP members do not clearly make them aware of this fact.

The audit also noted that between 2014 and 2019, there were 55 instances of benefit reductions across approximately 25 MEPPs. Between 2019 and 2023, FSRA estimates that there were 15 benefit reductions across nine MEPPs.

The Committee heard that in 2021, FSRA completed a review of MEPP governance and then issued a leading practice guideline that addresses member communications on benefit variability. FSRA said that MEPPs have generally embraced these leading practices. FSRA is now assessing MEPPs against the guideline and expects to have this work completed this fiscal year.

The Committee asked whether the best practice document is enforceable. FSRA said that as the supervisor of pension plans, it does have the ability to hold fiduciaries in pension plans to account. FSRA put these guidelines in place so that it can identify where fiduciaries are not living up to the standards of protecting their members and communicating about the risk to their benefits.

FSRA also explained that MEPPs are a way for employers to come together and offer benefits in the unionized trade environment where tradespeople may work for a number of different employers, or on a number of different contracts, throughout their careers. MEPPs provide some income security for tradespeople by allowing them to save through a fiduciary bound plan with professional expertise.

Consolidated List of Committee Recommendations

The Standing Committee on Public Accounts recommends that:

- The Financial Services Regulatory Authority report back to the Committee once it has completed its strategy for reforming the regulation of auto insurance rates and underwriting rules.

- The Financial Services Regulatory Authority publicly disclose what conflict in the courts costs the system.

- The Financial Services Regulatory Authority require insurance companies to provide more transparency in their data, such as providing a detailed public rationale for all rate changes listed by auto insurer and publicly disclosing the return on premium for each auto insurer on a yearly basis.

- The Financial Services Regulatory Authority resume onsite inspections of health service providers on a trial basis as planned, and if it decides not to continue onsite inspections after the trial period, share the reasons for not doing so with the Committee.

- The Financial Services Regulatory Authority review the Professional Services Guideline on a regular basis and approve rates in line with equivalent services for non-auto victims.

- The Ministry of Finance and the Financial Services Regulatory Authority consider moving to more standardized programs of care for the treatment of auto accident injuries as has been done in some other jurisdictions, while not precluding the ability of health care providers to apply their professional judgement and expertise in treatment.

- The Financial Services Regulatory Authority require insurers to confirm that their claims adjusters have sufficient knowledge of physical and psychological impairments such that they can review claims fairly.

- The Financial Services Regulatory Authority require that insurers include a proper medical or other reason in a timely manner when they dispute a claim. When a denial does not include medical or other reasons and lacks a specific explanation of why a benefit is not reasonable and necessary, it reduces transparency for the insured, and can result in unnecessary disputes, delays, and access to care.

- The Financial Services Regulatory Authority consult with auto insurance stakeholders, health care providers, and insurers to update the Ontario Claims Form 18 (OCF 18) to ensure that insurers have sufficient and proper information to make informed decisions about the treatment required for a claimant’s recovery from auto accident injuries.

- The Financial Services Regulatory Authority expand its analysis of the data it receives from the Licence Appeal Tribunal (LAT) to better understand the types of cases going to the LAT, why some insurers have a higher proportion of cases before the LAT than others, and identify trends and practices by industry and consumers that lead to an increased number of disputes.

- The Financial Services Regulatory Authority report back to the Committee on any changes that it would recommend to decrease auto theft in Ontario and the upward pressure auto theft puts on auto insurance premiums.

Appendix A – Response from the Financial Services Regulatory Authority Dated November 2, 2023

25 Sheppard Avenue West, 25, avenue Sheppard Ouest

Suite 100 Bureau 100

Toronto, ON Toronto (Ontario)

M2N 6S6 M2N 6S6

Telephone: 416 250 7250 Téléphone : 416 250 7250

Toll free: 1 800 668 0128 Sans frais : 1 800 668 0128

November 2, 2023

Tom Rakocevic Room 207

North Wing, Main Legislative Building, Queen's Park Toronto, ON M7A 1A8

Dear Mr. Rakocevic:

On behalf of Mark White and FSRA, please let me thank you for your letter dated October 5, 2023. We are pleased to provide you with FSRA's comprehensive responses pertaining to your questions on Multi-employer Pensions Plan (MEPP) and auto insurance rebates.

Multi-employer Pensions Plan (MEPP)

Questions:

· The number of instances of Multi-employer Pensions Plan (MEPP) member benefit reductions between 2019 and 2023.

FSRA response:

As mentioned in the OAGO report, FSRA conducted a study in 2019 in order to arrive at the conclusion that there were 55 benefit reduction amendments across approximately 25 MEPPs between 2014 and 2019. Based on a review of registered amendments between 2019 and 2023, we estimate that the number of benefit reduction amendments to be 15 benefit reductions across 9 Defined Benefit MEPPs.

Auto Insurance Rebates

Questions:

· Where the $1.8 billion figure comes from (e.g., by breaking down the amounts going into the $1.8 billion)?

FSRA response:

FSRA evaluated consumer relief based on General Insurance Statistical Agency (GISA) data. As of September 2022, the cumulative consumer relief reached $1.8 billion.

While the total relief amount cannot be segregated by types of relief as this information is not provided in the GISA database, it may be broken down by time period and by various insurer groups in terms of market share.

Ø Relief amount by time periods

2020 | 2021 | 2022 | |||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 |

Relief by Calendar Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

45 | 484 | 51 | 32 | 182 | 295 | 183 | 88 | 88 | 247 | 123 | |

Relief by Calendar Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 611 |

|

| 748 |

|

| 458 |

| |||

Cumulative Relief Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 1,818 |

|

|

|

|

| |

* The above relief figures are expressed in millions of dollars.

Ø Relief amount by insurer groups

o The 3 largest insurance groups, which collectively represent 46% of the market share, contributed $835 million in relief, constituting 46% of the overall relief amount.

o The 10 largest insurance groups, which collectively represent 92% of the market share, contributed $1.74 billion in relief, constituting 96% of the overall relief amount.

Questions:

· How rebates were provided (e.g., rate reductions, cash rebates etc.)?

FSRA response:

Auto insurance companies extended relief to consumers primarily through rate reductions and premium rebates during the pandemic. Insurers delivered premium rebates via either cheque issuance or email money transfers.

Questions:

· How many drivers benefited from rate reductions?

FSRA response:

In July 2020, FSRA conducted a survey, indicating that relief was beneficial to 6.1 million policies, covering approximately 93% of all Ontario auto insurance policies. This information represents a snapshot in time and is based on data collected from auto insurers in July 2020 through a survey. You can find further details related to the survey results on the FSRA website, and a link to the relevant webpage is provided for your reference.

If you have any questions, please do not hesitate to contact me (Chandra.Wijaya@fsrao.ca) or Stephen Power (Stephen.Power@fsrao.ca).

Sincerely,

Chandra Wijaya

Chief Risk Officer

Encl.

cc: Mark White, Chief Executive officer, Financial Services Regulatory Authority of Ontario

Greg Orencsak, Deputy Minister, Ministry of Finance

Nancy Mudrinic, Associate Deputy Minister, Office of Regulatory Policy and Agency Relations, Ministry of Finance

Stephen Power, Executive Vice President, Corporate Services, Financial Services Regulatory Authority of Ontario

Appendix B – Response from the Financial Services Regulatory Authority Dated November 4, 2023

25 Sheppard Avenue West, 25, avenue Sheppard Ouest

Suite 100 Bureau 100

Toronto, ON Toronto (Ontario)

M2N 6S6 M2N 6S6

Telephone: 416 250 7250 Téléphone : 416 250 7250

Toll free: 1 800 668 0128 Sans frais : 1 800 668 0128

November 4, 2024

Tom Rakocevic

Room 207

North Wing, Main Legislative Building, Queen's Park

Toronto, ON M7A 1A8

Dear Mr. Rakocevic:

On behalf of Stephen Power and FSRA, please let me thank you for your letter dated October 22, 2024. In the letter, the Committee requested that FSRA provide a breakdown and quantification of the type of consumer relief provided: (e.g., rate reductions, rebates, drivers changing their policy/coverage to lower premiums etc.) for those years by each insurer. We are providing you with FSRA's response below:

In April 2024, FSRA was able to provide the net COVID relief estimate by insurer and accident year by comparing average premiums before and during the pandemic for each company.

This data does not include additional information for FSRA to be able to provide a breakdown or quantification of the type of consumer relief provided (e.g., rate reductions, rebates, drivers changing their policy/coverage to lower premiums etc.) for those years by each insurer.

If you have any questions, please do not hesitate to contact me (Chandra.Wijaya@fsrao.ca) or Jane Albright (Jane.Albright@fsrao.ca).

Regards,

Chandra Wijaya

Head, Risk Management

Encl.

1

cc: Stephen Power, Interim Chief Executive officer, Financial Services Regulatory Authority of Ontario

Jane Albright, Interim Executive Vice President, Corporate Services, Financial Services Regulatory Authority of Ontario

Francisco Chinchon, Assistant Deputy Minister, Financial Service Policy Division, Ontario Ministry of Finance

Appendix C – Response from the Financial Services Regulatory Authority Dated April 8, 2024

25 Sheppard Avenue West, 25, avenue Sheppard Ouest

Suite 100 Bureau 100

Toronto, ON Toronto (Ontario)

M2N 6S6 M2N 6S6

Telephone: 416 250 7250 Téléphone : 416 250 7250

Toll free: 1 800 668 0128 Sans frais : 1 800 668 0128

April 8, 2024

Tom Rakocevic

Room 207

North Wing, Main Legislative Building, Queen's Park

Toronto, ON M7A 1A8

Dear Mr. Rakocevic:

On behalf of Mark White and FSRA, please let me thank you for your letter dated March 25, 2024. We are pleased to provide you with FSRA's comprehensive responses pertaining to your questions on consumer relief.

Question:

During the hearings, you (Mark) noted that $1.8 billion in consumer relief was provided during the pandemic and the Financial Services Regulatory Authority (FSRA) provided some additional information about that relief in the letter of November 2, 2023. The Committee has requested the following information about the consumer relief:

· Can FSRA provide, by insurer, a detailed breakdown of the rebates and savings thatwere provided between 2020 and 2022 and what amount of those rebates and savings were the result of people just changing their coverage levels?

FSRA response:

Yes, we can provide a more detailed breakdown of the net COVID relief estimate by insurer. Due to limitations in the available data, however, we are not able to provide a further breakdown by type of relief measure or quantify the impact of premium reductions due to changes in coverages, specifically.

To provide a more detailed, insurer-level breakdown of net COVID relief as requested, we compared average premiums before and during the pandemic for each company. The estimates include rate reductions, rebates, risk re-rating, premium deferrals, changes in premium capping, and any policy changes or changes in mix of business during the pandemic. The estimates also include any rate changes approved leading up

to the pandemic that became effective during the pandemic. The source of the data was General Insurance Statistical Agency (GISA).

FSRA has published approved rate changes and relief measures for all insurers on its web site.

Auto Rate Approvals (fsrao.ca)

Net change in average premiums before and during the pandemic years

Insurer Group ($ millions) | 2020 | 2021 | 2022 | Amount* |

Intact Financial Group | 82 | 190 | 79 | 351 |

Desjardins General Insurance Group | 135 | 77 | 126 | 338 |

Aviva Canada | 53 | 91 | 2 | 145 |

TD Insurance | 17 | (53) | (122) | (158) |

Allstate Canada | 81 | 109 | 67 | 257 |

Co-operators General Insurance Company | 30 | 45 | 59 | 134 |

Definity Financial Corporation | 48 | 45 | 10 | 103 |

CAA Insurance | 105 | 155 | 166 | 426 |

Travelers Canada | 18 | 13 | 5 | 36 |

Wawanesa Insurance | 16 | 44 | 46 | 107 |

Northbridge Insurance | (4) | (5) | (3) | (12) |

GORE Mutual | 7 | (3) | (7) | (3) |

OMIA | 8 | 12 | 9 | 29 |

SGI | (7) | 1 | 0 | (5) |

The Commonwell Mutual | 2 | 3 | 4 | 9 |

Unica | (2) | 2 | 0 | (1) |

Chubb | (1) | (2) | (3) | (6) |

Heartland Farm Mutual Inc. | 1 | 0 | 1 | 1 |

Peel Mutual | 0 | 1 | 1 | 2 |

Portage la Prairie Mutual | 1 | 1 | 0 | 2 |

Optimum Insurance | 1 | 1 | 1 | 2 |

Total | 591 | 727 | 441 | 1,757 |

* To provide a breakdown at the insurer level as requested, a more detailed methodology was used resulting in a total net relief of $1.76B.

Negative figures in the table indicate that the average premium of the insurer increased during the pandemic despite COVID relief measures. This may be due to rate increases that were approved prior to the pandemic and effective during the pandemic, as well as policy changes or changes in mix of business, all of which would impact average premiums.

Question:

· The Committee would also like to know whether FSRA publishes the average rate of return on premium for auto insurers on a yearly basis.

FSRA response:

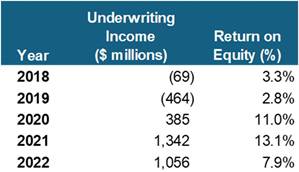

FSRA does not publish this information. However, the information regarding rate of return is published by GISA on their web site (see attached report). This report offers financial metrics for Ontario Auto Insurance for each of the last five years, including underwriting return, investment return, and return on equity. According to GISA, here is a summary of underwriting income and return on equity for 2018-2022. Data for the full year of 2023 has not been published. As of the first nine months of 2023, the industry showed a material deterioration in profitability compared to 2022.

If you have any questions, please do not hesitate to contact me (Chandra.Wijaya@fsrao.ca) or Stephen Power (Stephen.Power@fsrao.ca).

Sincerely,

Chandra Wijaya

Head, Risk Management

Encl.

cc: Mark White, Chief Executive officer, Financial Services Regulatory Authority of Ontario

Stephen Power, Executive Vice President, Corporate Services, Financial Services Regulatory Authority of Ontario

Greg Orencsak, Deputy Minister, Ministry of Finance

Francisco Chinchon, Assistant Deputy Minister, Financial Services Policy Division, Office of Regulatory Policy and Agency Relations, Ministry of Finance

Nancy Mudrinic, Associate Deputy Minister, Office of Regulatory Policy and Agency Relations, Ministry of Finance