STANDING COMMITTEE ON FINANCE AND ECONOMIC AFFAIRS

SIXTH INTERIM REPORT: ECONOMIC IMPACT OF COVID-19 ON SMALL AND MEDIUM ENTERPRISES

1st Session, 42nd Parliament

69 Elizabeth II

![ISBN 978-1-4868-4775-4 (Print)

ISBN 978-1-4868-4777-8 [English] (PDF)

ISBN 978-1-4868-4779-2 [French] (PDF)

ISBN 978-1-4868-4776-1 [English] (HTML)

ISBN 978-1-4868-4778-5 [French] (HTML)](/sites/olamain.dev.dd/files/committee/report/images/42_1_FE_SixthInterim_10082020_en%20HTML_files/image001.png) |

The Honourable Ted Arnott, MPP

Speaker of the Legislative Assembly

Sir,

Your Standing Committee on Finance and Economic Affairs has the honour to present its Report and commends it to the House.

Amarjot Sandhu, MPP

Chair of the Committee

Queen's Park

October 2020

STANDING COMMITTEE ON FINANCE AND ECONOMIC AFFAIRS

MEMBERSHIP LIST

1st Session, 42nd Parliament

AMARJOT SANDHU

Chair

JEREMY ROBERTS

Vice-Chair

IAN ARTHUR DAVID PICCINI

STAN CHO MIKE SCHREINER

Willowdale

STEPHEN CRAWFORD SANDY SHAW

MITZIE HUNTER DONNA SKELLY*

SOL MAMAKWA DAVE SMITH

Peterborough—Kawartha

NON-VOTING MEMBERS

STEPHEN BLAIS LAURA MAE LINDO

CATHERINE FIFE KALEED RASHEED

RANDY HILLIER JOHN VANTHOF

ANDREA KHANJIN

*DONNA SKELLY was replaced by LOGAN KANAPATHI on September 14, 2020.

MICHAEL COTEAU regularly served as a substitute member of the Committee.

JULIA DOUGLAS

Clerk of the Committee

SANDRA LOPES, LAURA ANTHONY and SUDE BELTAN

Research Officers

Contents

Impact of the COVID-19 Shutdown 3

Communication and Coordination 10

Regulatory Burden Reduction 14

Sector-Specific Recommendations 15

Strengthen Supply Chains and Support Business Growth 20

Support Start-ups and Promote Innovation 23

Appendix A: Terms of Reference*

Appendix B: Dissenting Opinion of the Liberal Party Members of the Committee

Appendix C: Dissenting Opinion of the Green Party Member of the Committee

Introduction

The Standing Committee on Finance and Economic Affairs is pleased to present its sixth interim report on the Economic and Fiscal Update Act, 2020, and the impact of the COVID-19 crisis on the Ontario economy.

The report presents the Committee’s findings and recommendations following its study of the impact of the COVID-19 pandemic on small and medium enterprises. It reflects the testimony of more than 200 witnesses who appeared online during public hearings on August 17, 18, 19, 20, 21, 24, 26, 27 and 28, and written submissions delivered to the Committee Clerk as of 6:00 pm on August 28, 2020.[1]

The Committee heard from organizations and business owners across the province who shared stories about the financial and personal costs of the COVID-19 “shutdown,” who quickly adapted their business models, and who are frustrated over continued uncertainty as they navigate the new normal. Through all of this, it was clear that Ontario’s small and medium enterprises are resilient and that with improved supports, they will continue to be a key driver of our shared prosperity. The Committee is grateful to those who took the time to share their views and personal stories.

This report provides an overview of the main issues raised and recommendations made during the Committee’s public hearings. For details of witness submissions, and their responses to questions from Committee Members, readers are referred to the official record of proceedings as reported in Hansard, and to the written submissions themselves.

Committee recommendations and a list of witnesses appear at the end of the report.

Committee Mandate

Motions adopted unanimously by the House on March 25 and May 12, 2020, established a two-part mandate for the Committee.

When the House passed Bill 188, the Economic and Fiscal Update Act, 2020, on March 25, 2020, it also adopted a motion providing that party leaders and independent Members may file letters with the Speaker, setting out their recommendations for economic and fiscal measures that should be included in the Bill. The motion further provided that when committees of the Legislature resume, the Standing Committee on Finance and Economic Affairs would be authorized to consider the Act, together with the letters filed by the leaders and independent Members, and that the Minister of Finance would be the Committee’s first witness when it commenced its review.

The motion passed on May 12, 2020, authorizing the Committee to begin consideration of the matters that had been referred to it on March 25. In addition, it empowered the Committee to study the impact of the COVID-19 crisis on specific sectors of the provincial economy, including “measures which will contribute to their recovery.” The sectors identified in the motion are:

· tourism;

· culture and heritage;

· municipalities, construction and building;

· infrastructure;

· small and medium enterprises; and

· other economic sectors selected by the Committee.

The Committee is specifically authorized to release interim reports, as it sees fit. Interim reports are to be presented to the House, and a copy of each report is to be provided to the Chair of Cabinet’s Ontario Jobs and Economic Recovery Committee. Interim reports will not be placed on the Orders and Notices paper for further consideration by the House, and the Government will not be required to table a comprehensive response to them.

A final report will be tabled, and a copy delivered to the Chair of the above-noted Cabinet committee, by October 8, 2020.

Appendix A to this report reproduces the Committee’s mandate in full.

Ministry Update

The Honourable Victor Fedeli, Minister of Economic Development, Job Creation and Trade, and the Honourable Prabmeet Singh Sarkaria, Associate Minister of Small Business and Red Tape Reduction, presented to the Committee on August 17, 2020.

The Minister of Economic Development, Job Creation and Trade thanked Ontario businesses for helping front-line workers and vulnerable individuals in Ontario. With support from the $50-million Ontario Together Fund, the Minister explained that businesses have quickly pivoted to manufacture the supplies and equipment needed in hospitals, long-term care homes and other critical public services. The Minister summarized:

Ontario’s businesses will continue to play an important role in our economic recovery, and it’s our job to provide the right kind of support so that businesses can remain competitive.

Noting that each sector faces a unique blend of challenges and opportunities, the Minister highlighted the importance of supporting manufacturing and the information and communications technology sector.

In 2019, manufacturing accounted for 700,000 jobs in Ontario, or 12% of GDP. However, there was a 29% decline in total monthly manufacturing GDP from February to April 2020. One way in which the Province hopes to restore consumer confidence is through its support of the Ontario Made program administered by Canadian Manufacturers & Exporters. Ontario Made aims to help consumers use their purchasing power to directly support homegrown manufacturers. The creation of a new agency, Invest Ontario, will also promote the province as an attractive investment destination.

The information and communications technology sector accounted for 323,000 jobs in 2019, approximately 6% of the province’s GDP. Despite the sector’s importance in an increasingly virtual world, the Minister explained that companies are having difficulty getting the funding they need to be competitive. The Intellectual Property Action Plan will help start-ups, entrepreneurs, and researchers better protect and bring their ideas to market.

The Associate Minister of Small Business and Red Tape Reduction explained that organizations with fewer than 100 employees have a significant impact on Ontario’s economy. These enterprises account for 98% of all businesses operating in the province, employ 2.4 million people, and produce 40% of the province’s GDP.

Explaining that the Ministry has consulted with the sector in 80 virtual roundtables, the Associate Minister identified three key issues facing small business: cash flow and liquidity, consumer confidence, and the continuation of government supports. The announced $10 billion in tax deferrals and relief, the Small and Medium-Sized Enterprise Loan program and the Canada Emergency Rent Assistance program were highlighted as initiatives that address these concerns. The Associate Minister expressed conviction that Ontario would eventually pull through the crisis:

We know that if we do work together and support each other through this, that we will truly come out of this even stronger as a province.

Impact of the COVID-19 Shutdown

The impact of the COVID-19 pandemic on Ontario’s small and medium enterprises (SMEs) has been widespread and devastating. Many witnesses stated that SMEs were “the least prepared for” and “the most affected by the pandemic.” When the initial shutdown occurred, business owners willingly closed their doors to do their part to help protect the health of fellow Ontarians. Once their region moved to Stage 2 and 3, some businesses remained closed or struggled to open with fewer customers. In some cases the closures have lasted more than 16 weeks and have meant completely forgoing revenue.

While we understand why we needed to shut down, we couldn’t have planned or prepared for this. Through no fault of their own, many have already closed their doors permanently or filed for bankruptcy. Thousands more now are on the verge of bankruptcy, including ourselves.

Collab Space and the Urban Centre

The Committee heard about the mental and emotional toll that small business owners have been experiencing due to the threat of losing their life’s work and fearing for their livelihood. Testimonies from hard-hit restaurants and arts and not-for-profit organizations depicted the devastating impact of the pandemic.

We were forced to lay off nine of our 11 employees… we are still sick over losing the people who were the core of our business. … Those first few weeks are a blur of decision fatigue, guilt over losing our team, and just the uncertainty of everything.

Dispatch

The Committee heard from witnesses who were able to open, but who stressed that just because they reopened did not mean that they were profitable, even in cases where sales appear to have increased. These sales often represented deferred income, not new sales, and certainly not enough to replace the income they had lost. Business owners described offering refunds while losing revenue in the form of membership fees and pre-bookings.

Most witnesses stated that the structural impact of the pandemic on SMEs has yet to take place. Witnesses from seasonal sectors (e.g., hospitality, festivals and special events) said that they anticipate more businesses to dissolve towards the end of the year because they missed their entire 2020 season and would not be able to make any significant revenue until June 2021. Similarly, in the restaurant sector, more closures are expected to take place as government support programs are coming to an end while public health restrictions and work from home practices continue.

The Committee heard from many start-ups and organizations representing start-ups and innovation sectors which presented their unique perspectives on the pandemic. In some cases these organizations had yet to earn revenue, making them ineligible for some forms of government support. The Committee also received testimony from the Community Action Planning Group: Jane-Finch Community which explained that home-based micro enterprises are essential to the livelihood of many individuals living in underprivileged neighborhoods. The pandemic’s effects on the operations of such businesses have been particularly severe and owners require mental health services to deal with the stress of trying to pivot in this crisis.

The Committee heard that small businesses owned by women and members of racialized communities were being hit particularly hard by the pandemic.

Some 80% of our members identify as female, and on average, just 15% of Canadian small businesses are majority female-owned. About 20% of our members identify as members of a visible minority, which is also higher than the national average. Please take a look at us. We are the face of the pandemic’s “she-cession” in Ontario.

Beauty United/Sugar Moon Salon Inc.

A Canadian Council for Aboriginal Business survey found almost four of five respondents reported that their business revenue had decreased by 30% or more, and 53% said their business revenue decreased by 75% or more. Over a third are no longer generating sales.

Witnesses shared concerns over the ripple effects of a decimated entrepreneurial sector including, but not limited to, rising unemployment rates and homelessness, loss of tax revenue for government, and the hollowing of downtown cores and main streets. The Ottawa Board of Trade summarized the concern: “SMEs’ failure is everyone’s failure.”

According to a survey conducted by the Canadian Federation of Independent Business, 62% of small businesses in Ontario were fully open in late August, with only 38% operating at or above normal staffing and only 26% at or above normal revenues. While troubling, witnesses stated that with the right kind of government support and policies, SMEs have the resilience and agility to bounce back and seize the opportunities that this crisis presents. Witnesses stressed that one-size-fits-all solutions will not work for SMEs; instead, they need nuanced and tailored programs given their diversity.

Financial Assistance

Liquidity

Canada Emergency Business Account

Business owners expressed gratitude for programs being offered by various levels of government to defer costs and improve cash flow. In particular, business owners spoke favourably of the Canada Emergency Business Account (CEBA), which provides interest-free loans of up to $40,000 to eligible small businesses and not-for-profits. Repaying the loan before December 2022 results in loan forgiveness of 25%. CEBA is administered by more than 200 financial institutions.

A few businesses indicated that eligibility for CEBA is too narrowly defined and the application process is confusing, even after recent improvements.

We go to the bank and the bank tells us to contact the CRA; we go to the CRA and the CRA tells us to contact the bank. Literally, the bank has helped us apply for this loan that we still keep getting declined for.

Snuggles n Bubbles Baby Spa

Of more concern to witnesses, however, was the amount being offered and the length of the loan. Businesses explained that due to the ongoing nature of the crisis, they will need the deferrals to continue for several years.

Some business owners and their representatives said that deferrals and loans are insufficient because some enterprises will never recoup lost revenues. These witnesses asked that a greater portion of the loan be forgivable or that the government introduce other business-focused grants. A few indicated that these grants could be industry-specific, while others suggested that they could be targeted at growth-oriented sectors.

Witnesses also reminded the Committee that female, Indigenous, Black and minority-owned businesses face unique barriers to accessing capital, and suggested that grants targeting these groups could pay larger economic and social dividends.

What I would say during this pandemic is that with most of the ACB [African, Caribbean and Black] community, they’re the ones who are going to be at a huge loss, and have suffered substantially. We’re not getting the support like we’re supposed to get from any kind of government resource.

Aroma Salt Therapy & Beauty Spa

The Anishnawbe Business Professional Association explained that only a small percentage of First Nation businesses can access financing from traditional financial institutions, particularly in Northern Ontario.

We’d like the Ontario government to consider these granting or future funding programs as investment decisions to support Indigenous communities as we seek a path of reconciliation.

Anishnawbe Business Professional Association

Tax Relief

The Canada Revenue Agency allowed all businesses to defer GST/HST payments or remittances owing on or after March 27, 2020, and before July 2020. Many witnesses told the Committee that simply deferring HST payments is not a solution. Instead, the government should allow SMEs to keep the HST or provide a rebate in order to have more available liquidity.

Similarly, the Canadian Federation of Independent Business suggested the Workplace Safety and Insurance Board (WSIB) rebate continue until 2021 and that the Employer Health Tax threshold increase be made permanent.

Rent and Utilities

Canada Emergency Commercial Rent Assistance

Witnesses spoke at length about the Canada Emergency Commercial Rent Assistance (CECRA) program, which provides forgivable loans to landlords whose tenants have experienced at least a 70% decline in revenue. To be eligible, the landlord must not charge more than $50,000 in rent, and the tenant must not generate revenues in excess of $20 million annually. The loans cover up to 50% of rent, the tenant pays 25% and the landlord agrees to forgo the remaining 25%. The program initially offered assistance from April to June, but was extended to include July and August.

Although landlords are encouraged to apply, participation in the program is voluntary. The Committee heard that many landlords refuse to participate, either because they are unwilling or unable to forgo a portion of the rent, do not want the extra work of applying, do not want to be unfair to those tenants who may not qualify, or because they do not want to invite government involvement or scrutiny to their business. A few witnesses indicated that participation in the program was being used as leverage by some unscrupulous landlords to negotiate leases which are unfavorable to the tenant.

I cannot understand how it was ever in the best interest of any small business that the government handed over full control of our futures to our landlords.[…] I spent countless nights worrying about my family’s business while waiting to see if my three landlords would participate.

Cambridge Butterfly Conservatory

It was recommended that the program be revised to allow tenants to apply directly, and/or that the 25% landlord contribution no longer be required. If this option is not possible, it was requested that funding be reallocated to other rent relief programs for business.

A number of witnesses also asked that the threshold for revenue loss be reduced. They explained that start-ups and newer companies do not qualify because they cannot prove loss of income. Furthermore, some are unable to participate because their revenue decrease fell just short of the 70%. This was particularly frustrating, the Committee heard, when a business owner’s revenue loss was mitigated by successfully pivoting.

We hustled and pivoted… We delivered groceries. We sold via companies like Uber… I am most proud of the “Feed the Front Line” program that we launched … where people could buy meals for doctors and nurses in four Ottawa hospitals. It was so successful that Freshii head office in Toronto decided to roll out our initiative across North America. However, when the rent relief program was announced … all our efforts to pivot … bit us in the behind… [because] our sales had dropped by 60%.

Entrepreneur

Despite challenges identified with the program’s design, those in receipt of the CECRA described it as essential to the survival of their business. The Committee heard that the program should be extended, but one landlord cautioned that small landlords could not continue to forgo rent if that remains a requirement of the program.

Witnesses expressed gratitude that the Province had passed legislation temporarily halting or reversing evictions of commercial tenants. They asked that these provisions be extended alongside the CECRA program. The Better Way Alliance also asked that the Commercial Tenancies Act be updated to cap rent increases, provide stronger eviction protections and establish a dispute resolution mechanism.

[Extending the moratorium is] a solution that does not cost taxpayers money and helps level the playing field between landlords and small businesses. And I’m pleading out here: Please, we have about two weeks to go, and after 60 years of operation, it appears that my business may actually be closed down on me against my will.

Business owner

Utilities

While businesses appreciated the government’s efforts to date to reduce hydro rates, they urged further reforms. The recommendations included tax credits, removing the global adjustment charge, and continuing to offer off-peak electricity rates.

Wages and Severance

Business owners also provided their thoughts on the Canada Emergency Wage Subsidy (CEWS). The Committee heard that the wage subsidy allows employers to keep loyal employees on payroll, providing much-needed continuity and reducing future recruitment and training costs. For some, the wage subsidy is crucial to the survival of their business, as they currently do not have enough revenue to pay for staff that are essential to their operations.

While appreciative of the program, the Ontario Business Improvement Area Association explained that some small businesses take dividends instead of wages, and are not eligible for the program. Contractors would also not be able to benefit from the program.

A few witnesses said that the application process is overly complex and confusing for business owners. For example, one restaurant owner indicated that the definition of a taxable benefit for the purpose of the subsidy was confusing, while another business said the online spreadsheet did not accurately calculate their claim.

Witnesses asked that the CEWS be extended into 2021 or until pandemic-related restrictions were lifted. While this was a common request before the Committee, a number of witnesses made the case that the extension could be focused on seasonal industries (which are unlikely to make up revenue during the winter months) or those industries that were typically dependent on large gatherings, such as those involved in hosting weddings and corporate events.

Under the Employment Standards Act, an employee who is laid off for long periods may be considered permanently terminated and therefore eligible for termination or severance pay. Regulatory changes made to the Act temporarily stopped the clock on pandemic-related layoffs. These new provisions, however, are set to expire in September and witnesses asked that they be extended. They indicated that having to provide severance pay will immediately bankrupt some businesses.

We are seeking an exemption for the tourism industry as severance costs come mid-November are significantly more than businesses can bear. Many businesses are at great risk of bankruptcy.

Kingston Accommodation Partners

Expenses and Liabilities

Safety and Cleaning

The Committee learned that small businesses are struggling with the costs of protecting their employees and patrons, including the costs of procuring personal protective equipment (PPE), redesigning workplaces with physical barriers, and providing additional cleaning and sanitization services. For example, Iron Fitness Strength Club in Markham explained that its operating costs have increased by almost $4,500 a month due to the installation of multiple sanitizing stations and increased janitorial costs.

The Province provides a Workplace PPE Supplier Directory. One witness suggested that the government should also bulk order PPE to provide it to SMEs at a lower cost. It was further suggested Ontario offer a tax credit for cleaning and PPE supplies in 2020 and 2021.

Insurance

Many SMEs have business interruption coverage under their insurance plans. However, the Committee heard that pandemic-related closures were not eligible due to policy restrictions.

Challenges with insurance costs and claims have added to SMEs’ stress and fatigue while trying to keep their businesses operating. Witnesses said that businesses are seeing their premiums increase or losing coverage altogether. In addition, insurance companies have added new COVID-19 waivers to policies.

Witnesses called on the Province to pressure insurance companies to provide a payout for loss of sales due to the government-mandated shutdown. In the absence of being indemnified, many witnesses asked that insurance companies provide some relief in the form of rebates or credits for the large insurance premiums they contributed over the course of their policies. They also asked that premium increases be capped.

Noting that insurance concerns are not restricted to the private sector, the Ontario Nonprofit Network asked that the Province establish “good Samaritan” protection for non-profits that follow all emergency orders and public heath guidelines. They explained that some organizations have not reopened and some board members are resigning because of liability risks.

Bankruptcy Protections

Many small and medium businesses are in risk of declaring bankruptcy in the wake of COVID-19. Small business owners often have a personal guarantee on their business loans or commercial leases – meaning that if the business cannot pay its debt, the owner (or whoever signed the guarantee) assumes personal responsibility for the debt. As a result, small business owners are facing immense pressure:

My wife and I stand to lose everything we have worked for in the last 25 years. We will lose our house, and it will push us into personal bankruptcy. […] I obviously would have never signed a personal guarantee or even made the decision to try to continue to grow our business over the last year, if we had reasonably predicted what is probably going to be the largest financial crisis in the past 100 years.

Business Owner

Witnesses urged immediate action to alleviate personal emotional turmoil and ensure businesses avoid bankruptcy and permanent closures.

Witness Recommendations

· Federal Assistance Programs — work with the federal government to ensure that programs targeting small and medium-sized employers are easy to apply to, are extended for the duration of pandemic-related restrictions and/or until the economy recovers, and provide special relief for hard-hit industries and businesses. Specifically:

· Canada Emergency Business Account (CEBA) — increase loan amounts and provide more debt forgiveness.

· Canada Emergency Commercial Rent Assistance (CECRA) — lower the threshold for revenue loss and provide support directly to tenants.

· Canada Emergency Wage Subsidy (CEWS) — simplify the application process and extend the subsidy.

· Loans/Grants — provide industry-specific and community-focused grants and loans.

· Evictions — extend moratorium on commercial evictions.

· Utilities — continue to provide and enhance measures to reduce electricity rates.

· Severance — extend provisions that paused pandemic-related layoffs.

· Tax Relief — extend current tax relief measures and provide HST relief.

· Insurance — exercise provincial regulatory power to control insurance costs and require insurance companies to provide relief to SMEs.

· Personal guarantee — provide government protection for no-fault bankruptcies for small businesses for up to 18 months.

The New Normal

Communication and Coordination

The Committee frequently heard about the challenges associated with the new environment that SMEs and Ontarians are now operating within. As fundamental changes to the way Ontarians work and live continue, the small business ecosystems that previously existed are struggling.

The reality is that if people are working at home and that is going to be the future trend, then we will continue to see a diminished quantity of customers. Many other takeout operations, independently owned coffee shops, depanneurs, dry cleaners, florists, just to name a few examples, are all vulnerable in the same way. We rely on people being at work in the vicinity of our operations. The reality is, as a small business, we strategically choose our business locations where we see a potential need.

Business owner

To operate in this new reality, witnesses stressed the need for effective and timely communication between the government and businesses about any plans regarding future shutdowns, restrictions, and reopening strategies. Most witnesses said that they received very little information which made it difficult for them to plan and be prepared. Businesses also requested to be consulted and included in future planning stages.

We beseech you […] allow us a voice in the development of such re-opening plans. Lives depend on getting it right; so do livelihoods.

Stratford Festival

Businesses provided feedback about their experiences with government offices during reopening stages and highlighted major delays in processing requests/approvals that were necessary for their operations. Witnesses also pointed to the lack of coordination among government agencies. They hoped that such problems would not occur during a second wave.

[W]e’re [a dance studio in Stage 3] still waiting for a response on the guidelines that we submitted back in May. We still have not heard from the government to have those guidelines approved that we wrote for reopening dance studios safely, and we have over 550 studios that have signed those guidelines.

Business owner

Public Health Guidelines

Categorization of businesses

Many witnesses stated that the categorization of businesses as essential and non-essential during the first wave discriminated against small businesses and created inconsistencies in practice. Particularly, small retailers stated that it was unfair for them to accumulate debt with no possibility of making revenue while they watched big box retailers continue to sell nonessential items (such as clothing, shoes, and appliances) during the shutdown. Some businesses said they could not survive a second shutdown.

Allowing big-box stores to monopolize this pandemic and grow stronger over independent small business cannot be tolerated ever again. […] Things like curbside pickup for all retailers who can position themselves safely should be respected moving forward. Alternatively, if drastic measures are required, make certain to close all non-essential aisles in any store deemed essential.

Party Mart

Most witnesses stated that, in practice, certain public health guidelines resulted in inconsistencies, confusion, inefficiencies, and in some cases, misbranding of sectors as unsafe. Witnesses representing attractions, amusement and water parks, and racetracks said they were particularly disadvantaged. Attractions Ontario said the announcement from the government that not all parks would be able to open in stage 3 was a huge blow to the recovery prospects of their members, especially after they had made significant investments in their safety plans.

The province needs to understand that how it has handled this situation has substantially inappropriately branded this industry [waterparks] as unsafe, which in the current environment has damaged the industry’s reputation with consumers.

Bingemans

Special events, wedding, and entertainment businesses stressed that a 50-person cap on indoor gatherings was not economically feasible for their operations. Many witnesses requested flexibility to increase that number (up to 50% capacity) if they can provide physical distancing and other safety measures in their facilities.

Some businesses asked for regional variations and demanded a more nuanced approach to the application of public health guidelines. Others suggested that they should have a say over, or means to appeal, their classification.

While we were pleased to see bowling centres included as part of the reopening plan for Stage 3, the rigid 50 person per facility limit has meant there has been very little if any practical benefit. The small number of bowlers allowed to be in a centre at one time costs more to service than they can ever generate in revenue.

Rinx Entertainment Centre Inc. and

Playtime Bowl & Entertainment

For businesses that have operations in the United States, rapid testing is essential to avoid workforce disruptions, as voiced by Innovative Automation. The Coalition of Concerned Manufacturers and Businesses of Canada also stated that an orderly opening of the economy should include rapid illness and antibody testing to provide the industry with an accurate picture of the disease and outbreaks.

Consumer Confidence

Ontarians are hesitant to resume their regular activities and are forgoing some entirely. Many businesses explained that that while they understand these fears, they can, and do, operate following strict public health safety guidelines.

When they allowed for dine-in, I was so excited because I’m like, “Okay, the floodgates are going to open. We’re finally going to be able to get back to business.” And it didn’t happen. That’s when I went through a depression. […] How do we bring confidence back? You’re going to boost the economy when you bring the confidence back to the people that they’re safe and it’s okay to go out.

Simmering Kettle and Dosti Eats

The Committee heard from business owners who are working hard to build confidence among consumers so they feel comfortable entering their premises and using their services. Not surprisingly, consumer-based businesses were particularly concerned about their customers’ willingness to return to normal. They noted that the messaging the public receives can be confusing—the public is being asked to both stay home to protect each other from the virus but also to buy from local business.

One way the government could be more consistent is to mandate mask use in all public spaces. The Retail Council of Canada told the Committee that there are 32 different sets of rules about masks in Ontario, mandated by local health units, and urged a harmonization of mask policy throughout Ontario. Business owners noted that it reassures employees, removes the burden to request it from customers, and makes everyone more comfortable with the shopping experience.

Digital Infrastructure

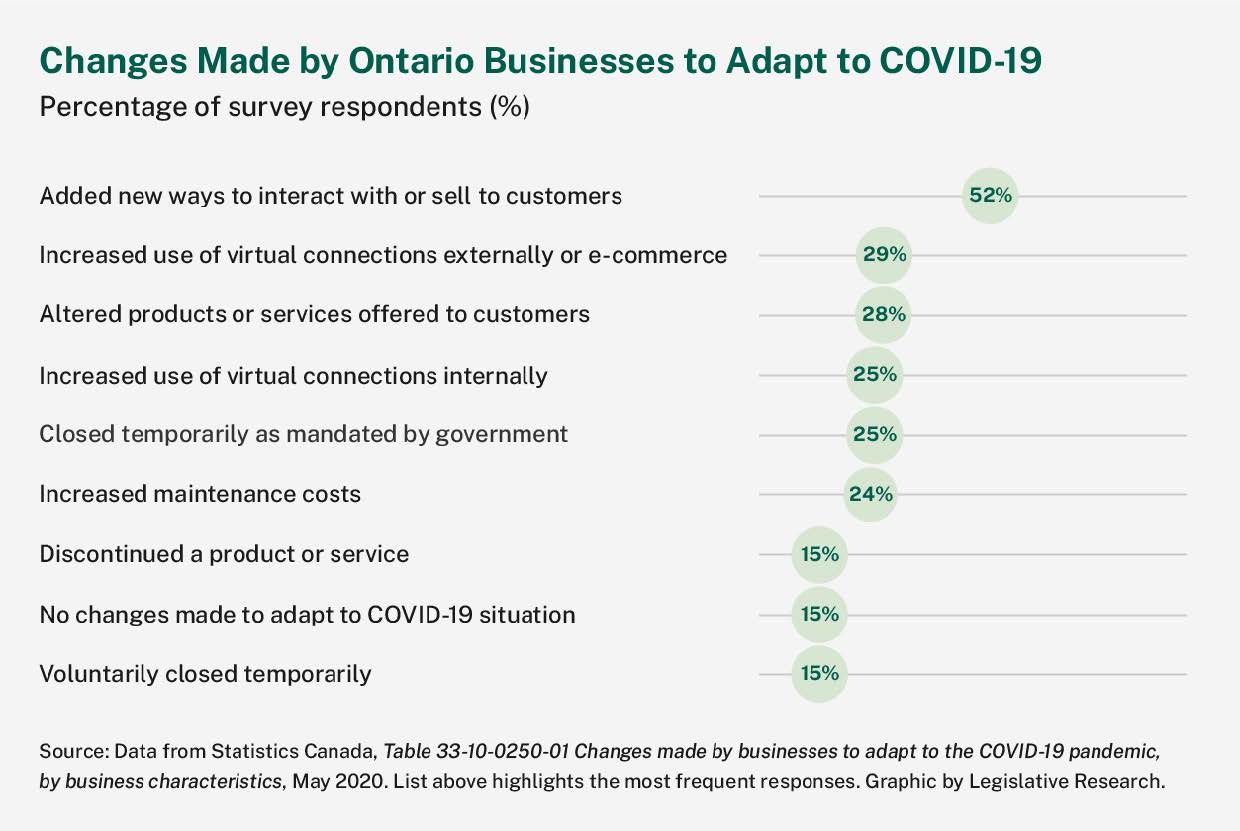

The Committee heard that SMEs were less prepared for the drastic shift to e-commerce than larger businesses. Prior to the pandemic, only 60% of Ontario small enterprises had a website and only 7% had an online payment solution.

The Digital Main Street program provides grants up to $2,500 to companies to adopt digital technology. Witnesses were appreciative of the program and urged its continuation in order to support small businesses. They recommended expanding the program beyond downtown business improvement areas and to organizations without a storefront.

However, as noted in previous sector meetings of this Committee, e-commerce and digital tools only work insofar as the broadband internet which supports it. Witnesses highlighted the importance of improving broadband access in rural and northern areas. The Anishnawbe Business Professional Association stated that unreliable broadband access makes it difficult for Indigenous entrepreneurs to grow their businesses. Witnesses from the agriculture industry noted that better broadband is needed for farmers to use precision agriculture, an advanced farming method that relies on satellite-technology, as well as to improve their e-commerce efforts.

One of the biggest and hardest hit are the rural communities, and moving forward on how they will make an e-commerce digital imprint is next to impossible due to the lack of infrastructure.

1000 Islands Gananoque Chamber of Commerce

Availability of Labour

The Committee heard from business owners who were making investments to keep their employees safe, but whose employees had nevertheless not returned to work when businesses began to reopen. Some business owners attributed this to the Canada Emergency Response Benefit (CERB), describing it as overly generous. Others argued workers were not returning because of low wages and a lack of paid sick days.

Witnesses explained that the lack of child care made it impossible for many parents—especially mothers—to return to work. When parents tried to juggle work and family responsibilities, it negatively impacted their productivity. The Ontario Chamber of Commerce and the Canadian Women’s Chamber of Commerce were among those noting the disproportionate impact the recession is having on women, urging the Province to consider child care as part of its economic recovery plan.

This is a “she-cession” even more so than a recession. Women have been disproportionately hit […] Most of the productivity gains that Canada has made in recent years have actually been because of increased participation on the part of women and underrepresented groups, and everything that can be done to encourage that is critical to a robust recovery.

Ontario Chamber of Commerce

When you look at women-identified business owners or entrepreneurs, the top three concerns or impacts that really stood out were a devastating loss of revenue through loss of contracts, loss of customers, loss of clients, as well as other associated events or other associated impacts such as payment delays and supply chain disruptions.

Canadian Women’s Chamber of Commerce

Regulatory Burden Reduction

Witnesses told the Committee that they appreciated the government’s recent efforts to reduce the regulatory burden for small businesses. However, witnesses stressed that further streamlining regulatory processes is both “revenue neutral” and essential to Ontario’s economic recovery.

Witnesses representing various sectors, including manufacturing, construction, and agriculture, stated that permitting processes were long, convoluted, and costly for small businesses.

Examples of regulatory burdens that business owners highlighted included:

· the high number of environmental approvals required to start a construction project in Ontario;

· duplicative requirements from federal and provincial governments;

· inefficient and complicated permitting processes for building and renovations; and,

· a lack of standardized permitting processes for fibre optic, and high costs for deploying broadband infrastructure in rural Ontario.

Witness Recommendations

· Communication and coordination — consult with businesses on second wave planning and provide consistent information in a timely manner.

· Standardized essential businesses — ensure small and medium-sized businesses are treated fairly by prohibiting large retailers from selling nonessential items or allowing for curbside pickup for all businesses.

· Clarify public health guidelines — introduce clear, nuanced standards and guidelines according to regional realities and sector/facility specifics, and provide consistent, effective, and timely feedback to businesses regarding their application.

· Consumer confidence — mandate mask use and clarify provincial messaging to encourage safe consumer behaviours.

· Regulatory burden — further reduce the regulatory burden on small and medium-sized businesses.

· Broadband technology — invest in broadband technology for better internet access in rural and remote communities.

· Digital Main Street Program — extend the program to small businesses without a storefront.

· Child Care — consider child care as part of future economic recovery plans.

Sector-Specific Recommendations

Witnesses also commented on pandemic-related issues affecting SMEs in specific industries: agriculture, alcohol and cannabis, arts and culture, charities and non-profits, construction and building, gaming, health, hospitality, infrastructure, and tourism.

Agriculture

The Ontario Federation of Agriculture told the Committee, “if there’s one thing that COVID-19 has highlighted, it’s the importance of a strong domestic supply chain for the agri-food industry.” They urged the Committee to continue to keep this a top priority.

Both the Beef Farmers of Ontario and Chicken Farmers of Ontario discussed pressure on the supply chain as they experienced reductions in processing capacity while processors adjusted to new health and safety guidelines. The Chicken Farmers of Ontario also explained there were some distribution challenges as demand decreased in out-of-home consumption and grew in retail grocery and e-commerce.

The Ontario Fruit and Vegetable Growers’ Association explained that farmers faced labour-related challenges this year, including outbreaks among workers.

Agriculture societies provide facilities and grounds for various community and business activities, meetings and fundraising events, and sports and recreation. The Ontario Association of Agriculture Societies determined that their membership is facing a revenue shortfall while the Canadian Association of Fairs and Exhibitions estimate that at least one in 10 Ontario fairs will shut down permanently without additional funding.

Witnesses from this industry had a number of recommendations including

· Reduce property taxes for value-added agriculture to encourage growth and diversification of Ontario’s agri-food products.

· Enhance the rural and urban (i.e., transportation and retail) side of the agri-food value chain.

· Develop a quarantine support program to address labour shortages excluded from crop insurance programs.

· Develop a beef processing infrastructure fund for projects at provincial abattoirs to increase processing capacity, combining no-interest loans, non-repayable loans, and cost-share funding.

· Work with the federal government to improve funding programs offered to producers through the Canadian Agricultural Partnership.

· Fund the $12.2 million shortfall for Ontario agriculture societies.

· Remove the requirement for organizations with revenue over $250,000 to have an auditor’s report to be eligible for Resilient Communities Fund.

Alcohol and Cannabis

While alcohol sales at the LCBO were robust, sales to restaurants and export markets, as well as revenues from events for weddings and corporate meetings, all but vanished. Cannabis sales benefited from curb-side pick-up but the industry was still emerging when the pandemic hit, and witnesses said it needs support to reach its potential.

The Committee heard from numerous businesses that explained that alcohol sales are essential to their survival. They recommended the Province

· continue to allow the sale of alcohol for delivery and takeout; and

· continue to support efforts to expand the use of patios as weather permits without an additional application or permitting fee.

Witnesses from the wine industry had a number of recommendations including:

· Extend additional support measures from the LCBO to at least the end of 2020.

· Implement a wholesale pricing structure and create specialty stores throughout the province.

· Eliminate the 6.1% wine tax

Witnesses from the craft beer industry recommended the following:

· Expand retail locations and lift restrictions on listings for craft beer.

· Allow craft beer brewers to open a retail store without an operating brewery on site.

· Eliminate the environmental levy on beer cans.

Cannabis-related recommendations included:

· Reinstate curbside e-commerce, pick-up and delivery for licensed cannabis retailers.

· Allow private retailers to buy directly from licensed cannabis producers rather than only from the Ontario Cannabis Store.

Arts and Culture

The arts and culture sector provides a significant contribution to the economy and to the wellbeing of Ontarians. However, months of canceled music events and theatre performances have grinded the sector to a standstill. The radio industry, which is the only source of news in many smaller communities, is struggling with lost revenues. The Committee received testimony that the sector needs funding to ensure its survival.

Witnesses had a number of recommendations including:

· Create a provincial wage subsidy or live arts labour credit for hiring professional contracted musicians and/or actors.

· Partner with municipalities to hire musicians to provide small-scale “cultural relief” events for the public.

· Invest in the Ontario Arts Council to provide viable virtual alternatives to live theatre performance, and provide support for the Ontario Cultural Attractions Fund to encourage outdoor festivals.

· Ensure that the Ontario Arts Council consults with rural municipalities to develop a funding model with eligibility for small rural art galleries.

· Create a donation matching program to incentivize private-sector donations.

· Create two radio advertising funds, $20 million each, with an additional required contribution from broadcasters. The funds would allow small businesses and tourism organizations to advertise their local goods and events.

Charities and Non-profits

The Committee heard from numerous charities and not-for-profit organizations which described the difficult circumstances they are facing while trying to serve the public. According to a report by the Ontario Nonprofit Network and the Assemblée de la Francophonie de l’Ontario, 59% of surveyed non-profits and charitable organizations reported a decrease in revenues, 40% experienced an increased demand for services, 30% had laid off staff, and 23% incurred an increase in costs (PPE and technology). One in five organizations are expecting to close in the next six months.

Charities and non-profits stressed they need funding to keep their doors open to deliver essential programing, especially supports to vulnerable populations such as those with chronic illnesses and conditions. The sector also needs support to reimagine how to deliver its programing for the next two to three years.

These organizations made several recommendations including those below:

· Provide $680 million in sector stabilization funding.

· Double the provincial portion of the Charitable Donation Tax Credit through to the end of 2021 and make the credit refundable.

· Match donations to provincial charities or national charities with provincial offices.

Construction and Building

The Committee heard from the construction sector during hearings leading to its fourth interim report on municipalities, construction and the building industry. However a number of witnesses reminded the Committee of the impact that COVID-19 has had on small and medium-sized business operating in this sector, and the importance of attracting people to skilled trade professions and removing barriers to practice.

Projects underway when the pandemic first began experienced delays, and many continue to proceed more slowly due to supply chain issues, permitting delays and social distancing requirements.

Witnesses from this industry had a number of recommendations including those below:

· Exempt contractors and subcontractors from liability for pandemic-related delays.

· Establish a relief provision that allows banks and bonding companies to financially support contractors while they deal with contractual and payment delays.

· Create a home renovation tax credit.

· Create a home and building retrofit program focused on improvements to indoor air quality and on reducing energy costs.

· Provide grants or tax incentives for small businesses to take on apprentices.

Gaming

The gaming industry was identified by witnesses as needing help to pull through the cash flow and business development challenges triggered by the pandemic, and exacerbated by the still-emerging nature of the industry. Witnesses pointed to Quebec’s tax framework which has allowed the industry to grow more rapidly than it has in this province.

To increase competitiveness, several recommendations were made including the following:

· Improve the Ontario Interactive Digital Media Tax Credit by, for example, implementing a service standard, redefining eligible labour activities, and allowing for more collaboration between Ontario companies.

· Allocate a higher proportion of tax credits for the cultural and media sector to gaming.

· Allow the establishment of video gaming terminals in licenced restaurants, bars and service clubs.

Health

The Association of Optometrists of Ontario and the Ontario Pharmacists Association made presentations reminding the Committee that their membership includes many small business owners who are themselves struggling with the increased costs of PPE. Both associations suggested that government could use their services to divert patient care away from emergency rooms, allowing hospitals to focus on COVID-19 efforts.

To recoup PPE costs and address other cost pressures, optometrists recommended increasing eye exam fees whereas pharmacists recommended increasing the per flu shot subsidy.

Hospitality

The hospitality industry is affected by many of the challenges already noted in this report: rent, wages, additional costs, and depleted revenues. A common request from restaurant owners was that the Province continue to allow them to deliver alcohol alongside food. They also asked that the Province allow them to buy alcohol at a lower price.

Restaurants Canada asked that the government reduce credit card interchange fees, and slow down the implementation of the requirement that takeout containers be made from 100% EPR. The Kit Kat Restaurant Group asked that Ontario mandate lower fees for food delivery services such as Uber, following in the footsteps of other jurisdictions like the New York.

Infrastructure

Witnesses reminded the Committee of the importance that investments in public infrastructure can have on Ontario’s economic recovery. These projects could include traditional stimulus investments in roads, bridges and transit that revitalize communities and connect cities, as well as broadband and cellular infrastructure needed in northern and rural areas.

Witnesses also commented that infrastructure investments should help the most vulnerable and strengthen cultural communities. The Ontario Non-Profit Housing Association, for example, suggested elevating community housing as part of essential infrastructure for Ontario’s economic recovery. The Toronto Symphony Orchestra suggested renovating cultural facilities to help them meet social distancing requirements, and equipping them for digital content capture.

Tourism

While tourism was the focus of this Committee’s second interim report, many small and medium-sized enterprises in this industry shared their concerns during this round of hearings. They provided more detail on the continuing impact of the pandemic on their sector, explaining that they are among the hardest hit and that they will be among the last to recover. They asked again that the Province consider the long-term trajectory of their sector’s recovery when designing supports, develop tax credits to encourage travel within Ontario, and continue to invest in marketing to support small tourism-related businesses. Referring to the industry as the “single-biggest employer of young people under the age of 30,” witnesses shared their concerns for youth employment in the province.

Northern and rural areas are particularly reliant on the tourism industry, and representatives of these regions asked that the Committee consider this fact as it develops its recommendations. The Tourism Industry Association of Ontario also highlighted the devastating impacts on Indigenous-owned SMEs in the industry.

Indigenous tourism in Ontario was the fastest-growing segment of our industry in the last few years. It is one of our key draws for international visitors. The fact that our borders are closed to international visitors and that there are still quarantine measures in place certainly has had a huge impact, and unfortunately, Indigenous businesses are suffering the brunt of that. They are closing. They are not able to open.

Tourism Industry Association of Ontario

Looking Forward

Strengthen Supply Chains and Support Business Growth

The pandemic exposed weaknesses in Ontario’s supply chains across many industries. Witnesses asked that manufacturing within the province be encouraged to strengthen the supply chains of essential goods and services.

I think the disruption to supply chains really brought into focus the idea that we need a flexible and resilient manufacturing sector, because that will often supply the upstream or the downstream products that make the products that can be assembled or sold in our local shops or provided by local service providers.

Wellmaster Pipe and Supply Inc.

As VentureLAB explained, the production of foundational pieces of technologies, such as those embedded in medical devices and contactless solutions, are currently manufactured outside the province. By bringing the engineering and manufacturing of these technologies to Ontario, we can stabilize the supply chain of products and services that keep schools, homes and communities safe. Reshoring these and other high-value electronics can also create opportunities for SMEs along the supply chain and increase the demand for skilled workers. Canadian Manufacturers & Exporters further explained that leveraging Ontario’s resources will have an impact on the upstream and downstream supply chain.

Manufacturers develop the technologies, machinery and equipment, and infrastructure needed for resource extraction. As resource extraction expands so too does demand for manufactured products. And, in turn, manufacturers use many of the resources in the production of their goods by turning raw materials into value-added products. In other words, a reliable and stable supply of natural resources is critical for manufacturing growth.

Canadian Manufacturers & Exporters

Witnesses asked that the Province continue to encourage consumers to buy locally, and to create the conditions where companies can purchase services from one another. However, they cautioned Ontario’s market is small and could benefit from increased interprovincial trade. Different standards and regulations impede the movement of goods and services. The Ontario Chamber of Commerce stressed the urgency of prioritizing interprovincial free trade given the rise of protectionist policies around the world. Despite the current challenges, such trade was described by many witnesses as a stepping stone to international markets. Witnesses also asked the Province to work with the federal government to ensure favourable trade agreements.

The Committee was inspired by stories of businesses that have expanded in Ontario and internationally during these unprecedented times. For example, Club Coffee LP explained how it was able to expand during the pandemic by providing environmentally-friendly coffee pods. The witness noted that there is a huge demand for plant-based packaging, and that government has a role to play to support its development and export. More generally, witnesses asked for tax incentives and investments to help companies grow here and abroad.

Canadian Manufacturers & Exporters commended the government for its Ontario Made initiative, describing it as an indication that “manufacturing matters once again.” The organization suggested that the program could be a permanent part of the Province’s recovery strategy, through increased and multi-year funding, similar to the Good Things Grow in Ontario campaign.

Witnesses recommended the following:

· Make and buy local - encourage consumers and businesses to buy from Ontario small and medium enterprises.

· Support manufacturing – create a competitive tax environment and increase investment in Ontario-based manufacturing industries.

· Interprovincial trade — reduce barriers to the movement of goods within Canada.

· International trade – work with the federal government to negotiate favorable international trade agreements.

Strategic Procurement

Government procurement can be used strategically to support small and medium-sized businesses while stimulating economic growth. While trade agreements forbid governments from officially giving preference to their own citizens, one witness said that many jurisdictions have figured out how to structure their RFPs to do this in practice.

To help SMEs compete more effectively, witnesses recommended that the RFP process be simplified, the decisions made transparently, and that the money flow quickly. Many SMEs do not have the resources to participate in long and technical procurement processes, even when they could provide a better service or price than their larger counterparts. The Province was also asked to give feedback to smaller companies that are not successful, and to broaden its search outside of existing vendors of record, which tends to favour larger and more established companies.

Witnesses explained that having a government entity as a customer can provide financially stability and growth opportunities to smaller companies since it validates the company’s products and services, making them more attractive to larger customers. Futurpreneur Canada noted that having even one small government contract can make a transformative impact on a young entrepreneur’s business.

A number of sectors were highlighted as a potential focus of procurement efforts, including advanced manufacturing, technology and health sciences. Some witnesses asked that the Province focus on virtual health initiatives, which have the potential to keep seniors in their homes and out of long-term-care facilities, and address the health needs of Ontarians during the pandemic. The Ontario Centres of Excellence suggested the public sector issue a challenge to support innovation-based procurements to drive digitalization and technology adoption across the public sector, allocating procurement budgets on a “use it or lose it” basis.

Up until COVID, there were these two solitudes: the tech industry and the health care industry. What has happened, one of the benefits of COVID is we’ve been brought together.

Communitech

The Ontario Non-Profit Network noted that the government could also use its purchasing power to support social enterprises by establishing a target to shift a portion of its existing contract-based spending to the non-profit sector.

Recommendations related to procurement included:

· Simplify — help small and medium enterprises compete more effectively, by simplifying the RFP process, making decisions transparently, and flowing money quickly.

· Engage — encourage public sector organizations to broaden their search outside of their existing vendors of record though a challenge-based call for proposals.

· Digitize — procure small and medium enterprises to support virtual health care and other digital public sector efforts.

Support Start-ups and Promote Innovation

Start-ups and entrepreneurial talent spur economic growth and job creation and are critical for the Province’s economic recovery. COVID-19 abruptly interrupted these activities and compounded previously existing problems, such as access to capital and the ability to scale-up and commercialize ventures.

The Committee heard that access to private investment capital pools, which are pivotal to start-up growth and operation, vanished in the early months of the pandemic. Moreover, essential networking opportunities were reduced, leaving a gap in relationship building and mentoring. Many witnesses stressed the need for the government to step in to support networking infrastructure and provide funding directly to start-ups. Another idea presented to the Committee was investing in a network of early adopter institutions to enable commercialization and innovation.

Several witnesses commented that Ontario could better recognize how intellectual property-based technologies contribute to the knowledge economy.

Our financial institutions do not know how to lend against intellectual property. For a small business, if I’m going to a bank looking for a loan, they’ll look for whether I own some physical assets as collateral, right? But if I tell them I have some IP, they don’t know how to finance it. Therefore, the knowledge economy typically gets underfinanced in our economy today.

Technology expert

Witnesses stressed the need to strengthen investments and protections around companies that are rich in intellectual property, for example by adopting policies which encourage private capital to provide financing for companies built on intellectual property, and developing a patent program.

The Committee also learned that challenges persist when attempting to scale start-ups. Canadian Manufactures & Exporters recommended tax incentives during scale-up periods to reward companies that are turning intellectual property into locally commercialized and produced projects. Ontario Centres of Excellence summarized how capital, scaling, commercialization, and procurement are linked to support economic growth.

For start-ups and advanced manufacturing, the Committee received testimony about the importance of retaining and attracting highly skilled labour to Ontario. Witnesses said that remote work presents an opportunity to find talent across the province, while federal and provincial immigration programs can be used strategically to attract the best from around the world.

Several witnesses were optimistic that the entrepreneurial spirit remains strong in Ontario, citing an increase in applications to grant programs and attendance at online training classes. The Ontario Bioscience Innovation Organization suggested retraining highly skilled individuals displaced by pandemic-related layoffs for careers in this growing industry.

Witnesses had many recommendations, including those listed below:

· Intellectual property — develop an intellectual property strategy to encourage capital investment in companies rich in intellectual property.

· Capital — improve access to capital for start-ups.

· Health Innovation Fund — create a Health Innovation Fund to accelerate the development of health science companies in Ontario.

· Tax incentives — provide tax incentives to encourage local investment for local and early-stage companies to help organizations scale-up.

· Retain and train skilled labour — invest in a talent program to retain and train highly skilled labour in Ontario.

Committee Recommendations

The Standing Committee on Finance and Economic Affairs recommends that:

- The Province advocate for small business by working with the Federal government to change the Canada Emergency Commercial Rent Assistance program to allow tenants to apply for support and to extend the program to January 1, 2021.

- The Province advocate for small business by working with the Federal government to change the Canada Emergency Commercial Rent Assistance program to lower the threshold of revenue loss for eligibility.

- The provincial government commit to work with the federal government to determine the next phase of the Canada Emergency Commercial Rent Assistance program and whether the program would benefit from the extension of the commercial eviction ban and other measures.

- The Province explore grants and provide funding programs as investment decisions to support Indigenous communities as a path to reconciliation and economic recovery from the COVID-19 pandemic.

- The Province work with the federal government to expand the Women Entrepreneurship Strategy to increase funding specific for Black, Indigenous and people of colour.

- The Province explore the creation of a buy local radio advertising campaign or program to support Ontario broadcasters and to promote Ontario’s small businesses.

- The provincial government explore ways to assist individuals and businesses with personal, auto and commercial insurance.

- The provincial government explore ways to incentivize home renovations focused on improving indoor air quality and reducing energy costs.

- The provincial government explore establishing a stabilization fund for Ontario’s non-profit sector.

- The Province should expand the support provided to small businesses at all of the 47 Small Business Enterprise Centres across the province.

- The Province should explore options for assisting small businesses to offset increased costs due to procuring PPE for their employees.

- The Province should provide mental health supports geared to small business owners.

- The Province should make permanent the temporary regulation that permits restaurants to offer alcohol delivery and take-out and allows for 24-hour a day truck deliveries.

- The Province should explore which other temporary regulatory burden relief measures taken during the pandemic should be made permanent.

- The Province should continue to assist small and medium enterprises by modernizing regulations, digitalizing and working through suggestions submitted through the Tackling the Barriers portal.

- The Province should create a new one-stop COVID-19 recovery-focused website for small businesses.

- The Province should continue to work with the Federal Government to provide further COVID-19 relief measures for small and medium enterprises.

- The Province should create a focused campaign to increase awareness of existing programs geared towards small businesses.

- The government continue to promote, stabilize, and grow Ontario's manufacturing sector by increasing access to capital, reducing red tape, and lowering the cost of doing business.

- The government continue to strengthen the manufacturing and supply chain of Ontario Made goods for vital PPE and other critical goods.

- The government continue investment and support for Ontario made innovation and intellectual property.

Witness List

|

Organization/Individual |

Date of Appearance |

|

1000 Islands Gananoque Chamber of Commerce |

August 17, 2020 |

|

ALS Society of Canada |

Written submission |

|

Alzheimer Society of Ontario |

Written submission |

|

Angel Investors of Ontario & Georgian Angel Network |

August 19, 2020 |

|

Anishnawbe Business Professional Association |

August 20, 2020 |

|

Ardra Inc. |

August 17, 2020 |

|

Aroma Salt Therapy & Beauty Spa |

August 28, 2020 |

|

Ascari Hospitality Group |

August 18, 2020 |

|

Attractions Ontario |

August 28, 2020 |

|

Automotive Industries Association of Canada |

August 18, 2020 |

|

AVARA Media Inc.: Oakville |

August 26, 2020 |

|

Baccanalle & Capital Fare Café |

August 27, 2020 |

|

Barrie & District Association of REALTORS® |

August 24, 2020 |

|

Barrie Chamber of Commerce |

August 26, 2020 |

|

Barton Village Business Improvement Area |

August 20, 2020 |

|

Bayshore Healthcare Ltd. |

August 28, 2020 |

|

Beauty United/Sugar Moon Salon Inc. |

August 19, 2020 |

|

Beef Farmers of Ontario |

August 27, 2020 |

|

Better Way Alliance |

August 18, 2020 |

|

Betty McGie |

August 21, 2020 |

|

Bingemans |

August 17, 2020 |

|

Bishop Water Technologies |

August 18, 2020 |

|

Boating Ontario Association |

August 24, 2020 |

|

Bob Desauntels |

Written submission |

|

Body Mind Fitness |

Written submission |

|

Boneyard Event Services Inc. |

August 24, 2020 |

|

Bottle Shop |

Written submission |

|

Bowl Canada |

Written submission |

|

Boys and Girls Clubs of Canada |

August 24, 2020 |

|

Bradley Elkins |

August 24, 2020 |

|

Brampton Board of Trade |

August 26, 2020 |

|

BTi Brand Innovations Inc. |

August 20, 2020 |

|

Byrnes Communications Inc. |

August 21, 2020 |

|

Cambridge Butterfly Conservatory |

August 17, 2020 |

|

Camping in Ontario |

August 18, 2020 |

|

Canada’s National Brewers |

Written submission |

|

Canadian Actors' Equity Association |

August 24, 2020 |

|

Canadian Association of Tour Operators |

August 18, 2020 |

|

Canadian Business Resilience Network |

Written submission |

|

Canadian Cancer Society |

August 19, 2020 |

|

Canadian Cancer Society, Lung Association, Heart and Stroke Foundation and Diabetes Canada |

Written submission |

|

Canadian Chamber of Commerce |

August 26, 2020 |

|

Canadian Federation of Independent Business |

August 24, 2020 |

|

Canadian Federation of Independent Grocers |

August 18, 2020 |

|

Canadian Lung Association |

Written submission |

|

Canadian Manufacturers & Exporters |

August 26, 2020 |

|

Canadian National Institute for the Blind Foundation |

Written submission |

|

Canadian Nuclear Isotope Council |

August 26, 2020 |

|

Canadian Women’s Chamber of Commerce |

August 24, 2020 |

|

Carpenters District Council of Ontario |

August 19, 2020 |

|

Category 5 Imaging |

August 18, 2020 |

|

Chemistry Industry Association of Canada |

Written submission |

|

Chicken Farmers of Ontario |

August 27, 2020 |

|

Chris James |

August 28, 2020 |

|

Ciena Corporation |

August 28, 2020 |

|

City of Brampton |

Written submission |

|

City of Stratford: investStratford |

August 20, 2020 |

|

Clarington Board of Trade |

August 28, 2020 |

|

Club Coffee LP |

August 24, 2020 |

|

Coalition of Concerned Manufacturers and Businesses of Canada |

August 20, 2020 |

|

Cogeco |

Written submission |

|

COLE Engineering Group |

August 20, 2020 |

|

Collab Space Corp |

August 19, 2020 |

|

Communitech |

August 26, 2020 |

|

Community Action Planning Group: Jane-Finch Community |

August 24, 2020 |

|

Community Fibre Company |

August 19, 2020 |

|

Competition Bureau Canada |

Written submission |

|

Convenience Industry Council of Canada |

August 24, 2020 |

|

Corktown Residents and Business Association |

August 26, 2020 |

|

Council of Canadian Innovators |

August 26, 2020 |

|

Cristina's Tortina Shop Inc. |

August 20, 2020 |

|

CropLife Canada |

August 24, 2020 |

|

Crown Group of Hotels |

August 28, 2020 |

|

Crystal Longo |

August 24, 2020 |

|

Ctrl V |

August 21, 2020 |

|

Cultural Arts Studio |

August 28, 2020 |

|

Cybersecurity Compliance Corp. |

August 21, 2020 |

|

Direct Sellers Association of Canada |

August 26, 2020 |

|

Dispatch |

August 17, 2020 |

|

DMZ Innisfil and Participating Companies |

Written submission |

|

DMZ/DMZ Ventures |

August 21, 2020 |

|

Drinks Ontario |

August 26, 2020 |

|

DriveWise and KnowledgeSurge Institute |

August 18, 2020 |

|

Eirene Cremations Inc. |

August 26, 2020 |

|

Electrical Contractors Association of Ontario |

August 27, 2020 |

|

Explore Waterloo Region |

August 17, 2020 |

|

FanSaves |

August 18, 2020 |

|

Fire & Flower |

August 21, 2020 |

|

First Work |

August 27, 2020 |

|

FirstOntario Performing Arts Centre |

August 26, 2020 |

|

ForaHealthyMe Inc. |

August 27, 2020 |

|

FSET |

August 26, 2020 |

|

Futurpreneur Canada |

August 24, 2020 |

|

Gabriel Araujo |

Written submission |

|

Gathering of Ontario Developers |

August 19, 2020 |

|

GavCom Media Productions |

August 21, 2020 |

|

Global Skills Hub |

August 17, 2020 |

|

Gordon Grant |

August 20, 2020 |

|

Grape Growers of Ontario |

August 27, 2020 |

|

Greater Kitchener Waterloo Chamber of Commerce |

August 24, 2020 |

|

Greater Niagara Chamber of Commerce |

August 21, 2020 |

|

Greater Peterborough Chamber of Commerce |

Written submission |

|

Greyhound Canada Transportation ULC |

August 26, 2020 |

|

Guelph Chamber of Commerce |

August 28, 2020 |

|

Habitat for Humanity – Ontario Caucus |

Written submission |

|

Halibut House Fish and Chips |

August 28, 2020 |

|

Haunted Walks Inc. |

August 18, 2020 |

|

Heart & Stroke Foundation |

Written submission |

|

Heating Refrigeration, Air Conditioning Institute of Canada |

August 20, 2020 |

|

Hilton Niagara Falls |

August 17, 2020 |

|

Imperial Tobacco Canada |

Written submission |

|

Indo Canada Ottawa Business Chambers |

August 28, 2020 |

|

Innovative Automation |

August 19, 2020 |

|

Innovative Dance |

August 21, 2020 |

|

Institute for Advancements in Mental Health |

Written submission |

|

Insurance Brokers Association of Ontario |

August 26, 2020 |

|

Intellectual Property Institute of Canada |

August 24, 2020 |

|

Interactive Ontario |

August 26, 2020 |

|

Iron Fitness Strength Club |

August 18, 2020 |

|

Jay9 Dance Centre |

August 21, 2020 |

|

Jodi Di Menna |

Written submission |

|

K. Winter Sanitation Inc. |

August 18, 2020 |

|

Karla Briones |

August 28, 2020 |

|

Karna Gupta |

August 26, 2020 |

|

Kawartha Art Gallery |

Written submission |

|

Kim Thiara |

August 27, 2020 |

|

Kingston Accommodation Partners |

August 20, 2020 |

|

Kit Kat Restaurant Group |

August 21, 2020 |

|

KW Oktoberfest Inc. |

Written submission |

|

Lab Improvements |

August 18, 2020 |

|

Lawrence O’Brien |

August 18, 2020 |

|

Linda J. Howes-Smyth |

Written submission |

|

Live History |

August 17, 2020 |

|

Louis Roesch |

August 19, 2020 |

|

Mahtay Café |

August 18, 2020 |

|

Manny Mellios |

August 20, 2020 |

|

Mappedin |

August 19, 2020 |

|

Marco Pronto |

August 19, 2020 |

|

Marlin Stoltz |

August 19, 2020 |

|

MasterCard |

Written submission |

|

Mayor’s COVID-19 Economic Support Task Force (City of Brampton) |

Written submission |

|

MediSeen Health |

August 26, 2020 |

|

Memories Bridal |

August 28, 2020 |

|

Mississauga Board of Trade |

August 24, 2020 |

|

Mortgage Professionals of Canada |

August 19, 2020 |

|

Municipality of Sioux Lookout |

August 19, 2020 |

|

Neighbourhood Pharmacy Association of Canada |

August 27, 2020 |

|

Norah Rogers |

August 26, 2020 |

|

OfficeInc! Corp. |

August 21, 2020 |

|

Oliver & Bonacini Hospitality |

August 27, 2020 |

|

Ontario Aids Network |

Written submission |

|

Ontario Association of Agricultural Societies |

August 26, 2020 |

|

Ontario Association of Broadcasters |

August 20, 2020 |

|

Ontario Association of Optometrists |

August 17, 2020 |

|

Ontario Bioscience Innovation Organization |

August 24, 2020 |

|

Ontario Business Improvement Area Association |

August 24, 2020 |

|

Ontario Centres of Excellence |

August 26, 2020 |

|

Ontario Chamber of Commerce |

August 24, 2020 |

|

Ontario Convenience Stores Association |

August 26, 2020 |

|

Ontario Craft Brewers Association |

August 19, 2020 |

|

Ontario Craft Wineries |

August 27, 2020 |

|

Ontario Dairy Council |

August 27, 2020 |

|

Ontario Dance and Performing Arts Studios |

Written submission |

|

Ontario Federation of Agriculture |

August 20, 2020 |

|

Ontario Fruit and Vegetable Growers' Association (OFVGA) |

August 24, 2020 |

|

Ontario General Contractors Association |

August 19, 2020 |

|

Ontario Library Association |

Written submission |

|

Ontario Motorsports Promoters |

August 18, 2020 |

|

Ontario Music Educators’ Association |

August 26, 2020 |

|

Ontario Non-Profit Housing Association |

August 18, 2020 |

|

Ontario Nonprofit Network |

August 19, 2020 |

|

Ontario Pharmacists Association |

August 20, 2020 |

|

Ontario Restaurant Hotel and Motel Association |

August 18, 2020 |

|

Ontario Sewer and Watermain Construction Association |

August 17, 2020 |

|

Ottawa Board of Trade |

August 26, 2020 |

|

Ottawa Coalition of Business Improvement Areas (OCOBIA) |

August 24, 2020 |

|

Ottawa Gatineau Wedding Industry Association |

Written submission |

|

Ottawa Special Events |

August 17, 2020 |

|

Party Mart |

August 17, 2020 |

|

Paul Goulet |

August 21, 2020 |

|

Pembina Institute |

Written submission |

|